Back

AR

Let's build Somethin... • 3m

4. LTV to CAC is king Lifetime Value to Customer Acquisition Cost ratio is the only metric that matters. Hormozi's craziest ratios? 30:1 to 200:1. That's how you scale profitably and make "stupid money." Optimize your business back to front.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 3m

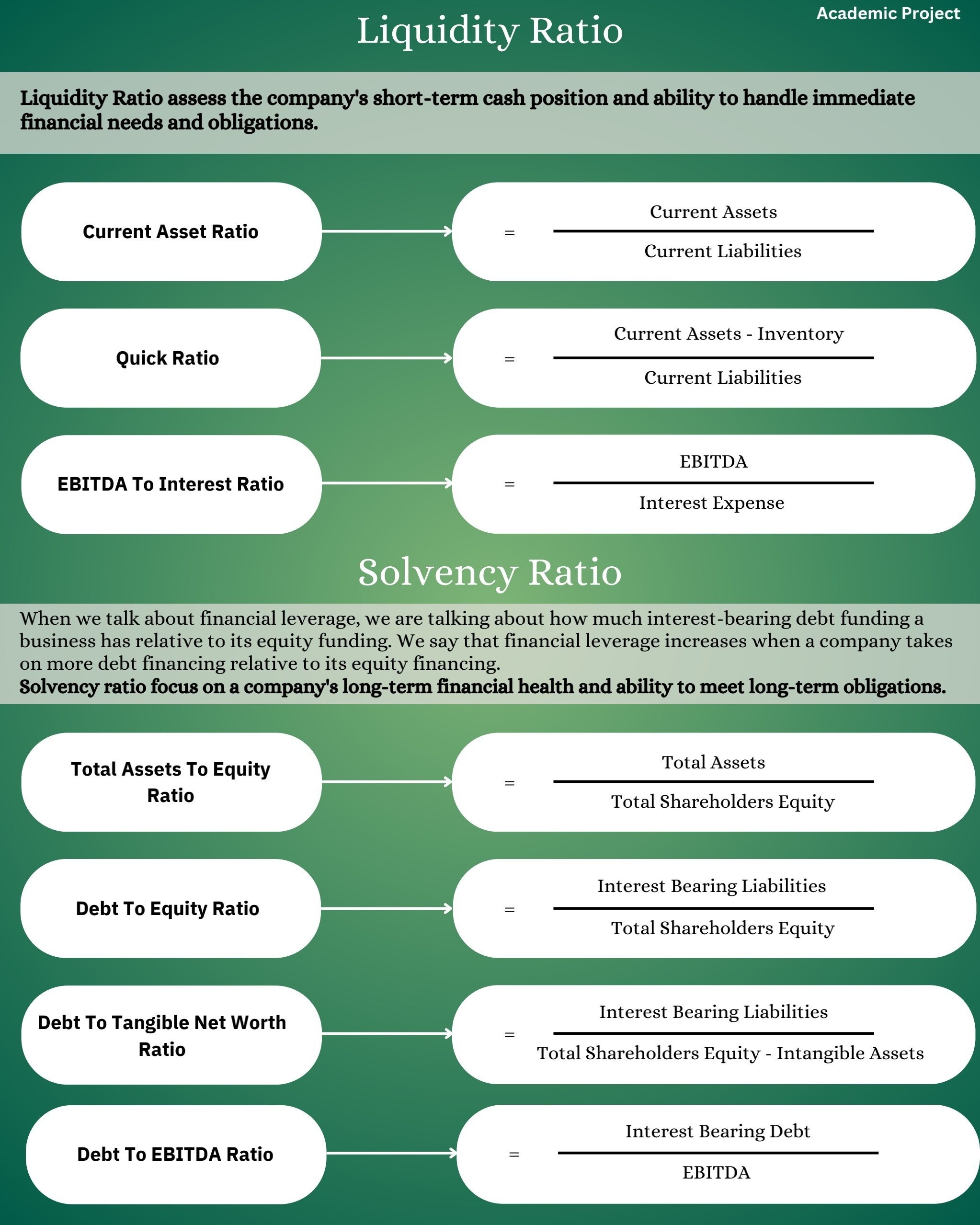

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Vivek Joshi

Director & CEO @ Exc... • 3m

Unlock the secrets of startup success with our comprehensive guide on Decoding Unit Economics! In this video, we break down the critical components that can determine the fate of your early-stage venture. Learn how to define your unit, calculate Cust

See MoreSwapnil gupta

Founder startupsunio... • 3m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreAccount Deleted

Hey I am on Medial • 4m

7 Essential Metrics Every Startup Should Track 1. Customer Acquisition Cost (CAC) https://www.investopedia.com/terms/c/customer-acquisition-cost.asp 2. Lifetime Value (LTV) https://www.investopedia.com/terms/c/customer-lifetime-value-clv.asp 3. Bu

See More

Download the medial app to read full posts, comements and news.