Back

CA Rajat Agrawal

EaseValue Advisors • 9m

One of my startup clients recently struggled with severe cash flow issues — something I see quite often, especially in AI-driven or tech-based startups. Despite having a great product and market fit, they were stuck because of delayed receivables and no structured financial planning. They couldn’t even decide when to hire or scale because money flow was unpredictable. We helped them build a proper cash flow forecast, and within a month, they had clear visibility on when money was coming in and going out. That single step changed their decision-making completely. If you're building a startup, especially in AI or tech, don't underestimate cash flow planning. It's just as important as your product roadmap. If any Medial members have questions about Cash flow , feel free to WhatsApp us at 8440044833. We’ll be happy to help you sort it out.

Replies (2)

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreShubham Jain

Partner @ Finshark A... • 11m

Mandatory TReDS Onboarding for Companies with Turnover Above ₹250 Crores As per Gazette Notification S.O.-4845E dated 7th November 2024, all companies with a turnover exceeding ₹250 crores are required to onboard the Trade Receivables Discounting Sy

See MoreVedant SD

Finance Geek | Conte... • 1y

Financial Planning for Bangalore Entrepreneurs Bangalore, a thriving hub for startups, offers immense opportunities but navigating the financial landscape can be challenging. Here's a simplified guide: * Define Goals: What are your financial object

See MoreSandip Kaur

Hey I am on Medial • 1y

Mastering Cash Flow: Simple Strategies for Indian Startups Cash flow can either make or break your startup, and managing it well is critical. Here are some practical tips to help your startup thrive financially: 1.Separate Business and Personal Fina

See MoreVIJAY PANJWANI

Learning is a key to... • 16d

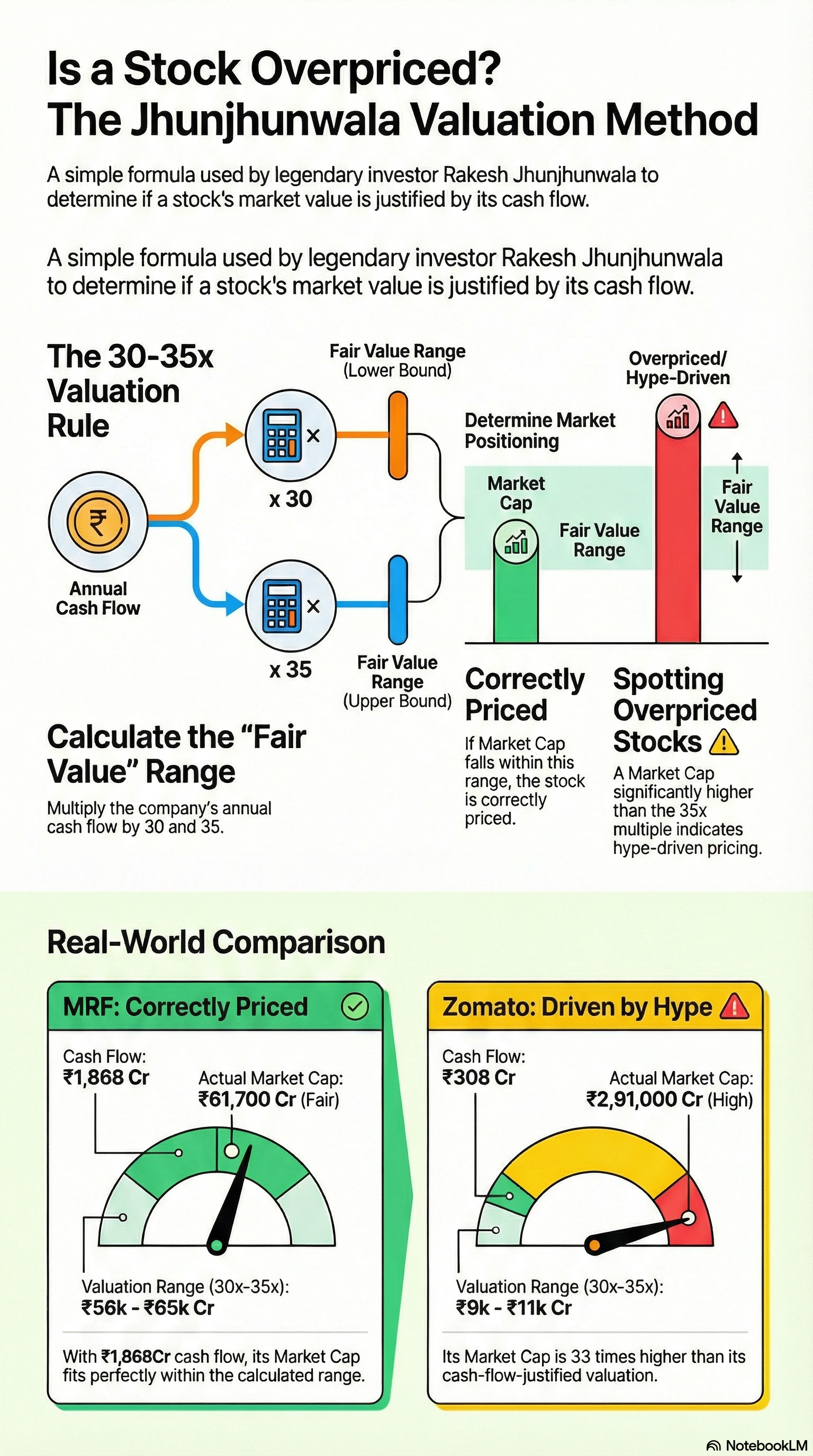

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Vikas Acharya

Building Reviv | Ent... • 1y

WTF is RUNRATE ? Run Rate A financial projection of your yearly revenue or expenses based on current performance. Example: If your startup earns ₹100,000 in one quarter, your annual run rate would be ₹400,000. Why it matters: Helps forecast growth

See More

Karnivesh

Simplifying finance.... • 2m

For a long time, I assumed that profitability meant safety. If a business was making money, I believed it was stable. Over time, I realised profit alone can be misleading. Many businesses fail not because they aren’t profitable, but because deeper i

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)