Back

Rohan Saha

Founder - Burn Inves... • 1y

Last week, when the news broke that the Fed might cut interest rates, the subsequent rally in our market left no room for further gains. It was unlikely to see a 1-2% return in just one day, and there hasn't been any significant inflow from FIIs. That's why it's advised not to try to trade on news; it can lead to significant losses.

Replies (3)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

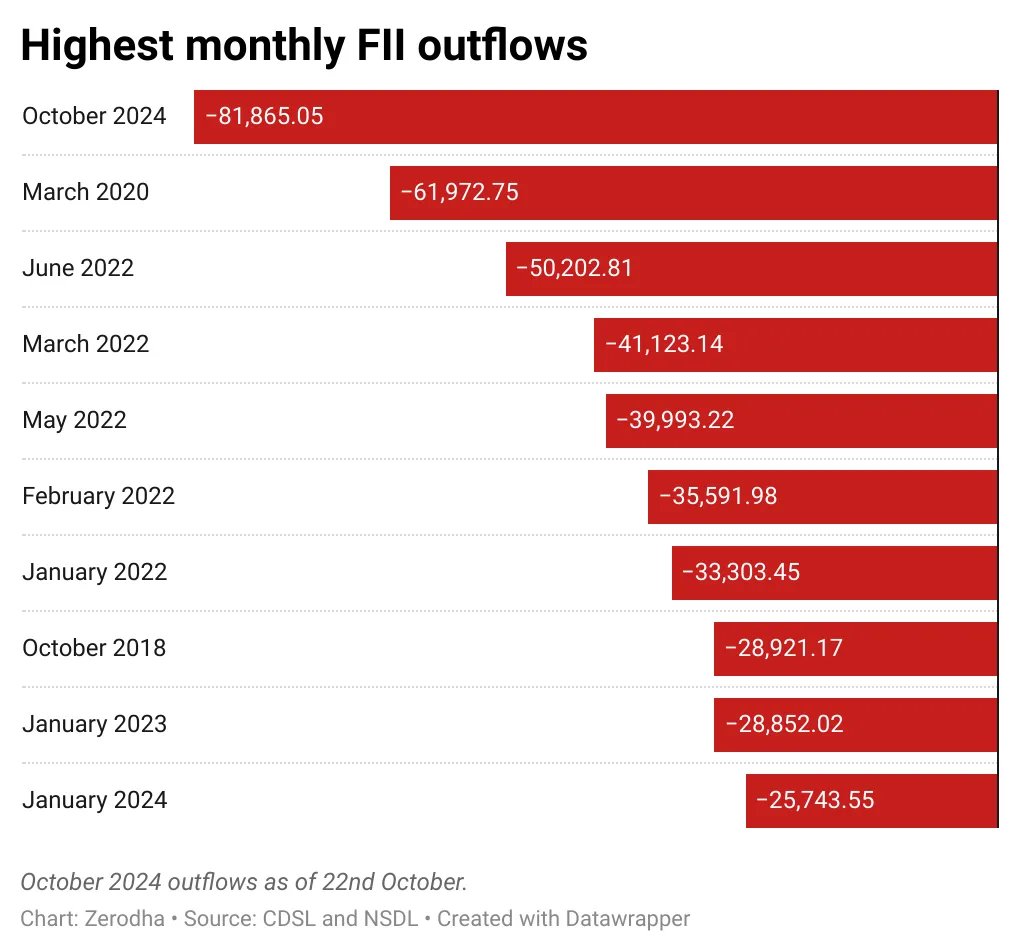

Indian companies are reporting good earnings this time, but for the market to see a significant rally, Foreign Institutional Investors (FIIs) need to invest in India. Domestic Institutional Investors (DIIs) or retailers alone cannot achieve this. Ano

See MoreRohan Saha

Founder - Burn Inves... • 1y

UBS has advised shorting the Indian rupee for now, which means FIIs may remain outside the Indian market for some time. Indian GDP growth is not looking impressive; at one point, China achieved over 10% GDP growth, while we have only managed to reach

See MoreRohan Saha

Founder - Burn Inves... • 1y

The Indian stock market has declined rapidly, but the market's PE ratio hasn't dropped as quickly. The reason behind this is the earnings not being as good. There is still some downside risk in the market. If an FTA (Free Trade Agreement) happens bet

See MoreRohan Saha

Founder - Burn Inves... • 10m

Based on the MMI index and PE ratio of the Indian market, the ongoing war hasn't had a significant impact on our market. This is mostly some profit booking happening right now by FIIs and especially domestic investors. I was waiting for the weekend t

See MorePranav Arya

Software Engineer | ... • 9m

Big news from the UK! A trial involving over 20,000 civil servants has shown significant productivity gains using Microsoft AI tools. Workers are saving an average of 26 minutes daily! The AI in focus is Microsoft 365 Copilot, assisting with tasks

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)