Back

Account Deleted

Hey I am on Medial • 9m

ARR vs MRR vs Cash Flow It’s easy to feel like things are going well when your ARR looks strong. Or when MRR keeps ticking up. But if your bank account is saying otherwise, something's off. Breakdown: 1) ARR shows the big picture. Great for investors, not for day to day decisions 2) MRR tracks monthly growth. Helpful for momentum, but not the full story 3) Cash Flow tells you what you can actually spend. And this is where most founders get blindsided If you’re wondering why you’re stressed even with good revenue numbers, it is probably that your cash flow is just misaligned. High ARR doesn’t help if you collect payments annually and burn through cash monthly. That gap between what’s booked and what’s in the bank can kill momentum. Keep an eye on all three. But when it comes to survival, cash flow is king.

Replies (3)

More like this

Recommendations from Medial

Manu

Building altragnan • 10m

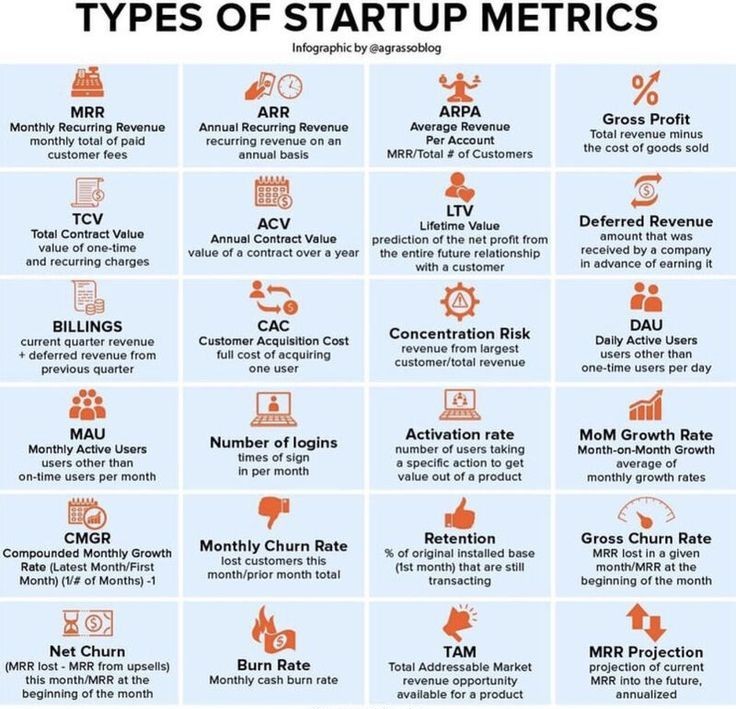

This infographic shows key startup metrics. MRR is monthly recurring revenue, while ARR is annual recurring revenue. ARPA shows average revenue per customer. Gross Profit is revenue minus costs. TCV and ACV measure contract values. LTV predicts total

See More

CA Jasmeet Singh

In God We Trust, The... • 9m

3 DIY Health Checks Every Founder Should Do Monthly 1. Cash Flow Pulse Check → Ask: Did I collect more than I spent this month? → If unsure, review bank statements & tally collections vs payments. Why it matters: Profitable on paper ≠ cash in bank.

See MoreKarnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreVikas Acharya

Building Reviv | Ent... • 11m

The A-Z Survival Guide to Entrepreneurship! C – Cash Flow Profitability sounds great, but if you run out of cash, your business dies—no matter how good your idea is. I learned the hard way that revenue doesn’t equal survival. Managing cash flow is

See MoreVIJAY PANJWANI

Learning is a key to... • 20d

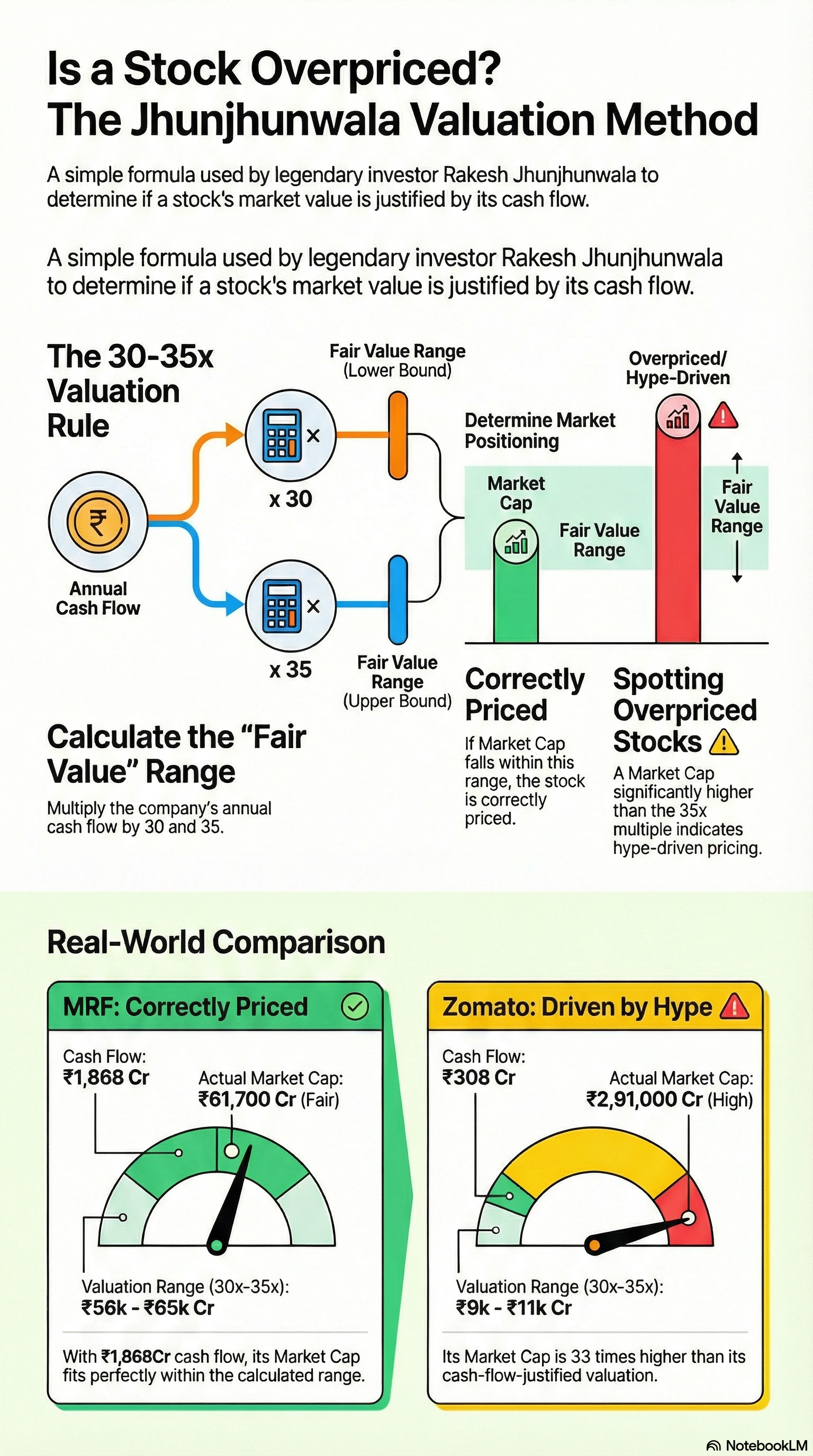

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)