Back

Comet

#freelancer • 1y

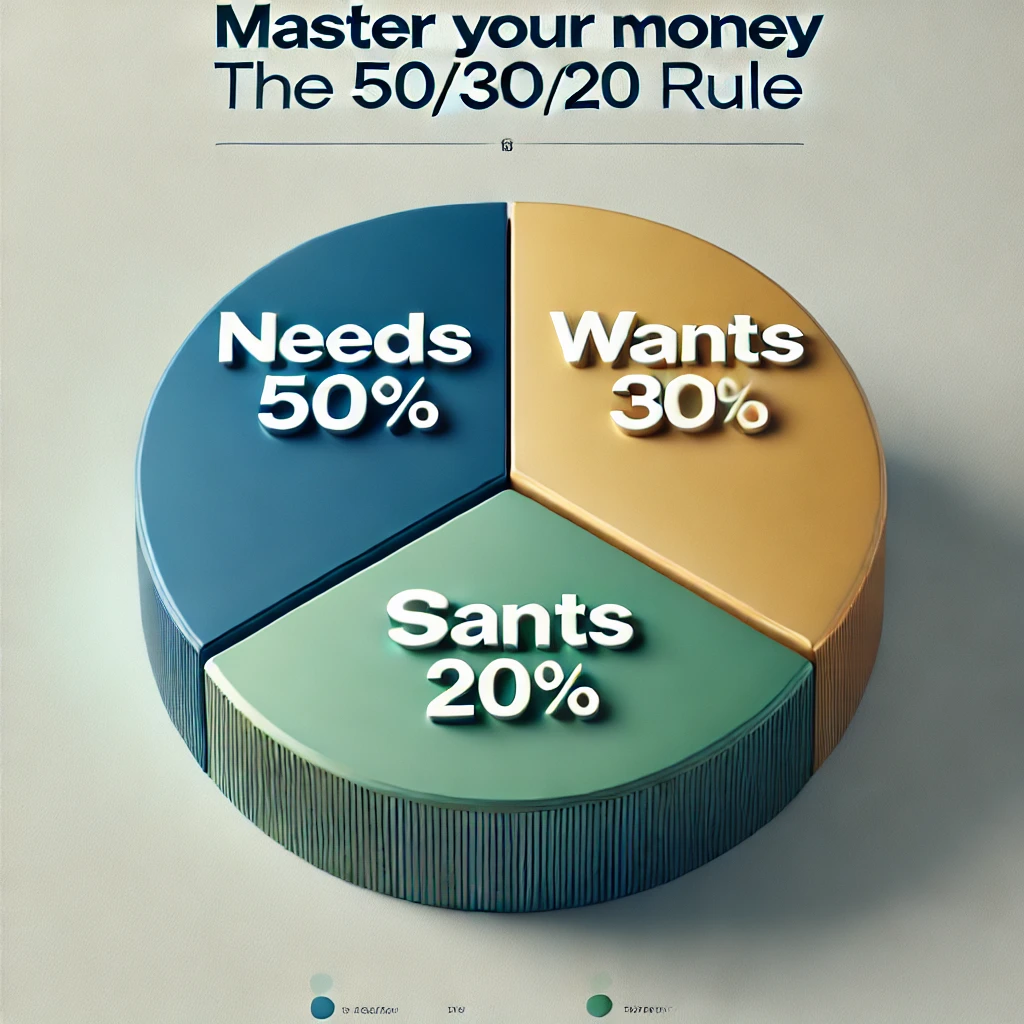

Take yourself through a financial audit this month, you're only going to improve if you stop hiding from your finances This includes a bare minimum review of your: - Income - Expenses - Savings - Debt - Credit Assess where you're in the red, and what you are doing well at

Replies (1)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-12 🎯Types of Expenses for VC? 🎯What is a Self-Managed Fund? 🎯Organisational Expenses: These are costs for VC Funds which includes such as Incorporation Costs, Statutory Compliance Cost of the Funds, Placement Commissions, Distri

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

Oyo, the hospitality startup, is pursuing a pre-IPO round at a $2.3 billion valuation, 80% below its 2019 peak of $10 billion. Fundraising: Targeting $80-90 million from HNIs, family offices, and smaller investors. Minimum investment reduced from $

See More

Suman solopreneur

Exploring peace of m... • 1y

is Emergency Fund are important? Rajesh, who works as a software engineer, suddenly faces a medical emergency in his family. He doesn’t have savings, so he ends up borrowing money at high interest, adding financial stress to an already tough time. M

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)