Back

Surya

Product • 1y

What makes for an ideal business acquisition? ->Bootstrapped: A company that has grown without heavy outside funding tends to be more stable. ->Strategic Fit: The acquisition should complement your existing operations and enhance synergy. ->Experienced Seller: A knowledgeable seller can make the transition smoother. ->Cultural Alignment: Ensuring compatible company cultures helps maintain employee morale. ->Good Valuations: Favorable multiples ensure a solid return on investment. ->Quick Due Diligence: A streamlined due diligence process speeds up closing. ->Warranties: Warranties at closing protect against unexpected liabilities. ->Cash Payment: Full cash payments simplify the transaction. ->12-Month Employee Agreement: Retaining key staff for a year stabilizes operations. What else would you add?

Replies (10)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

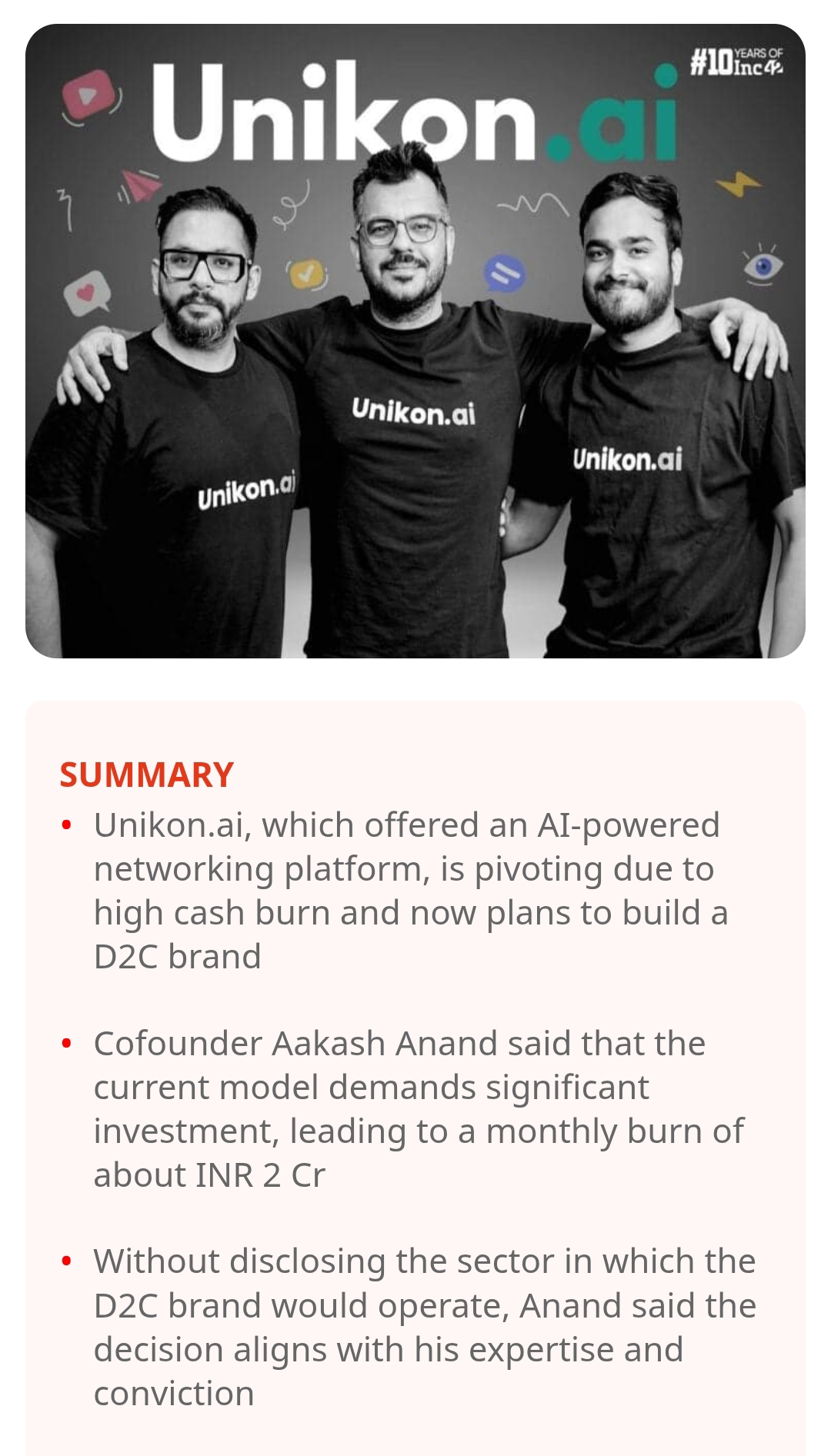

After raising $2.3 Mn since its inception in 2020, women-only community startup leap.club is halting its operations due to high customer acquisition costs and retention challenges. The startup announced the decision operations on Instagram and Link

See More

Priyanka Darak

Hey I am on Medial • 2m

The secret to closing a funding round? Momentum. ⚡️ Most deals don't die because of the vision—they die during due diligence because of "document chaos." A professional Virtual Data Room (VDR) is a signal to investors that you are execution-ready.

See More

Siva Subramanyam

Hey I am on Medial • 3m

Hello everyone! 👋 I’m an MBA graduate specializing in Human Resource Management, with hands-on experience in recruitment, employee engagement, and satisfaction surveys through internship. I’m currently seeking full-time opportunities in HR — especi

See MoreVivek Joshi

Director & CEO @ Exc... • 1m

Stop searching for capital and start closing it. 💼 Excess Edge Experts Consulting is scouting for only four institutional-grade debt projects. Requirements for Consideration: * Fundraising requirement of ₹50Cr or above. * Demonstrated profitabilit

See More

Vivek Joshi

Director & CEO @ Exc... • 2m

Stop searching for capital and start closing it. 💼 Excess Edge Experts Consulting is scouting for only four institutional-grade debt projects. Requirements for Consideration: * Fundraising requirement of ₹50Cr or above. * Demonstrated profitabilit

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)