Back

Anonymous 2

Hey I am on Medial • 1y

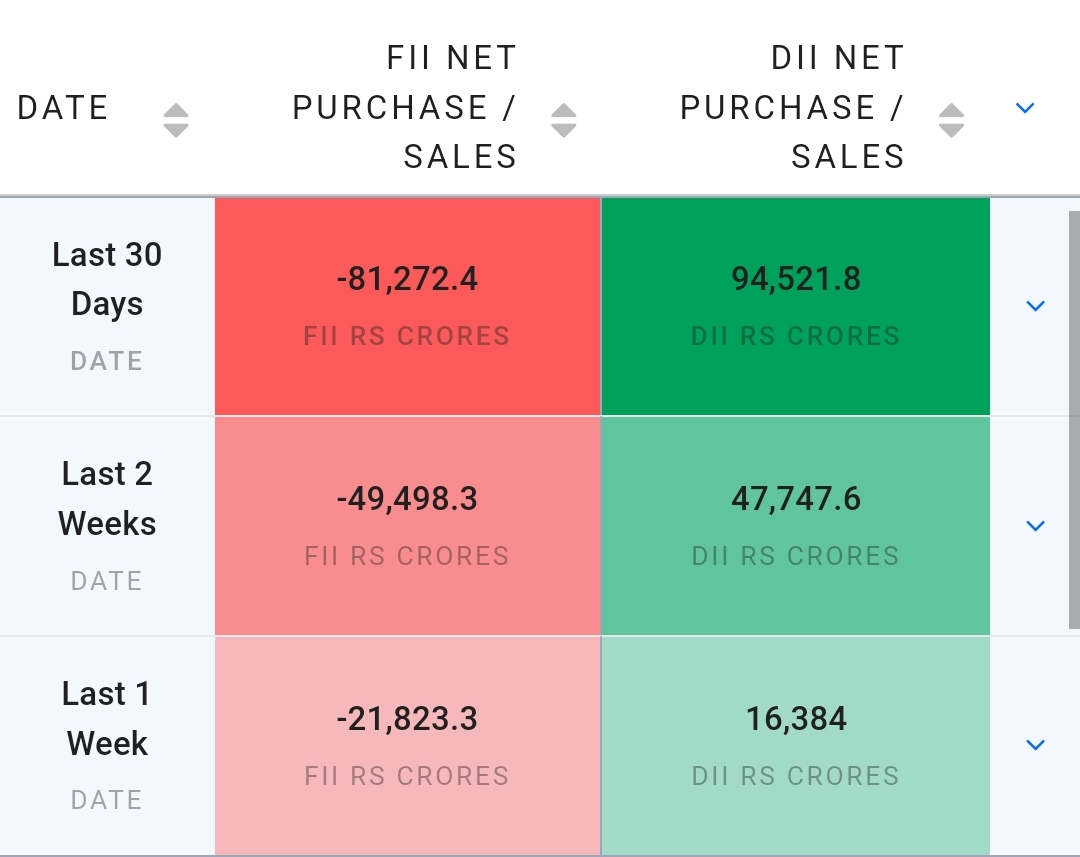

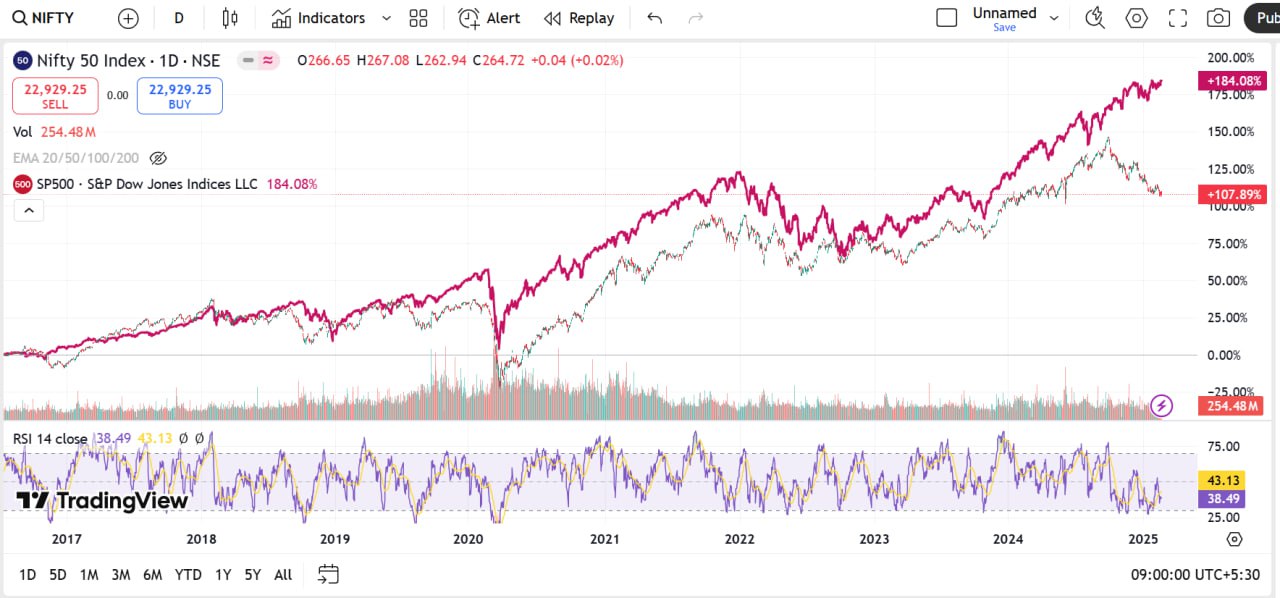

Honestly, the big moves happen when Foreign Institutional Investors (FIIs) pump money in. If that’s not happening, you’re just chasing shadows. A rate cut rumor won’t change that in the short term.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

As I mentioned earlier, Foreign Institutional Investors (FIIs) are significantly withdrawing their money from the Indian market. Many factors are working together, such as China’s economy, the US election, poor results from Indian companies, and the

See More

Rohan Saha

Founder - Burn Inves... • 1y

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See MoreRohan Saha

Founder - Burn Inves... • 1y

Indian companies are reporting good earnings this time, but for the market to see a significant rally, Foreign Institutional Investors (FIIs) need to invest in India. Domestic Institutional Investors (DIIs) or retailers alone cannot achieve this. Ano

See MoreRohan Saha

Founder - Burn Inves... • 1y

From September 27th until now, FIIs (Foreign Institutional Investors) have only been selling in the Indian market, and this trend is continuing. Looking at the current data, it also seems that Indian investors might be parking their money back into d

See MoreRohan Saha

Founder - Burn Inves... • 10m

There’s nothing to worry about, really. 'Wait and watch' always works in the market. Sometimes, doing nothing can be better than doing something. So, take advantage of a cheap market, have patience, and eventually the foreign institutional investors

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)