Back

Atharva Deshmukh

Daily Learnings... • 1y

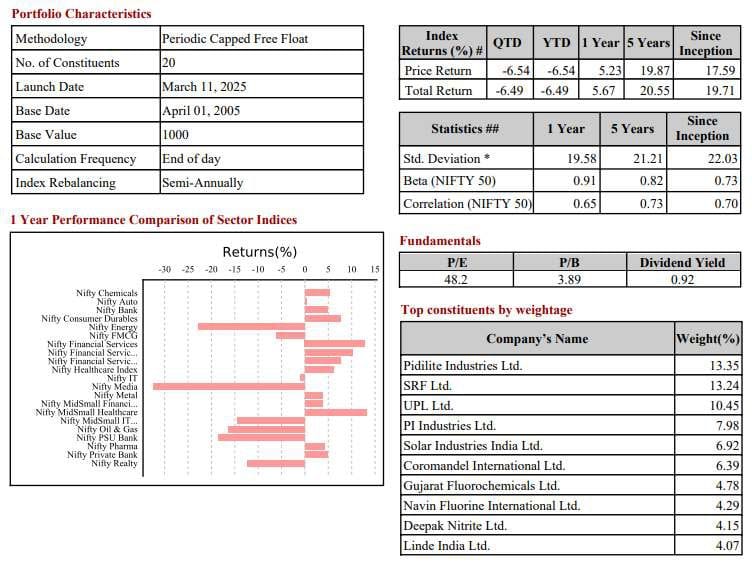

The Stock Market Index When we want to know about the trends in the market, we need to analyze few of the important companies in each industry. The important companies are pre-packaged and continuously monitored to give you this information. This pre-packaged market sentiment indicator is called 'Stock Market Index'. Two important indices representing BSE and NSE are S&P BSE Sensex and The Nifty 50 respectively. Practical Uses of the Index 1)Information:- Info about the market trends, up index indicates that people are optimistic, and a down index indicates a pessimistic future. 2)Benchmarking:- Index can be used to analyze the returns you get in comparison with the index. The objective of market participants is to outperform the index. 3)Trading:- Most popular use of the index is trading it, majority of traders in the market trade the index. There are certain indices representing specific sectors, these are called sectoral indices.E.g. the Bank Nifty on NSE represents Bank Sector

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 2m

When I first started following the stock market, I assumed NIFTY and Sensex represented the entire market. Green meant the market was up, red meant it was down. Simple. Over time, I realised that wasn’t the full picture. These indices don’t track ev

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 11m

Indian Stock Market Closure for Holi 2025? The Bombay Stock Exchange (BSE) building stands tall as investors await confirmation on whether the stock market will remain closed for Holi 2025. Meanwhile, benchmark indices, Sensex and Nifty 50, ended low

See More

financialnews

Founder And CEO Of F... • 1y

It is a sell-on-rise market; see Nifty@21,300 by end year Jai Bala, Chief Market Technician, predicts a downward trajectory for the Nifty and Bank Nifty indices, reaching 21,300 and 42,000 respectively by year-end. He anticipates a strengthening doll

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)