Back

Rohan Saha

Founder - Burn Inves... • 9m

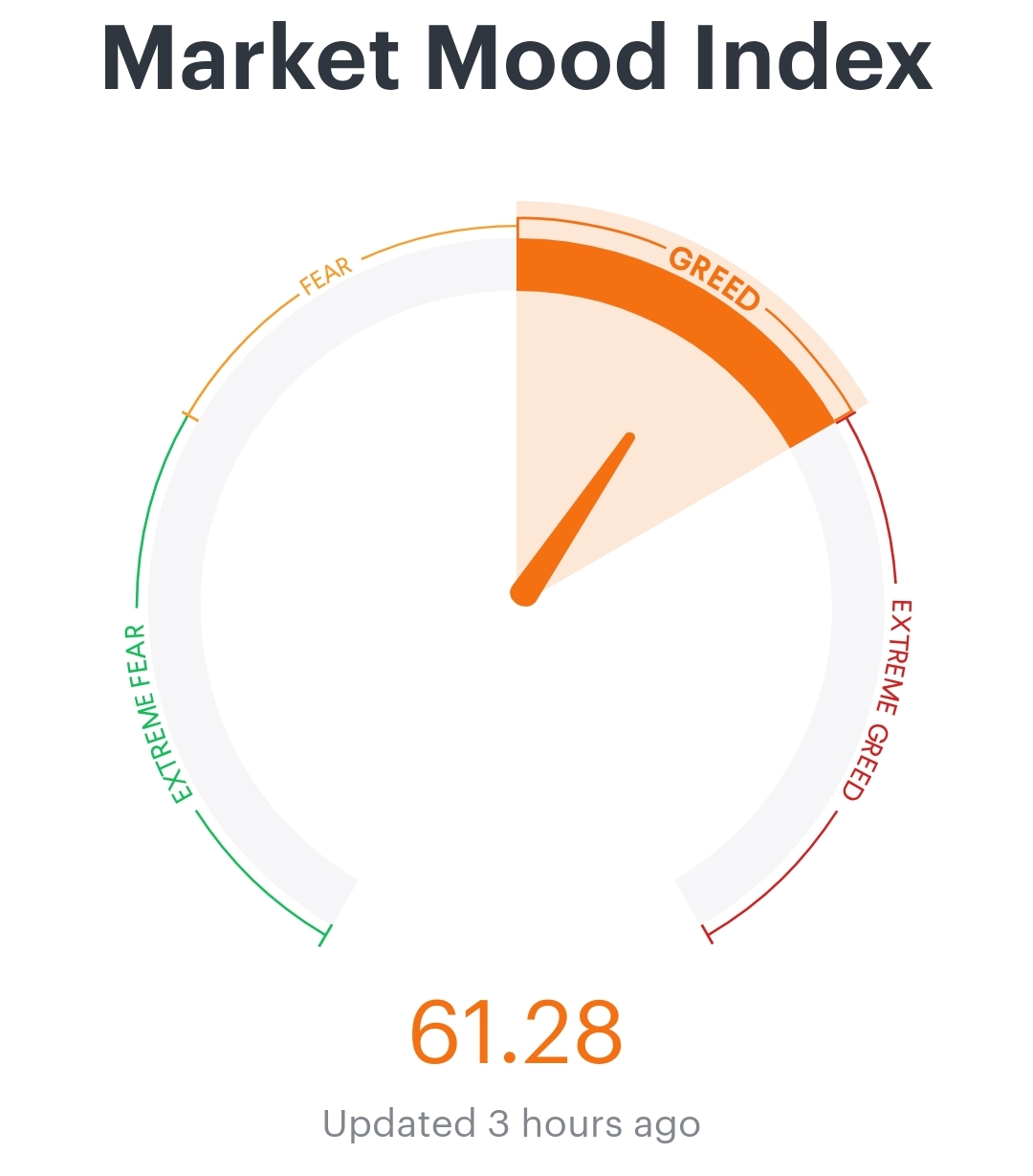

Even though the market fell today, our MMI index still jumped from 64 to 67 it's now just a few points away from the 'extreme greed' zone. I have a feeling that even a small move in the Indian market could trigger a noticeable shift in the MMI, especially since gold buying is picking up fast. Gold had a big rally today, and since gold buying is part of the MMI calculation, that’s definitely playing a role. Overall, I think the market will stay sideways for a bit maybe for a few days or at least until tomorrow depending on what the Fed announces. Personally, I don’t think the Fed will cut rates just yet, at least not until there’s more clarity on the tariff situation.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 8m

Looking at today’s MMI it seems pretty clear that even if the market does correct it probably won’t be a major drop we might just see a small dip enough to bring valuations to a reasonable level and then the market could bounce back Yesterday the MMI

See More

RootDotAi

From the ROOT to the... • 1y

Here's a Summary of the FED decision on March 20, 2024: 1. The Federal Reserve keeps interest rates steady at 5.50% for the fifth consecutive meeting. 2. The Fed maintains its anticipation of three interest rate reductions in 2024. 3. The proje

See MorePriyant Dhrangdhariya

Head of Finance @ Th... • 1y

India’s Gold Loan Market: A Glittering Opportunity The Sparkling Growth: Bajaj Finserv Ltd., a diversified NBFC, predicts India’s gold loan market—valued at $55.52 billion in 2022—will soar to $124.45 billion by 2029. A 12.22% annual growth fuels t

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)