Back

Replies (1)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 7 About Basic Finance and Accounting Concepts Here's Some New Concepts 8. Liquid Assets Easily convertible into cash without a significant loss in value. Examples: cash, cash equivalents, and accounts receivable. 9. Illiquid Assets Assets

See More

VIJAY PANJWANI

Learning is a key to... • 21d

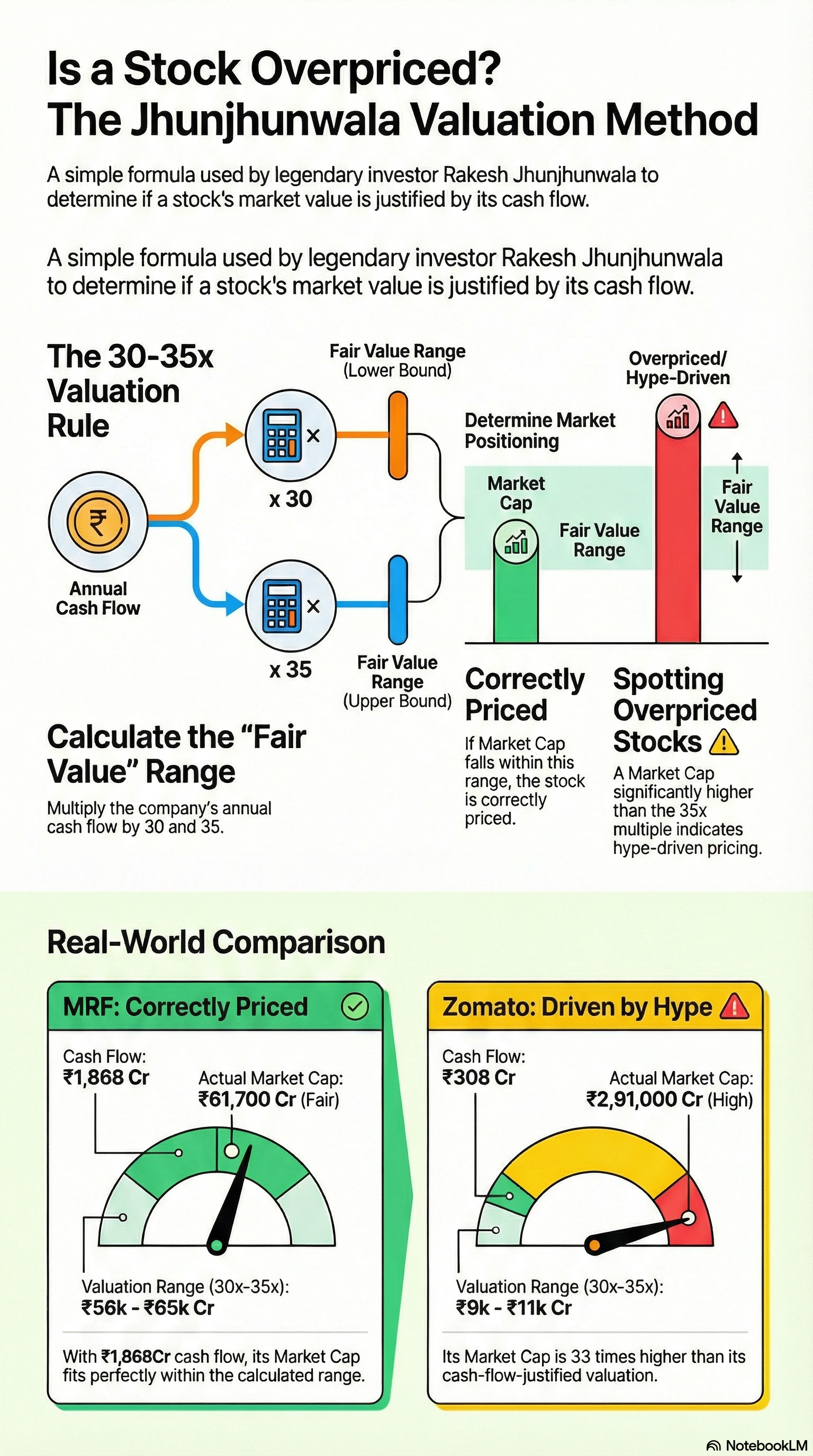

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Anonymous

Hey I am on Medial • 1y

Only two things sustain a stock price 1. Future Earnings/Cash flow Power(going concern): This tells a company's ability to generate sustainable profits or free cash flow. Whether you're analysing a high-growth tech company or a high dividend-paying

See MoreTushar Aher Patil

Trying to do better • 1y

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

CA Rajat Agrawal

EaseValue Advisors • 9m

One of my startup clients recently struggled with severe cash flow issues — something I see quite often, especially in AI-driven or tech-based startups. Despite having a great product and market fit, they were stuck because of delayed receivables an

See MoreKarnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreMahesh Reddy

Semi qualified CMA (... • 11m

Hey founder👋 Ever wondered how startups figure out their worth? Let me break down the Discounted Cash Flow (DCF) method—it’s easy! What’s DCF? It calculates a business’s current value by predicting its future cash flows and adjusting for risk usin

See MoreGireendra

The world runs on hu... • 1y

Who is the real richest man in the world? Warren Buffett – $149 Billion in Liquid Assets Bill Gates – $20 to $30 Billion in Cash Reserves Larry Ellison – $10 to 15 Billion in Liquidity Jeff Bezos – $5 to $10 Billion in Liquid Net Worth Elon Musk –

See MoreAnurag Bhardwaj

ECE student | Entre... • 9m

Today’s insight: Use other people’s money! 🚀 The rich get richer by leveraging— Banks lend for assets like properties. Landlords buy homes, Airbnbs cash flow. It’s not their money—it’s the bank’s! They profit while others pay the loan. How will you

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)