Back

Suman solopreneur

Exploring peace of m... • 1y

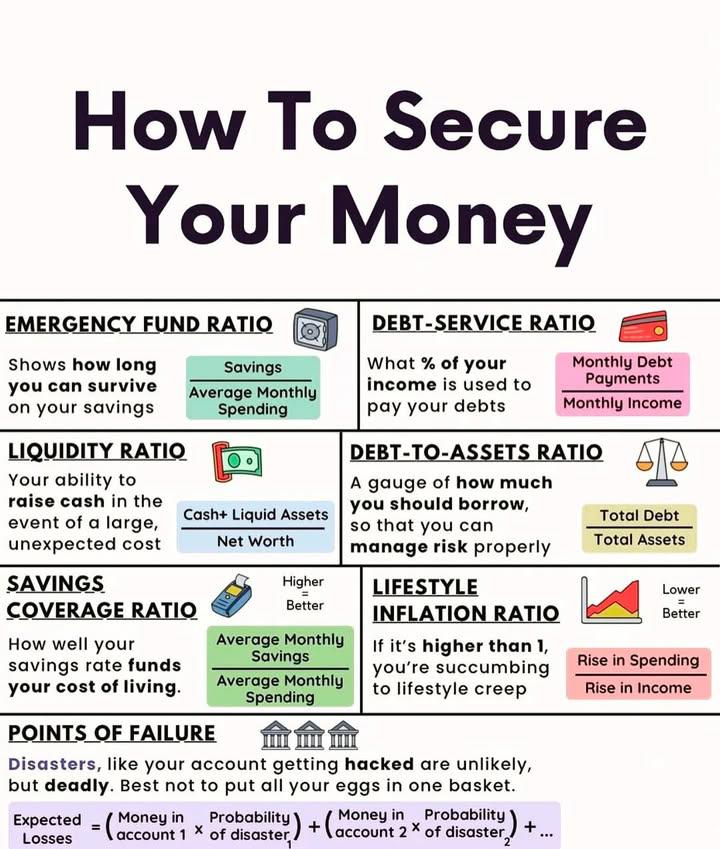

is Emergency Fund are important? Rajesh, who works as a software engineer, suddenly faces a medical emergency in his family. He doesn’t have savings, so he ends up borrowing money at high interest, adding financial stress to an already tough time. Meanwhile, his friend Priya, who earns the same salary, faces a similar situation. But Priya is prepared—she has an emergency fund. She calmly uses her savings and avoids debt. An emergency fund is simply 3–6 months of your basic living expenses, kept aside for unexpected situations like job loss, health issues, or sudden repairs. It’s your safety net, giving you peace of mind and protecting your long-term financial goals. Even saving ₹1,000–₹2,000 a month can build this fund over time. Start small and stay consistent—it’s a lifesaver!

Replies (1)

More like this

Recommendations from Medial

Vikas Acharya

Building Reviv | Ent... • 11m

Bengaluru Entrepreneur Stunned As Pilot Recognises His Startup Mid-Flight A Delhi-Bengaluru flight turned into an unforgettable moment for a Bengaluru entrepreneur when a fellow passenger - a pilot - unexpectedly recognised his startup. Udayan Walve

See MoreAngelic Braxton

Hey I am on Medial • 7m

Grandma Learns to Drift An 8-year-old boy taught his 68-year-old grandmother to play Drift Boss during a rainy weekend visit. She was hesitant at first, but after a few tries, she couldn’t stop laughing every time she drifted off the edge. It became

See MoreSaathvi SN

Attended Mangalore U... • 1y

Okay! Guys here is some situation to share well one of my friend from final year Bcom is having financial issues! She lives in pg and 2 more months for graduation. Her father is unable to pay her bills And she doesn't know what to do. She said she do

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)