Back

Mahesh Reddy

Semi qualified CMA (... • 11m

Hey founder👋 Ever wondered how startups figure out their worth? Let me break down the Discounted Cash Flow (DCF) method—it’s easy! What’s DCF? It calculates a business’s current value by predicting its future cash flows and adjusting for risk using a "discount rate." This is especially useful for startups with strong growth potential. Example: A startup expects ₹50 lakh yearly for 3 years. With a 10% discount rate: - Year 1 = ₹45.45L - Year 2 = ₹41.32L - Year 3 = ₹37.56L Total Value (DCF)** = ₹1.24 crore 🎉

More like this

Recommendations from Medial

Mahesh Reddy

Semi qualified CMA (... • 11m

Hey founder👋 why ₹1 today is more valuable than ₹1 tomorrow? Let me break down the concept of Present Value (PV)—it’s simpler than you think! It’s the value of future money today, adjusted for risk and opportunity cost using a "discount rate." It

See MorePulakit Bararia

Founder Snippetz Lab... • 1y

So how do you calculate your company’s valuation? Here’s the simplest way to think about it: 1. Forecast Future Earnings: Start with what your business makes now and apply a growth rate. Example: Year 1: $100K → Year 2: $120K → Year 3: $144K. 2.

See MoreSwapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreMahesh Reddy

Semi qualified CMA (... • 11m

Hey founder👋 Ever wondered how much your money can grow over time? Let me break down the concept of Future Value (FV) What’s FV? It’s the value of money at a future date, considering interest or growth over time. Think of it as how ₹1 today can turn

See Moregray man

I'm just a normal gu... • 11m

Zepto, a leading player in the quick commerce space, has significantly reduced its cash burn and is approaching a $4 billion annualised gross order value (GOV), according to cofounder and CEO Aadit Palicha. “We’re getting close to $4 billion in annu

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

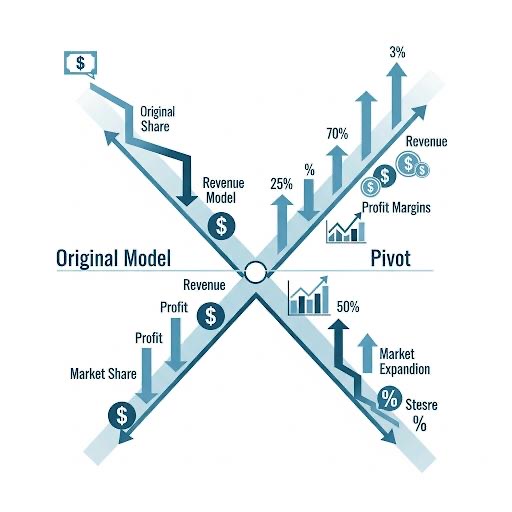

Pivoting -When do the numbers tell you it's time to drastically re-evaluate your startup's core business model?" Financial Red Flags: Consistently Negative Unit Economics: Losing money on every sale with no clear path to profit? Your Customer Acquis

See More

Tushar Aher Patil

Trying to do better • 1y

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)