Back

Rohan Saha

Founder - Burn Inves... • 9m

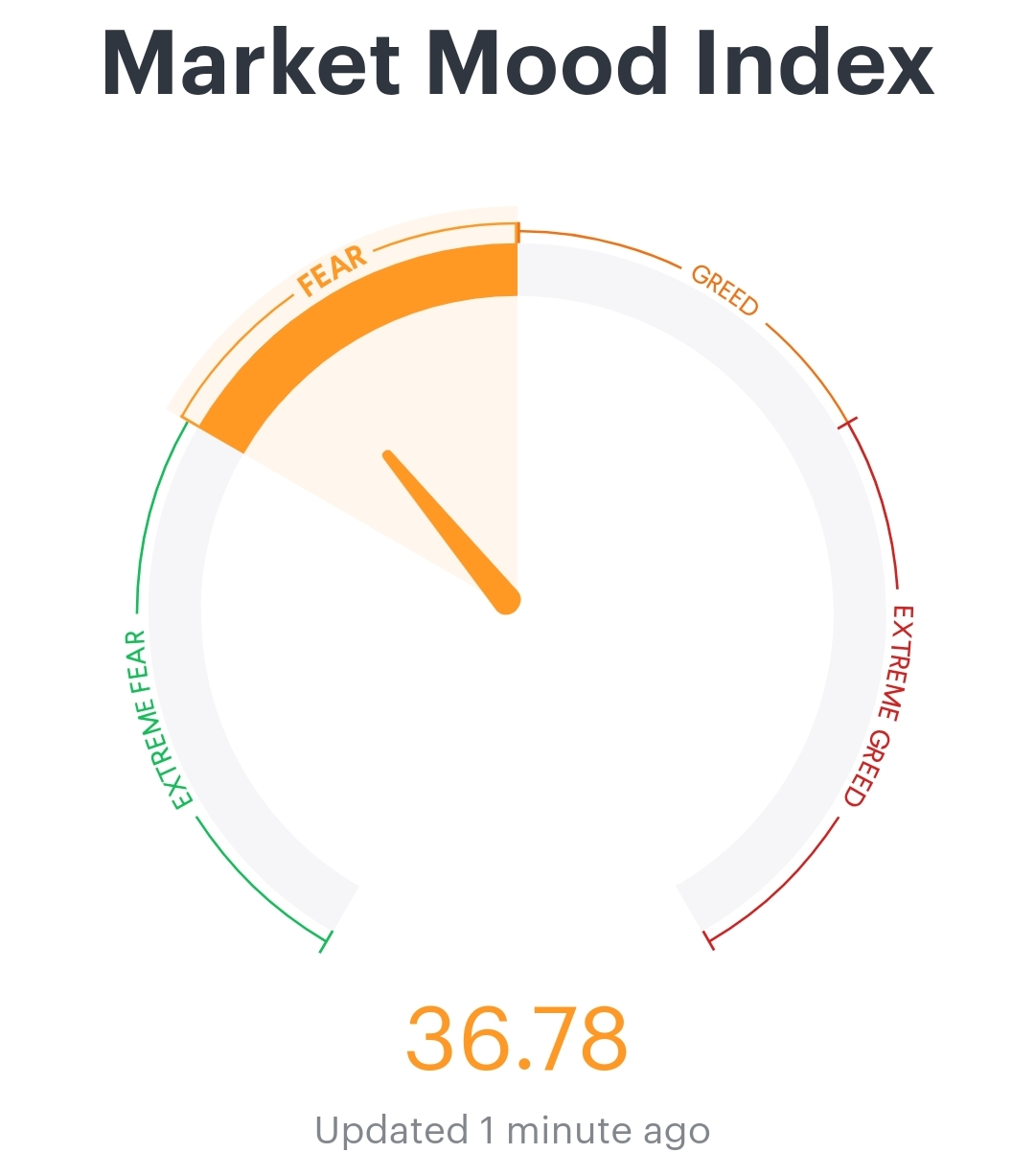

Based on the MMI index and PE ratio of the Indian market, the ongoing war hasn't had a significant impact on our market. This is mostly some profit booking happening right now by FIIs and especially domestic investors. I was waiting for the weekend to get a clearer picture, and things seem to be improving slightly on the geopolitical front. On May 13, 2025, India's inflation rate data is set to be released, which is also something to watch. If the rate comes in around the expected 3.1% or even lower, we might see another rate cut from the RBI.

Replies (4)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 8m

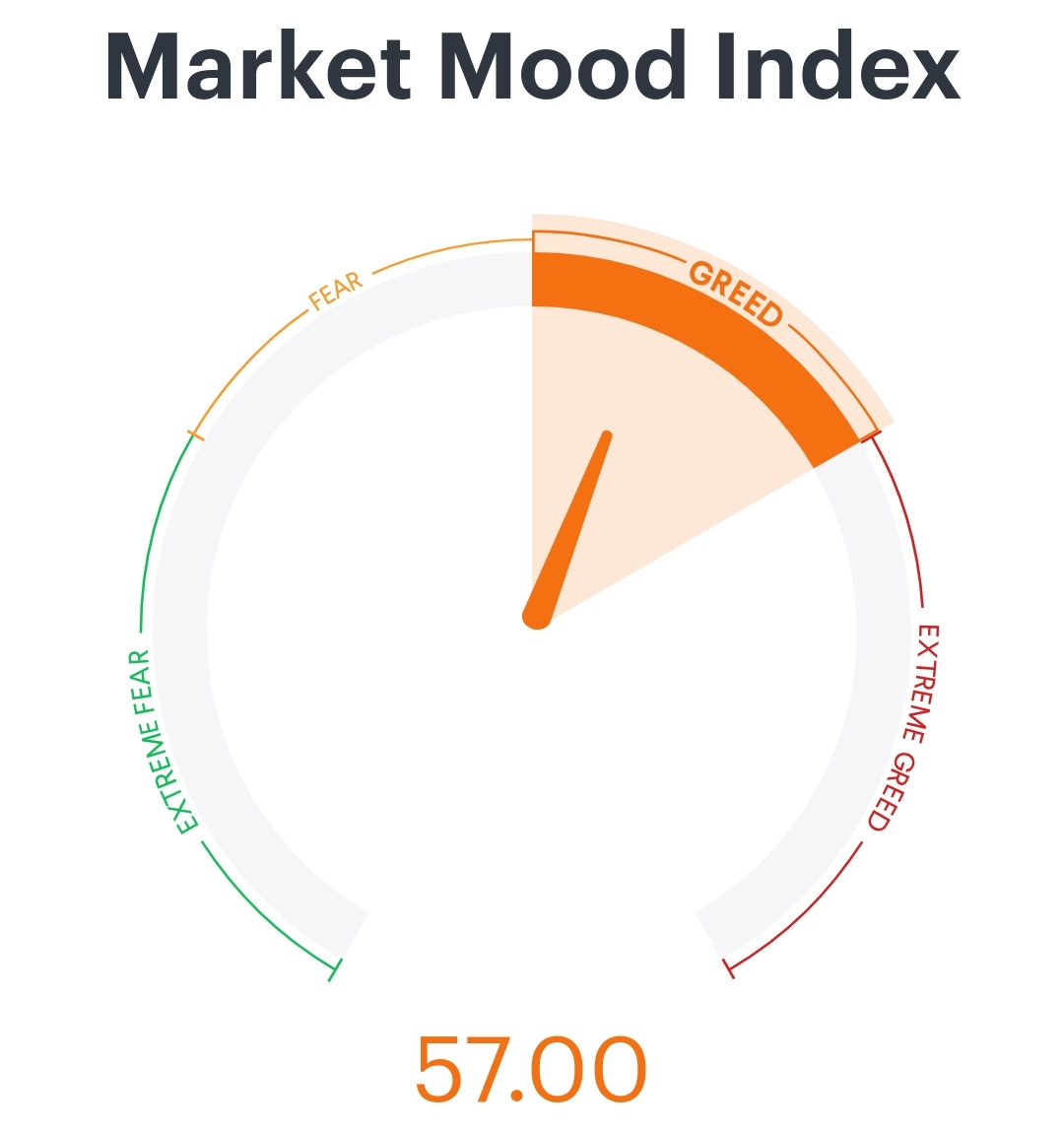

The Market Mood Index (MMI) is currently hovering around 57, which usually points to a bullish setup and potential for some decent upside. But we can't ignore the bigger picture global markets are still full of uncertainties. The US job data didn’t r

See More

Rohan Saha

Founder - Burn Inves... • 9m

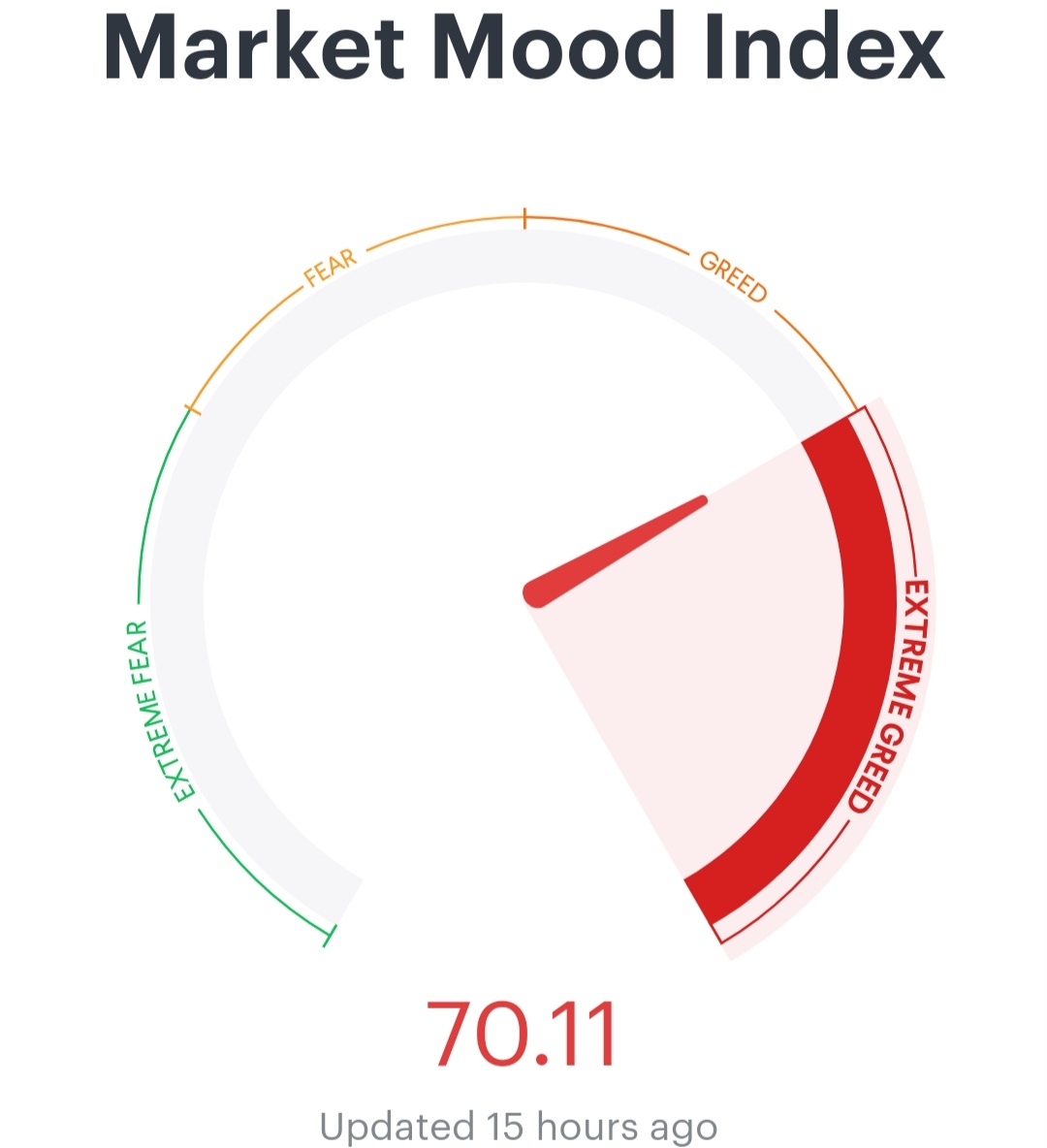

Even though the market fell today, our MMI index still jumped from 64 to 67 it's now just a few points away from the 'extreme greed' zone. I have a feeling that even a small move in the Indian market could trigger a noticeable shift in the MMI, espe

See MoreAtharva Deshmukh

Daily Learnings... • 1y

The Stock Market Index When we want to know about the trends in the market, we need to analyze few of the important companies in each industry. The important companies are pre-packaged and continuously monitored to give you this information. This pr

See MoreRohan Saha

Founder - Burn Inves... • 1y

There is no need to be too happy with today's market gains as the budget is yet to come, and we need to wait for it. The market valuation has improved, and the RBI is also increasing money liquidity. A rate cut might happen in the near future, which

See MoreRohan Saha

Founder - Burn Inves... • 8m

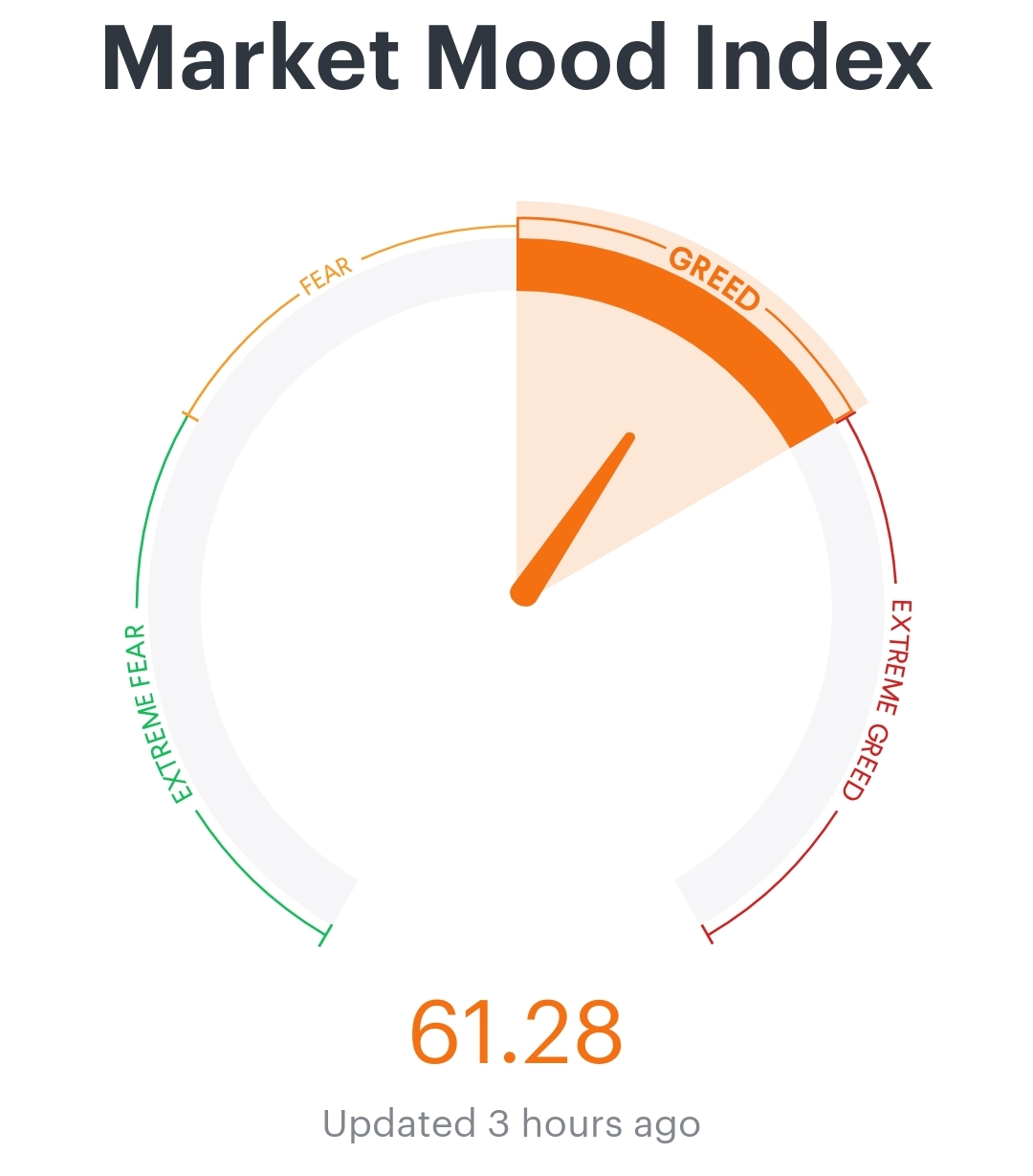

Looking at today’s MMI it seems pretty clear that even if the market does correct it probably won’t be a major drop we might just see a small dip enough to bring valuations to a reasonable level and then the market could bounce back Yesterday the MMI

See More

Rohan Saha

Founder - Burn Inves... • 1y

Last week, when the news broke that the Fed might cut interest rates, the subsequent rally in our market left no room for further gains. It was unlikely to see a 1-2% return in just one day, and there hasn't been any significant inflow from FIIs. Tha

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)