Back

Karnivesh

Simplifying finance.... • 2m

For a long time, I assumed that profitability meant safety. If a business was making money, I believed it was stable. Over time, I realised profit alone can be misleading. Many businesses fail not because they aren’t profitable, but because deeper issues remain hidden. Profits show up on paper, but they don’t always reflect cash flow strength, execution quality, or long-term resilience. 𝑾𝒉𝒂𝒕 𝒐𝒇𝒕𝒆𝒏 𝒈𝒐𝒆𝒔 𝒘𝒓𝒐𝒏𝒈? 💸 Profits without cash flow discipline. 📈 Growth without scalable systems. ⚠️ Weak governance and delayed risk awareness. 🔄 Overdependence on limited products or markets. Growth can hide inefficiencies until liquidity tightens or confidence breaks. When that happens, profitability offers little protection. 📌 𝗞𝗲𝘆 𝗹𝗲𝗮𝗿𝗻𝗶𝗻𝗴: Profit is an outcome, not a guarantee. Resilient businesses focus on cash flow, execution, and adaptability and not just earnings.

Replies (2)

More like this

Recommendations from Medial

Vikas Acharya

Building Reviv | Ent... • 11m

The A-Z Survival Guide to Entrepreneurship! C – Cash Flow Profitability sounds great, but if you run out of cash, your business dies—no matter how good your idea is. I learned the hard way that revenue doesn’t equal survival. Managing cash flow is

See MoreKarnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreSandip Kaur

Hey I am on Medial • 1y

Mastering Cash Flow: Simple Strategies for Indian Startups Cash flow can either make or break your startup, and managing it well is critical. Here are some practical tips to help your startup thrive financially: 1.Separate Business and Personal Fina

See MoreDAMALLA PIYUSH NARAYAN

"Building products, ... • 1m

Why Indian Startups Fail: Quick Hits ?? 🚀💥 1.No Product-Market Fit: No real demand? Validate early with feedback. 2.Burning Out of Cash: Poor money mgmt drains funds—budget strictly. 3.Weak Founding Team: Bad execution from mismatches—build bal

See More

Startup Savvy

Entrepreneur is What... • 1y

Signs of Fundamentally Strong Business :- 1) Brand Credibility 2) Financial Stability 3) High Performance Team 4) Future Plan 5) Demand For Product 6) Economic MOAT 7) Dispute Management 8) Innovation 9) Increasing Sales Year on Year 10) Increasing

See MoreKarnivesh

Simplifying finance.... • 1m

Slower growth usually sounds like a warning sign. But when I look at profitable companies today, I see something different happening. Many strong businesses are deliberately easing growth to protect margins, cash flows, and balance sheets. FMCG comp

See MoreKarnivesh

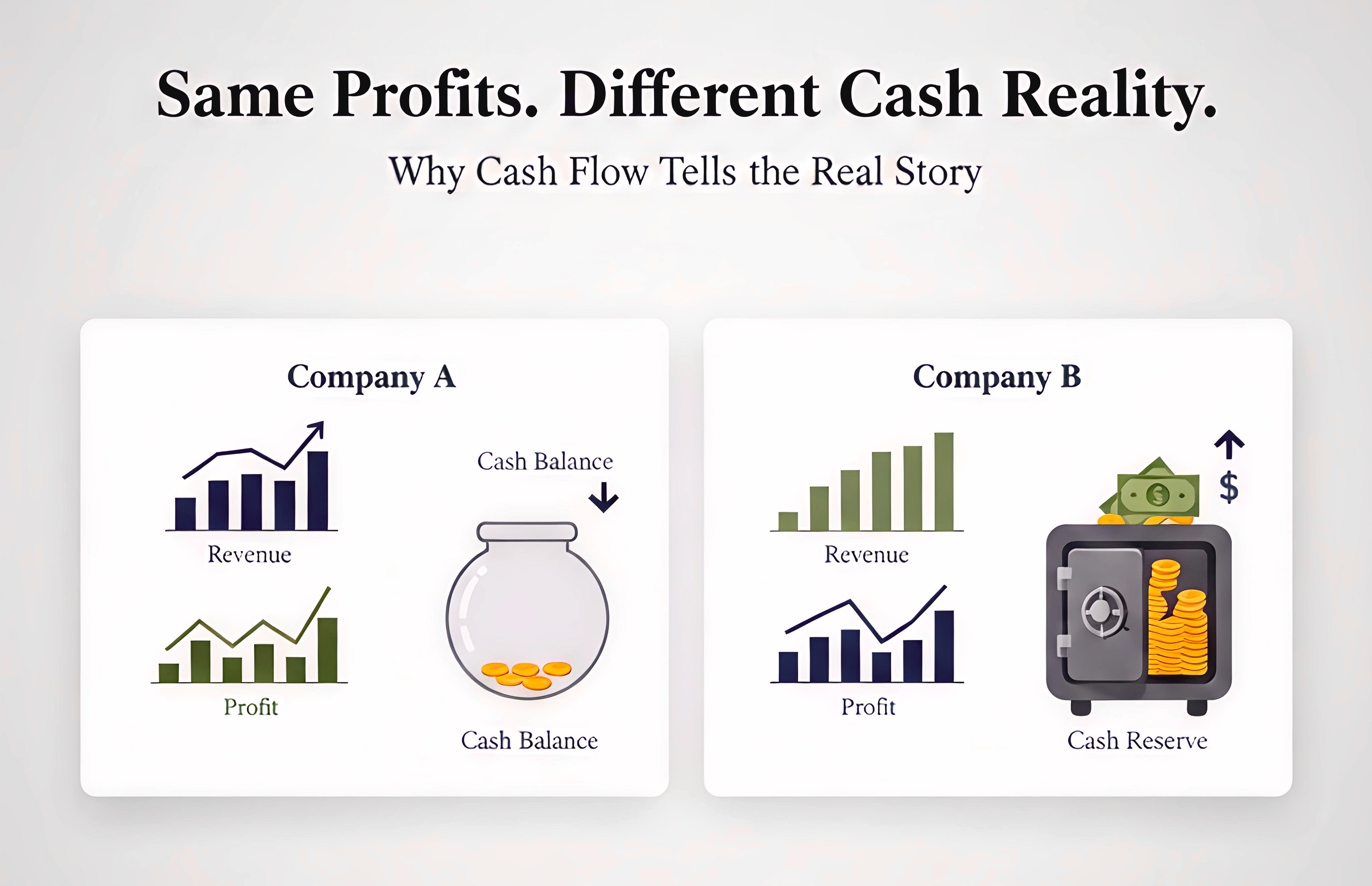

Simplifying finance.... • 27d

Two companies can report the same profit. Yet one constantly struggles with cash, while the other quietly builds a buffer. This used to confuse me until I started paying attention to how cash actually moves. Some businesses collect money quickly an

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)