Back

Karnivesh

Simplifying finance.... • 2m

Slower growth usually sounds like a warning sign. But when I look at profitable companies today, I see something different happening. Many strong businesses are deliberately easing growth to protect margins, cash flows, and balance sheets. FMCG companies are focusing on price discipline instead of chasing volumes. IT firms are prioritising deal quality over aggressive expansion. Even large startups are cutting back on burn to reach sustainable profitability. 𝙒𝙝𝙖𝙩’𝙨 𝙘𝙝𝙖𝙣𝙜𝙚𝙙 𝙞𝙣 𝙩𝙝𝙚 𝙚𝙣𝙫𝙞𝙧𝙤𝙣𝙢𝙚𝙣𝙩: • Capital is no longer cheap or unlimited • Profitability matters more than scale • Cash flow visibility is valued over rapid topline growth In earlier cycles, speed was rewarded. In this one, stability is. 📌 𝙈𝙮 𝙩𝙖𝙠𝙚𝙖𝙬𝙖𝙮: Slower growth backed by strong profits often signals maturity and discipline, not weakness. In uncertain times, resilience beats reckless expansion.

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 2m

For a long time, I assumed that profitability meant safety. If a business was making money, I believed it was stable. Over time, I realised profit alone can be misleading. Many businesses fail not because they aren’t profitable, but because deeper i

See More

Shanu Chhetri

CS student | Tech En... • 9m

Meta Platforms Inc. has experienced remarkable financial growth; while Facebook earned $32 million in profit during the entirety of 2012, by 2024 Meta generates that same amount every 10 hours, highlighting its extraordinary expansion and profitabili

See More

Atharva Deshmukh

Daily Learnings... • 1y

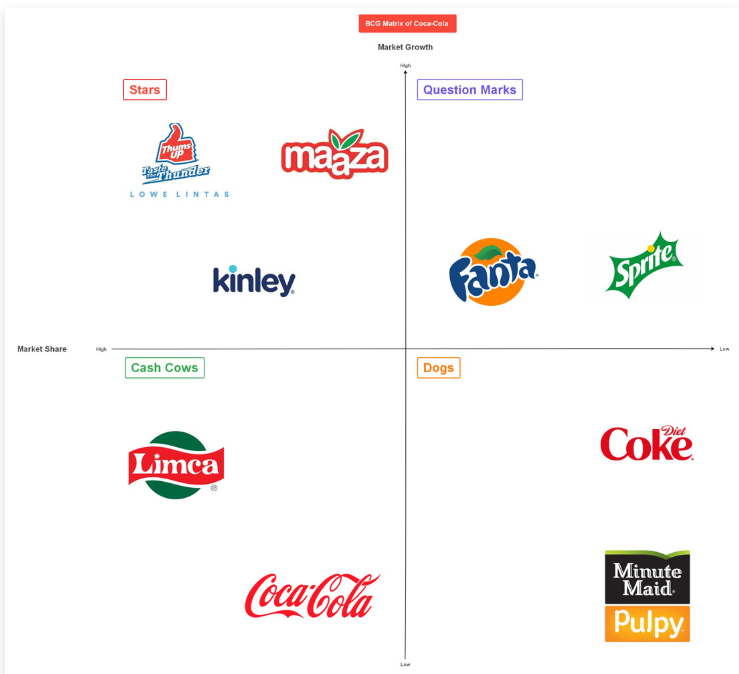

BCG Growth Matrix is a framework for analyzing a company's product portfolio. There are 4 quadrants, each of which represents a particular product or business, the vertical axis represents market growth (cash generation) and the horizontal axis repr

See More

Khansaama Food

Authentic Mughlai • 1y

Khansaama is more than just a food delivery brand—it’s a vision for the future of dining. With expansion plans that include launching new kitchens, master kitchens for B2B operations, and exploring untapped markets, we are poised for exponential grow

See MoreAanya Vashishtha

Drafting Airtight Ag... • 10m

"Should You Raise Funds or Bootstrap? Here’s a Reality Check." Raising funds sounds glamorous—big checks, investor clout, fast growth. But it’s a trade-off. You get cash but lose equity and often control; investors expect results, not excuses.

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)