Back

Anonymous 2

Hey I am on Medial • 8m

The obsession with quick profitability kills innovation. These companies invested in market dominance first, profitability second. That's why they're worth hundreds of billions today while "profitable from day 1" companies remain small. Network effects and scale matter more than immediate margins.

Replies (1)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How Silicon Valley Companies Thinks? What Matters 'Profits' or 'Valuations'........🤔 let me tell you a secret. In silicon valley, companies often operate differently from traditional businesses. here the focus is less on making immediate profits a

See More

Black ocean Cosmetic

Hey I am on Medial • 1y

In India's cosmetics industry, profit margins vary based on brand positioning and product type. For standard cosmetic products, companies typically achieve profit margins between 10% and 15%. In contrast, luxury cosmetic brands often realize signific

See MoreKarnivesh

Simplifying finance.... • 1m

Slower growth usually sounds like a warning sign. But when I look at profitable companies today, I see something different happening. Many strong businesses are deliberately easing growth to protect margins, cash flows, and balance sheets. FMCG comp

See MoreSHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

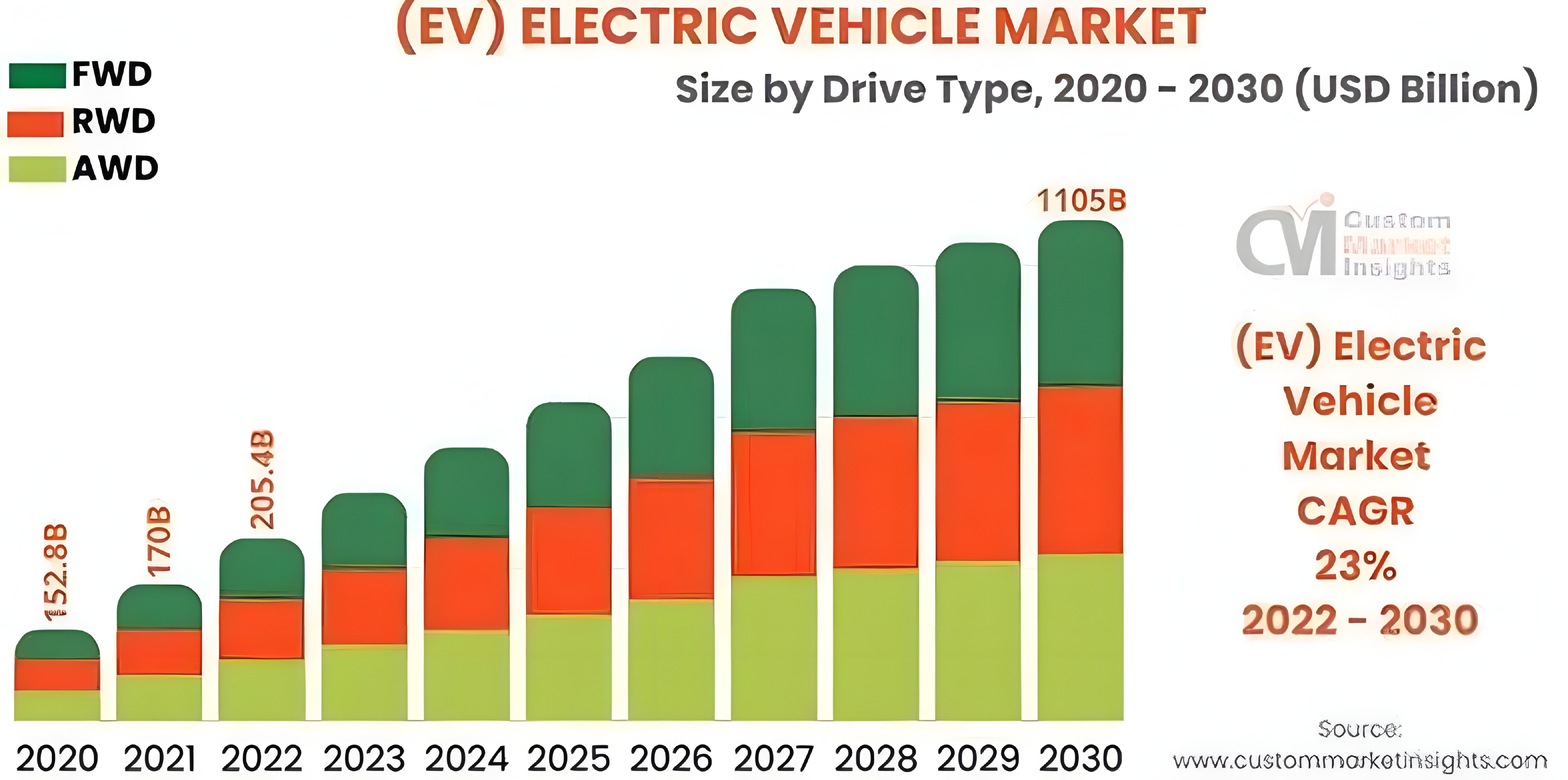

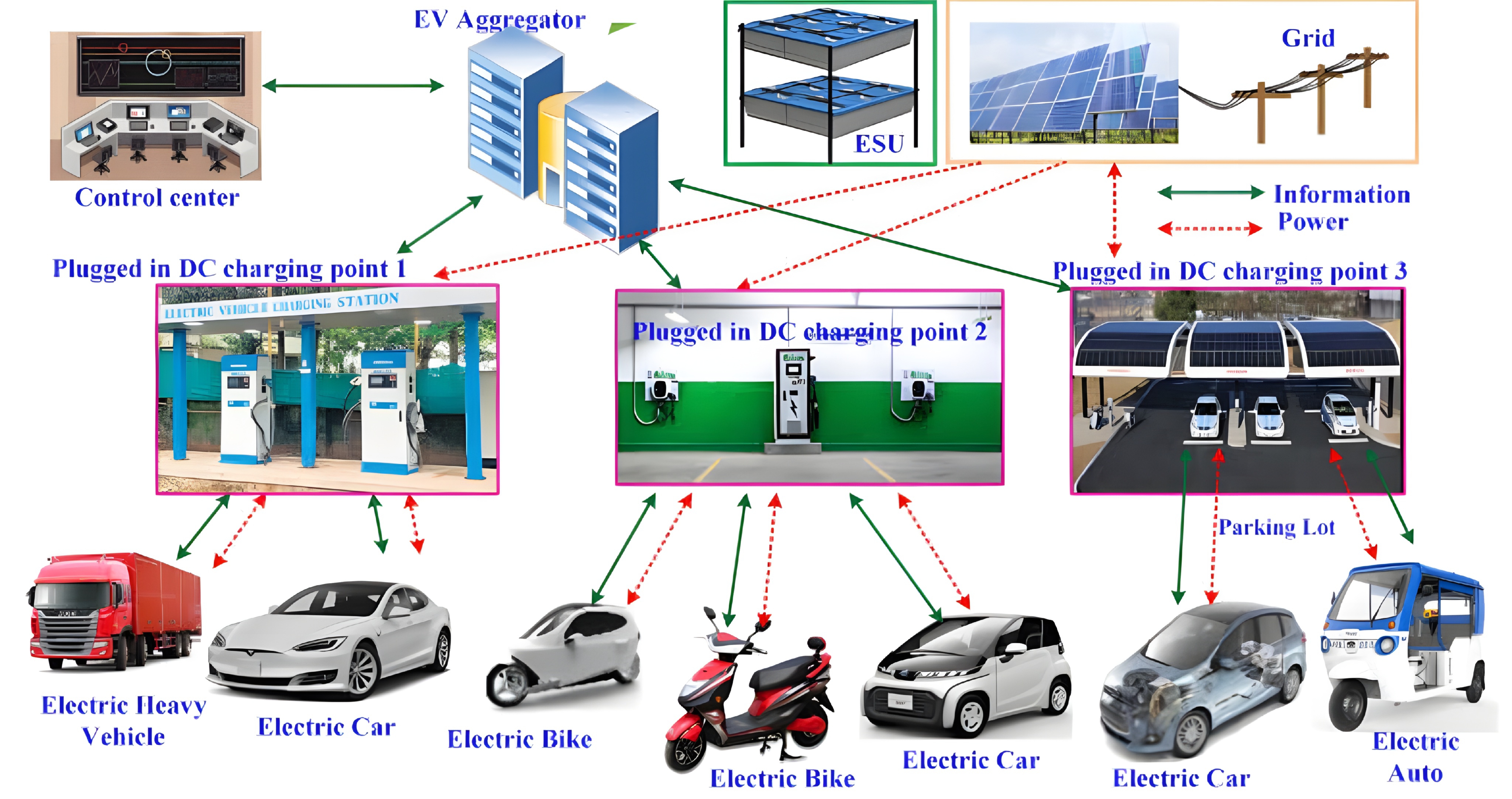

Idea For You Implement Now— “ All In One EV maintenance and repair hub ” So guy's according to my research Ev vehicle's and charging stations are increasing everywhere in India and globally because hundreds of companies and countries are investing

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

The ‘Unicorn’ Paradox: Why Funding Isn’t Always the Finish Line Everyone chases the unicorn. But what if achieving that $1B valuation isn’t the real finish line for a startup? Massive funding rounds can create the illusion of success—but behind the

See More

Mada Dhivakar

Let’s connect and bu... • 8m

Why Grok AI Outperformed ChatGPT & Gemini — Without Spending Billions In 2025, leading AI companies invested heavily in R&D: ChatGPT: $75B Gemini: $80B Meta: $65B Grok AI, developed by Elon Musk's xAI, raised just $10B yet topped global benchmar

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)