Back

Jayant Mundhra

•

Dexter Capital Advisors • 5m

So, the latest GST rate cuts have taken away all the attention and limelight from Next Gen GST reforms. But I spent 3hrs last night studying all that has been announced. And a significant and laudable non-tax change has gone largely unnoticed, something that has a massive benefit for businesses. And this post is a deep dive on that bit. .. Previously, every single refund claim joined a long queue on a tax officer's desk. - The officer would manually pull up your GSTR-1 & 3B, and your shipping bills from the customs portal - They’d visually inspect line by line. A tiny mismatch, a typo in an invoice number, and your entire claim would be thrown with a "deficiency memo" It was a system that treated everyone like a potential suspect. The burden of proof was entirely on you. And from 1st November, all that will be history. .. How? When a business files for a refund, it’ll be directed to an AI system that performs numerous checks in seconds. What checks? - The invoices you’ve declared for refund against your supplier’s declared sales in their GSTR-1 - Your export details with the ICEGATE customs portal, ensuring your shipping bills are legitimate - The movement of goods with data from the E-way Bill system - Your own summary returns (GSTR-3B) to ensure consistency And, with this, the system will pull up your GST Compliance Score - a risk rating based on your history. Have you filed returns on time? Paid your taxes consistently? Have you had any past red flags? .. Then your refund claim is split into one of two paths automatically. The first is the Green Channel. - If you have a high compliance score and all your data matches perfectly, the system automatically sanctions 90% of your refund on a provisional basis - No human intervention. The money is credited to your bank account within 7 days The second path is for high-risk cases. If the AI finds major discrepancies or if the business has a poor compliance history, only then is the case sent to an officer for a detailed, manual review. The difference is night and day. .. This is big, as it will free up honest taxpayers from bureaucratic torture and allow tax officers to focus their energy on genuinely suspicious cases. It replaces manual guesswork with data-driven certainty. This is the real, unheralded win of the next generation GST - It's the architecture of trust, built on technology. And I wish this had received more attention. No?

Replies (1)

More like this

Recommendations from Medial

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Venkatesh HR

Hey I am on Medial • 10m

Tell me how many of you want a detailed and simple application of each lessons of the "Straight Line System", a highly effective persuasion method created by Jordan Belfort who is known as the Wolf Of the Wall Street? The core foundation of this sys

See More

CA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

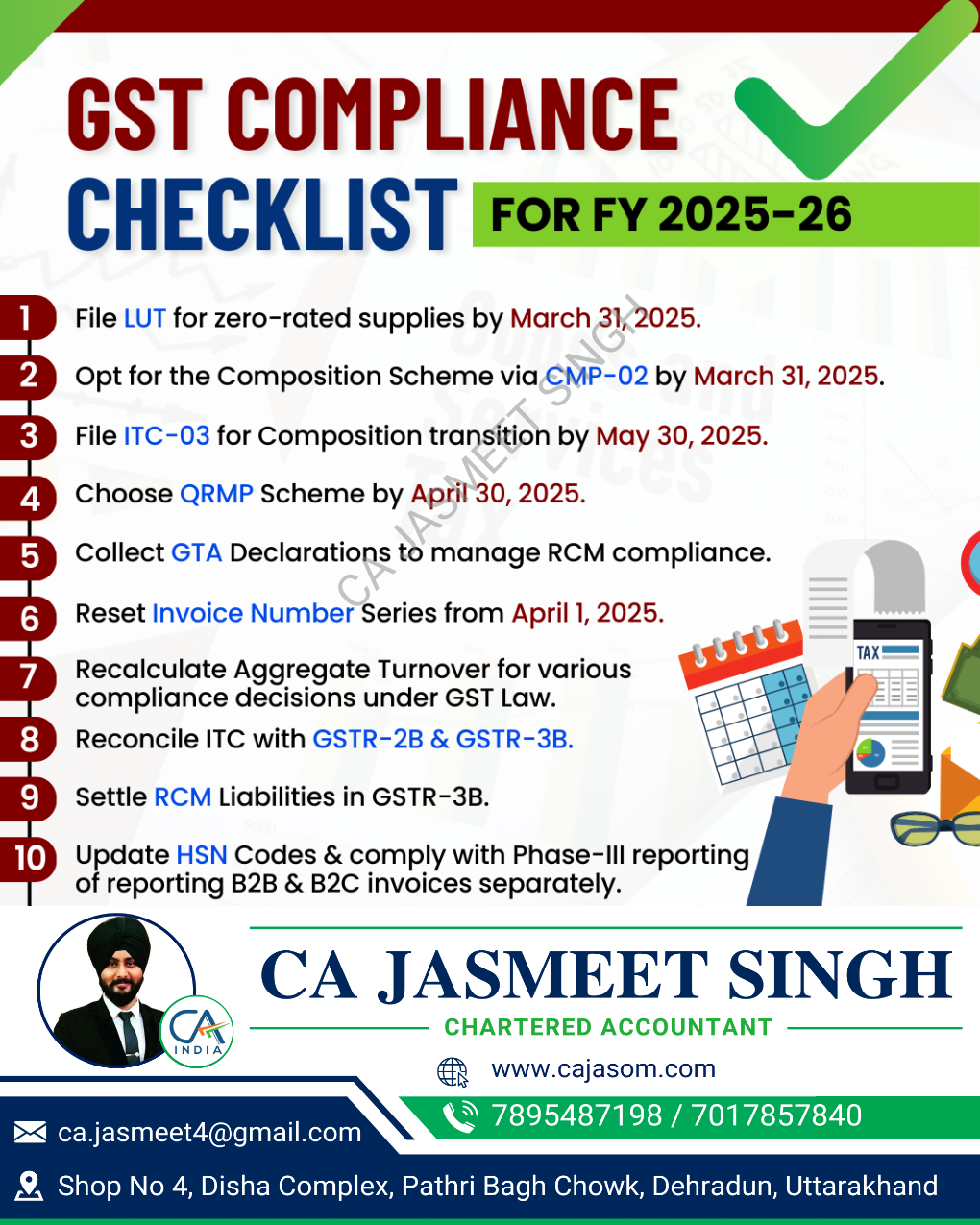

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)