Back

Arslan

Business owner | Bus... • 1y

Everyone wants FUNDING

Lets address the Elephant in the room

Funding ≠ Success

💰Myth:More funding=guaranteed success.

Reality: 70% of startups fail despite funding in 2-5 years(ex:Byju's huge funding and name like SRK)

What matters more:

1️⃣Product-Market Fit: Solve a real problem. No cash can save a product nobody wants

2️⃣Lean Execution: Do more with less. Bootstrapped giants like Zerodha or GitHub thrived on frugal innovation

3️⃣Customer Obsession: Retention > Acquisition. Loyal users fund growth via word-of-mouth

4️⃣Adaptability: Pivot fast. Netflix started with DVDs; Instagram was a check-in app.

5️⃣Team Grit: Skills + resilience > Ivy League pedigrees

Why overfunding kills:

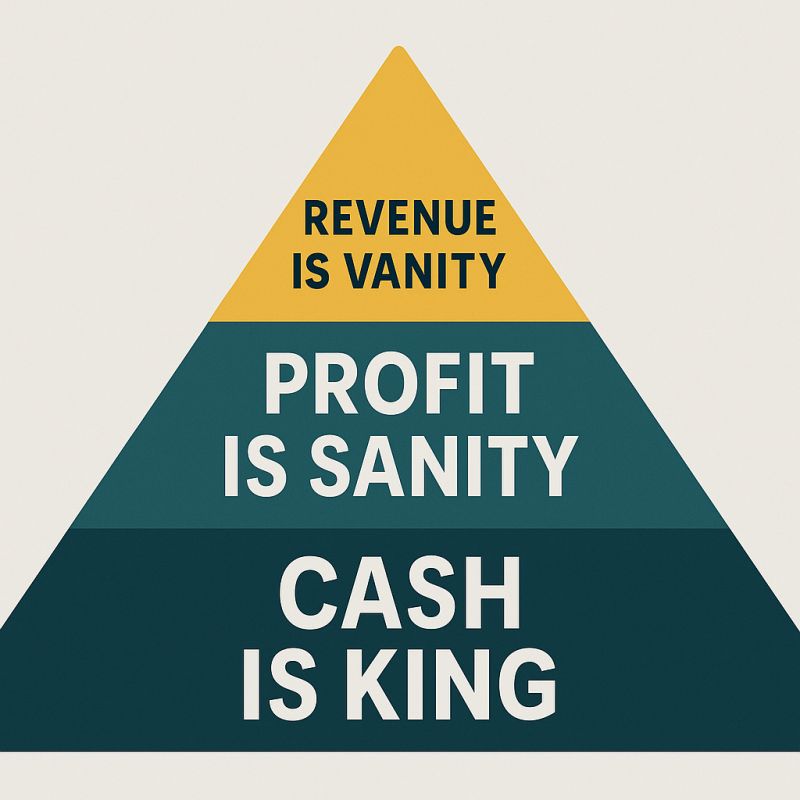

-Distracts from core metrics (burning cash on vanity goals)

-Creates complacency(“We have runway!” →delayed decisions)

-Dilutes ownership and control

Focus here instead:

-Profitability: Build a business, not a pitch deck

-Unit Economics: CAC

Replies (1)

More like this

Recommendations from Medial

Omkart

A SMM posting useful... • 10m

What does Series-A Funding round mean? For the companies that reach series A funding, the investors ask for more than a business idea, they demand a long term strategy. Series-A funding is provided to companies to help them scale their product offer

See MoreAccount Deleted

Hey I am on Medial • 10m

Raising millions won’t fix a broken business model. Plenty of startups burn through cash chasing growth, thinking more funding will solve their problems. But if the fundamentals aren’t strong - bad unit economics, no real demand, weak execution - VC

See MoreTejas

Digital Marketer & E... • 9m

In recent years, there has been a notable increase in startup closures in India, with over 28,000 startups shutting down in the past two years. This surge can be attributed to various factors, including a "funding winter," where investors become more

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Unlock the keys to successful startup funding in our latest video, "Mastering Startup Funding: Avoiding Pitfalls!" 🚀 Discover how to calculate your funding requirements without running dry or scaring away potential VCs. Learn to identify key milesto

See MoreAccount Deleted

Hey I am on Medial • 10m

A lot of founders think funding = validation, but that’s just step one. If you can’t turn that capital into real, sustainable growth, it’s just a countdown to running out of cash. Just because a startup raises VC money doesn’t mean it’s successful. V

See MoreSomen Das

Senior developer | b... • 1y

### Guide for Newbies: Getting Funding for Your Ideas/MVPs Hey experts, I'm diving into the wild world of startup funding and want some expert advice! Here are a few burning questions: 1. How, Where, and Whom to Contact for Funding? - What's t

See MoreRam Pavan

Building TravelTech ... • 6m

🚨 What the heck is Funding-Market Fit? I learned it the hard way. When I started building my travel-tech idea, I got pulled into “startup paperwork mode”: 👉 Should we register as Pvt Ltd or LLP? 👉 What about compliance costs? 👉 Do we need a CA o

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)