Back

Karnivesh

Simplifying finance.... • 2m

For a long time, I assumed revenue showed how strong a business really was. Studying Indian companies more closely changed that belief. What customers see isn’t always where profits are made. 𝐀𝐜𝐫𝐨𝐬𝐬 𝐈𝐧𝐝𝐢𝐚 𝐈𝐧𝐜., 𝐚 𝐜𝐥𝐞𝐚𝐫 𝐩𝐚𝐭𝐭𝐞𝐫𝐧 𝐬𝐭𝐚𝐧𝐝𝐬 𝐨𝐮𝐭👇 • 🏪 Consumer-facing businesses attract scale • 📉 These visible segments often run on thin margins • 💰 Real profitability comes from deeper revenue layers. 𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬: •Reliance’s retail builds reach, refining drives cash •TCS balances stable maintenance with high-margin consulting •HDFC Bank leverages low-cost deposits for lending spreads •Flipkart sells products, but monetises seller ads •Hero sells bikes, while financing boosts margins 📌 𝗞𝗲𝘆 𝗶𝗻𝘀𝗶𝗴𝗵𝘁: Revenue creates visibility, but margins create value. To understand a business better, look beyond top-line growth and ask where sustainable profits actually come from. 👉 For a deeper breakdown, refer to the attached link.

More like this

Recommendations from Medial

Arslan

Business owner | Bus... • 7m

Kisi mahapurush ne kaha hai "Profits ke peeche mat bhaago, kaamyab product banao, profits jhak maar ke peeche aayenge" When you launch a product or app. Don't quickly run for big margin or high subscriptions. Establish yourself in the market first,

See MoreKarnivesh

Simplifying finance.... • 1m

Operating leverage is one of those business concepts that looks harmless until conditions change. When fixed costs are high, growth feels powerful. Revenues rise faster than expenses, margins expand, and confidence builds. But the same structure tur

See MoreChandrakant Patanwadia

Business ideas • 1y

e-commerce business 1. Investment: Starting an e-commerce business requires significant investment. This includes website development, software, payment gateways, logistics, inventory management, and marketing. Initial investment for a small-scale e-

See MoreKarnivesh

Simplifying finance.... • 1m

Most investors don’t lose money because they miss data. They lose money because they track the wrong metrics. Every sector runs on a different economic engine. What drives profits in FMCG won’t work for Banking. What works in Banking won’t explain

See MoreKarnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreKarnivesh

Simplifying finance.... • 1m

For years, growth meant adding users. Today, what matters more is how much value each user generates. That’s where ARPU (Average Revenue Per User) quietly becomes the most important metric. Streaming and subscription businesses have learned this t

See MoreVCGuy

Believe me, it’s not... • 10m

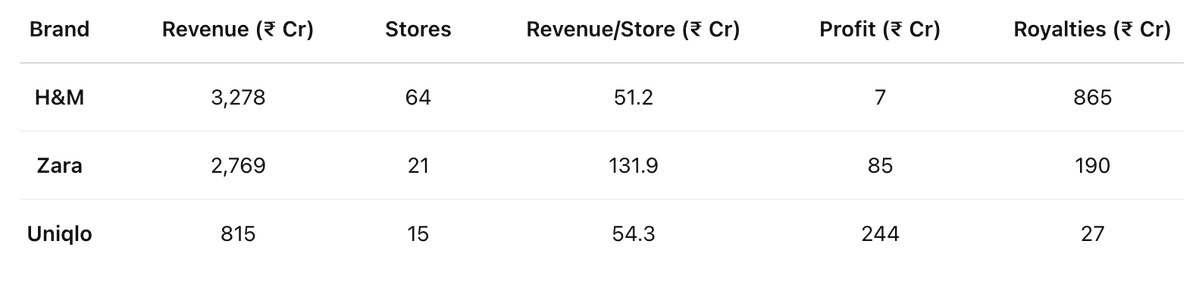

I assumed H&M’s lower price point would translate into healthier profits. H&M may lead in total sales, but it’s shelling out 4.5× what Zara pays in royalties — ₹865 Cr vs Zara’s ₹190 Cr, eating into margins⤵️ (source - Entrackr) From what I’ve seen

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)