Back

IncorpX

Your partner from St... • 8m

Hey Abhishek, If you're planning to close your GST registration and there's a balance in your Electronic Credit Ledger (ITC), please note that this amount cannot be directly withdrawn in cash, as it’s meant only for adjusting GST liabilities. However, you may be eligible for a refund under certain conditions, such as 1. Exports without payment of tax (under LUT) 2. Inverted duty structure (higher input GST than output GST) 3. Cancellation of GST registration, provided there is no outstanding liability In such cases, you can file Form GST RFD-01 after submitting your Final Return (GSTR-10), and the eligible refund will be credited to your bank account upon approval. Please feel free to dm us for more info Warm regards, Team IncorpX www.incorpx.co.in

Replies (2)

More like this

Recommendations from Medial

Ravi Kumar Mishra

Hum hai Aapke Busine... • 8m

ITR 23-24 24-25 25-26 Compution,Balancesheet with Ca Certified 1. GST Registration 2. GST return Filing 3. MSME Registration 4. Tds FILLING 5. Company, NGO & Partnership Reg. 6. Importer Exporter Code 7. ISO Non-Iaf/IAF Registration 8. Start up

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

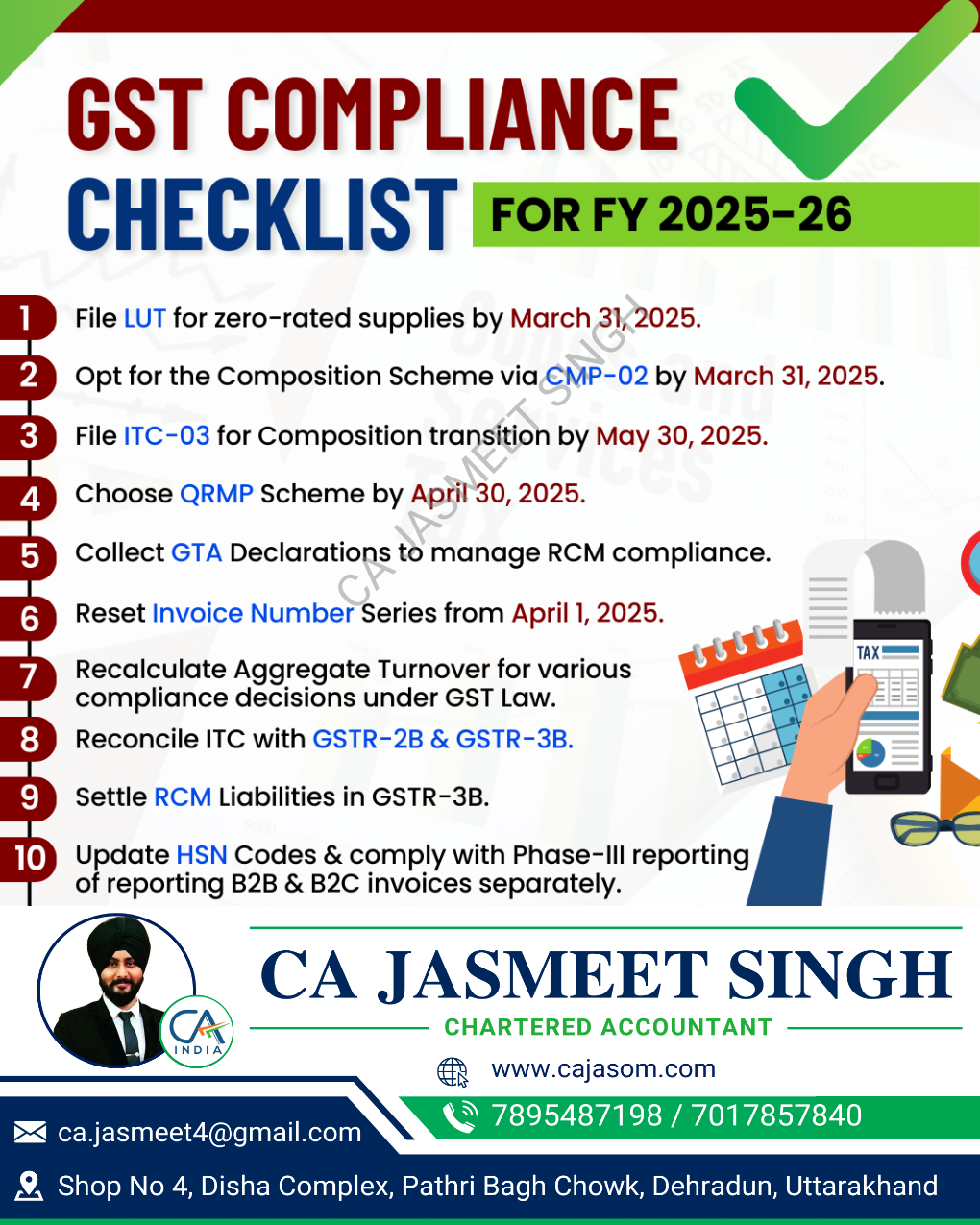

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

CA Jasmeet Singh

In God We Trust, The... • 11m

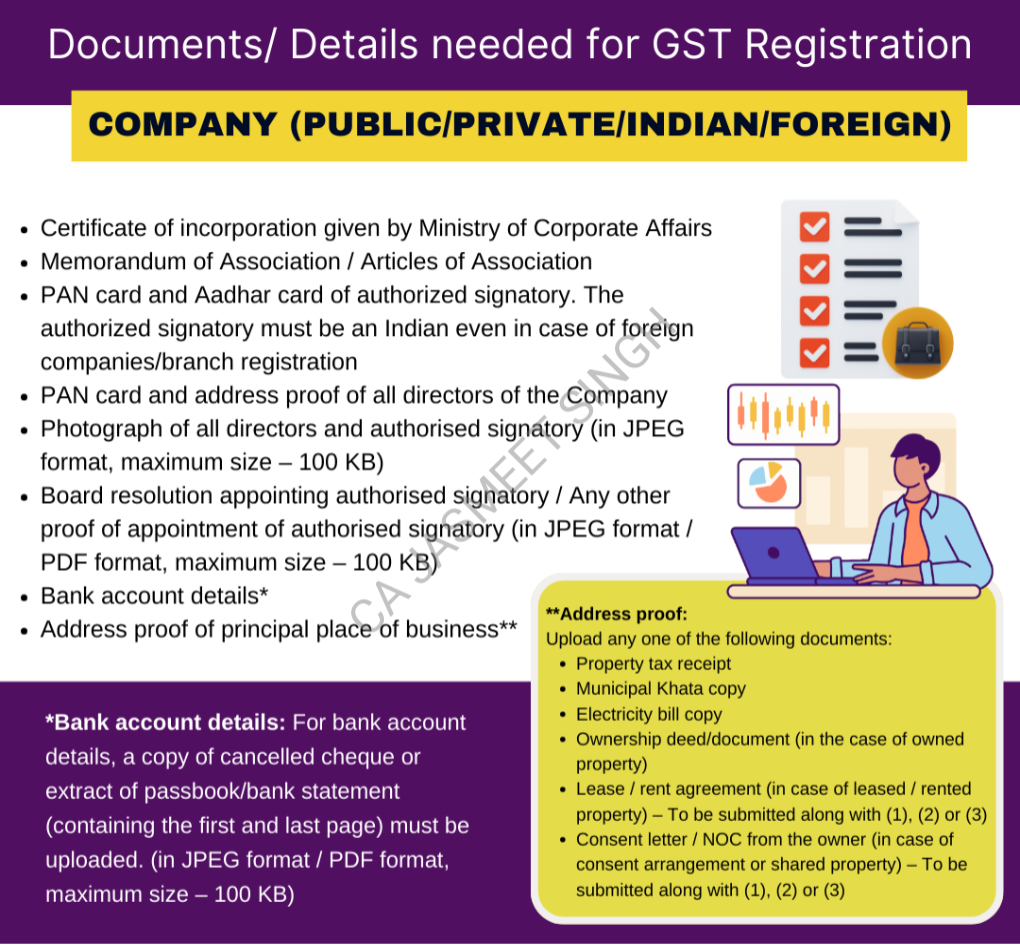

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Jayant Mundhra

•

Dexter Capital Advisors • 5m

So, the latest GST rate cuts have taken away all the attention and limelight from Next Gen GST reforms. But I spent 3hrs last night studying all that has been announced. And a significant and laudable non-tax change has gone largely unnoticed, somet

See More

Dheeraj Yadav

Hacker and OSINT Exp... • 1y

Hey everyone, I want opinion on company incorporation and gst registration. I have checked many websites which offers company incorporation and gst registration online including razorpay rise, startup wala, cleartax, etc. Almost all of them which a

See MoreAASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Aditya Arora

•

Faad Network • 5m

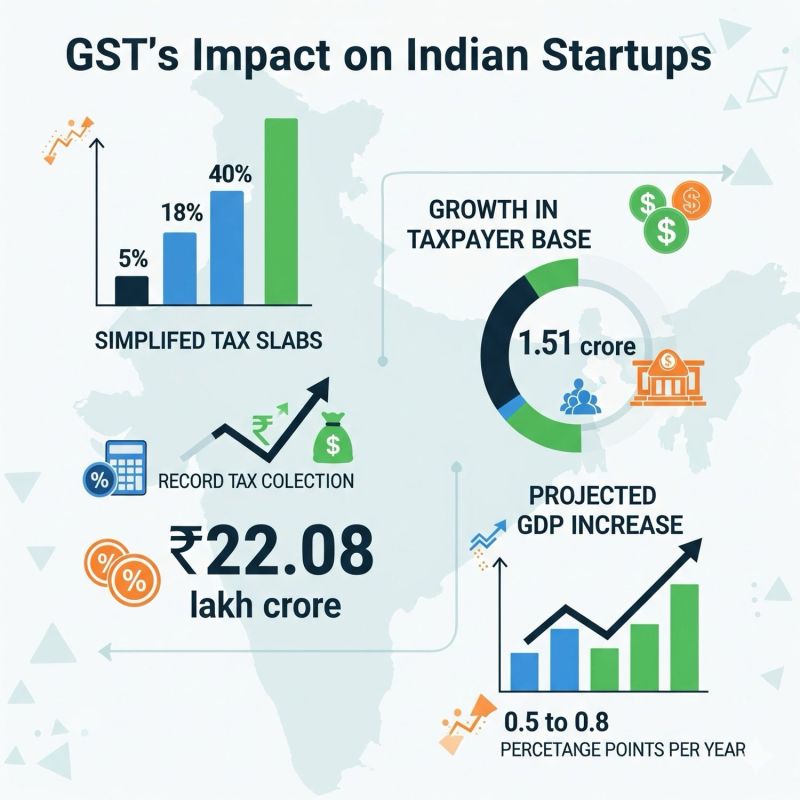

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)