Back

Rohan Saha

Founder - Burn Inves... • 8m

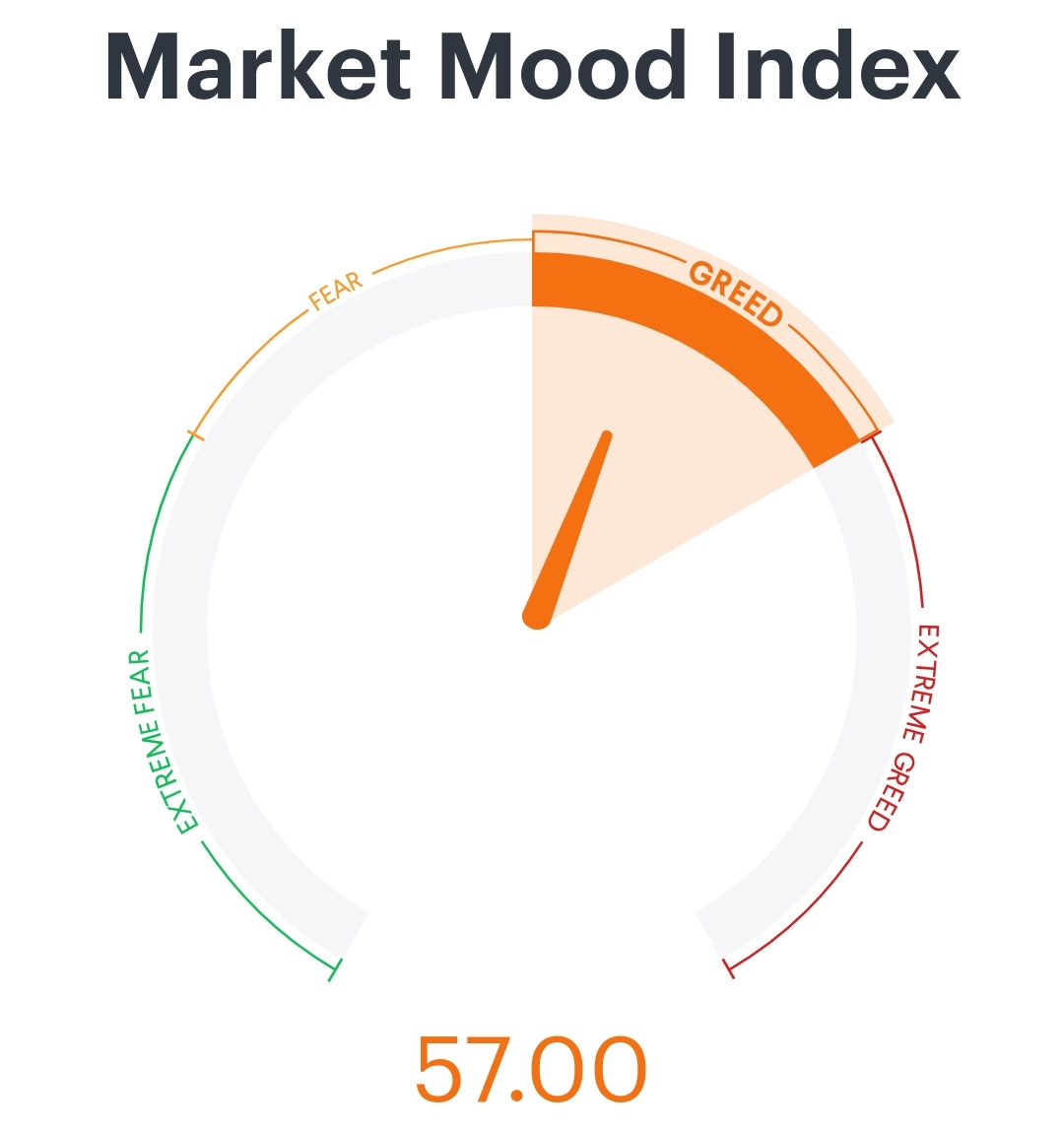

The Market Mood Index (MMI) is currently hovering around 57, which usually points to a bullish setup and potential for some decent upside. But we can't ignore the bigger picture global markets are still full of uncertainties. The US job data didn’t really impress, and there’s still no clear update on the tariff situation. In times like these, it might be tough for the markets to hold on to higher levels for long, especially with FIIs likely to book profits and play it safe.

Replies (4)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

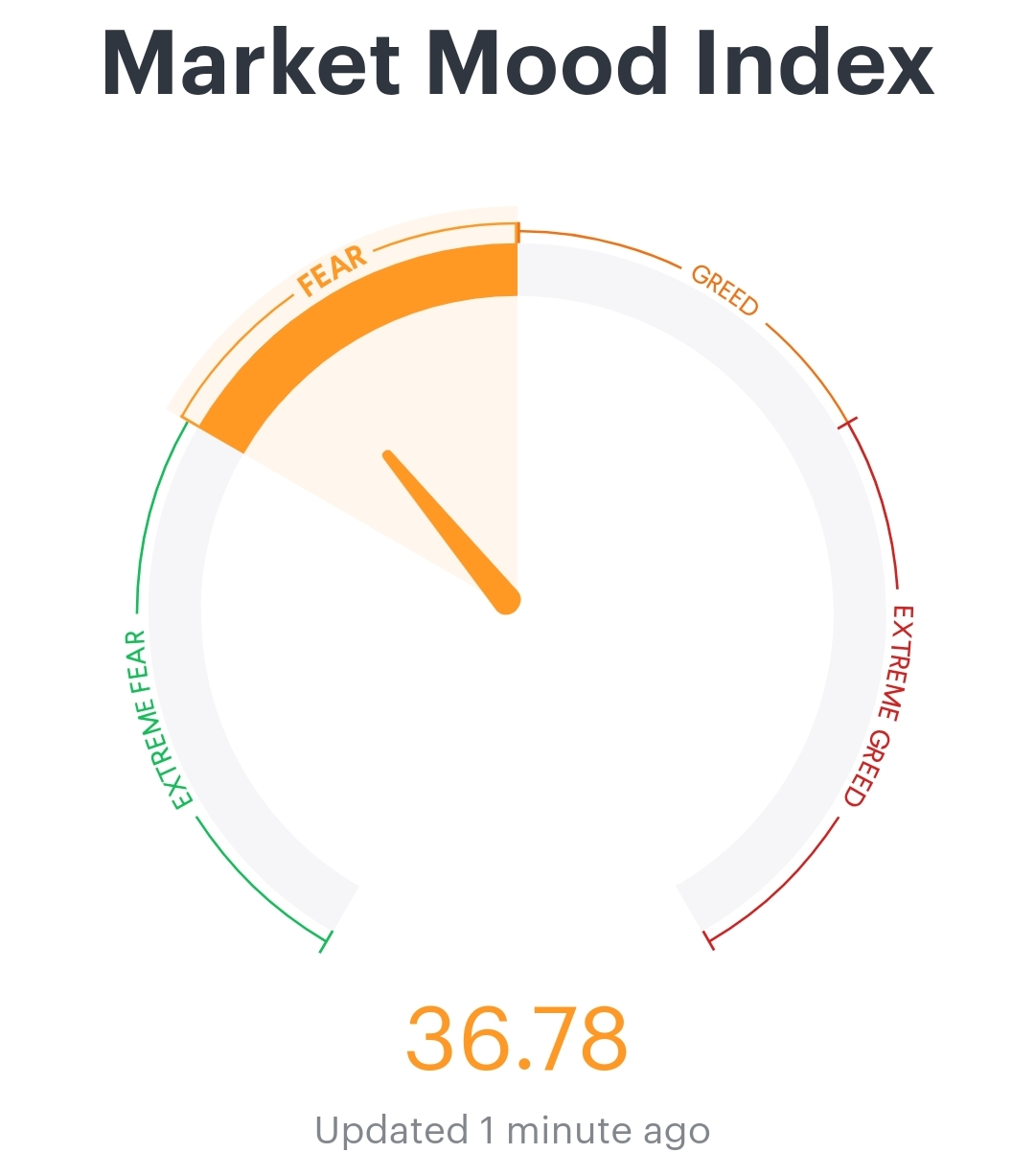

Even though the market fell today, our MMI index still jumped from 64 to 67 it's now just a few points away from the 'extreme greed' zone. I have a feeling that even a small move in the Indian market could trigger a noticeable shift in the MMI, espe

See MoreProgrammerKR

Founder & CEO of Pro... • 10m

iPhone Prices May Rise Due to Tariffs Tariff tensions may lead Apple to increase iPhone prices for the first time in years. Analysts watch closely as supply chains and consumer markets brace for impact. #Apple #iPhone #Tariffs #TechEconomy #Consume

See MorePRATHAM

Experimenting On lea... • 5m

The U.S. market is overvalued, with a Buffett Indicator at 217% and P/E near 37–38, close to dot-com bubble levels (P/E - 44). Global markets ( India or China) may outperform the U.S. in the next 5–10 years. FIIs should flow some cash in India as we

See MoreRohan Saha

Founder - Burn Inves... • 9m

Based on the MMI index and PE ratio of the Indian market, the ongoing war hasn't had a significant impact on our market. This is mostly some profit booking happening right now by FIIs and especially domestic investors. I was waiting for the weekend t

See MoreRohan Saha

Founder - Burn Inves... • 6m

Global markets have turned a bit bullish with the news of a possible Fed rate cut in September in India too I feel we might see a gap up opening tomorrow but here the big factor is company earnings and for quite some time they have not been coming ou

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)