Back

robin

Don't be afraid to b... • 8m

I read somewhere that debt for companies is used as a method for tax evasion, many companies lie about debt to evade the tax so they can keep the full profits for themselves, correct me if I am wrong

Replies (1)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

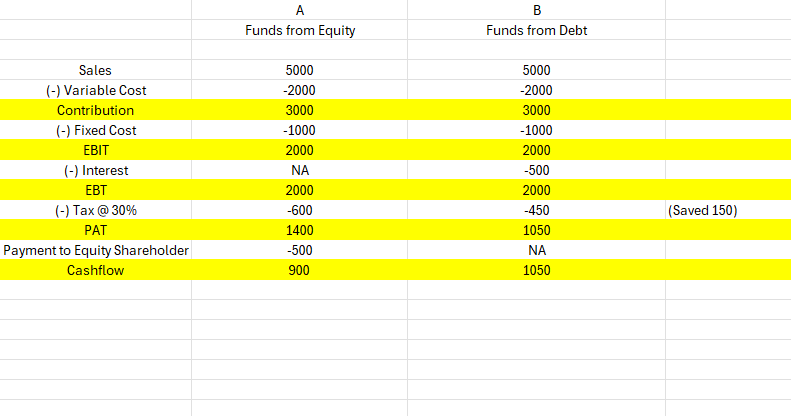

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Sanskar

Keen Learner and Exp... • 1y

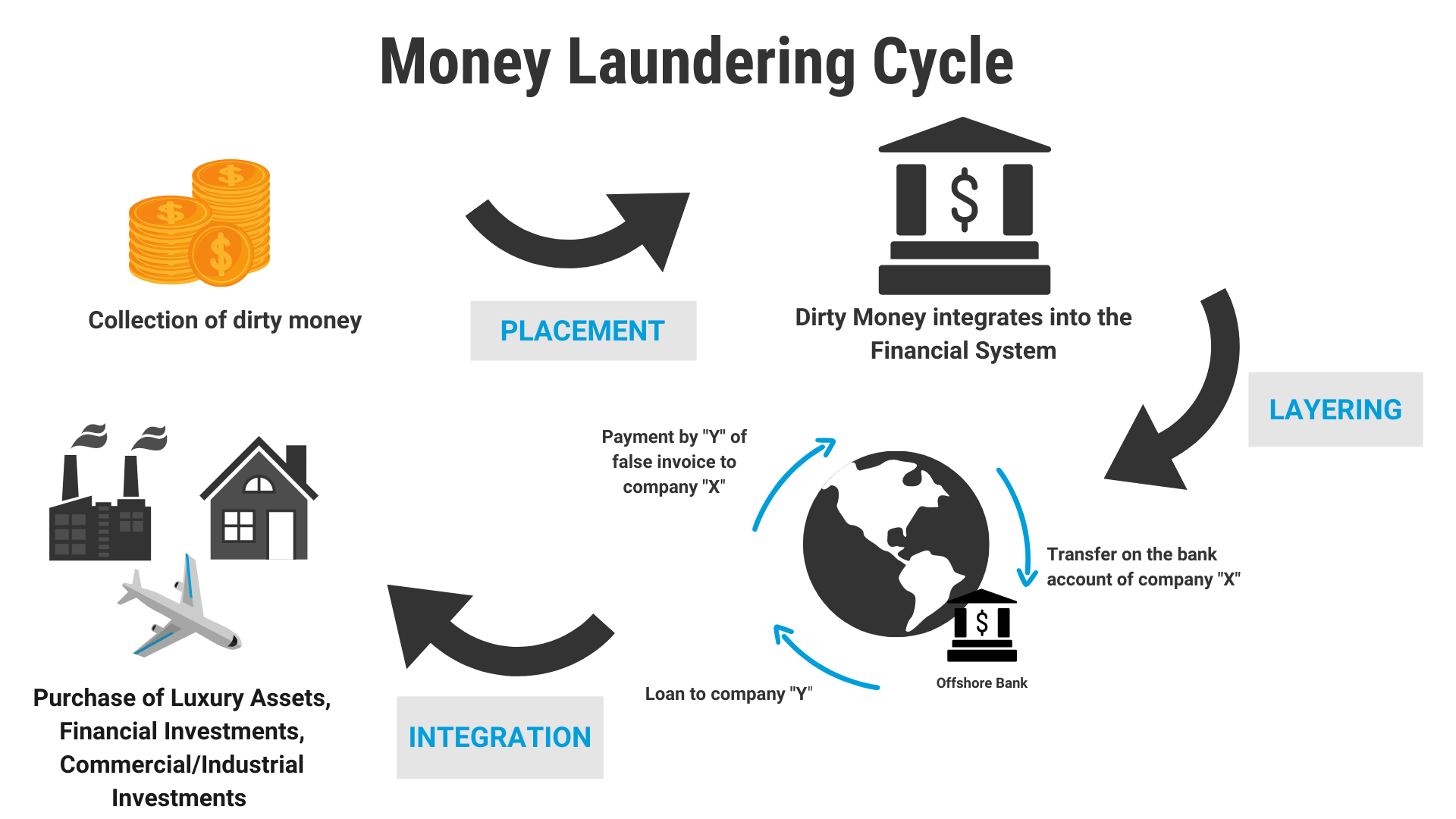

In 2016, a German journalist Bastian Obermayer has published 11.5M documents online. These documents contained details about financial tax evasion and money laundering of the VIPs and VVIPs. This list contained the names of 11 world leaders, politic

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Sameer Patel

Work and keep learni... • 1y

PAN Card The PAN (Permanent Account Number) card is a ten-digit alphanumeric identifier issued by the Income Tax Department of India. It's crucial for various financial transactions such as opening a bank account, filing income tax returns, and buyin

See MoreAccount Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)