Back

Rohan Saha

Founder - Burn Inves... • 1y

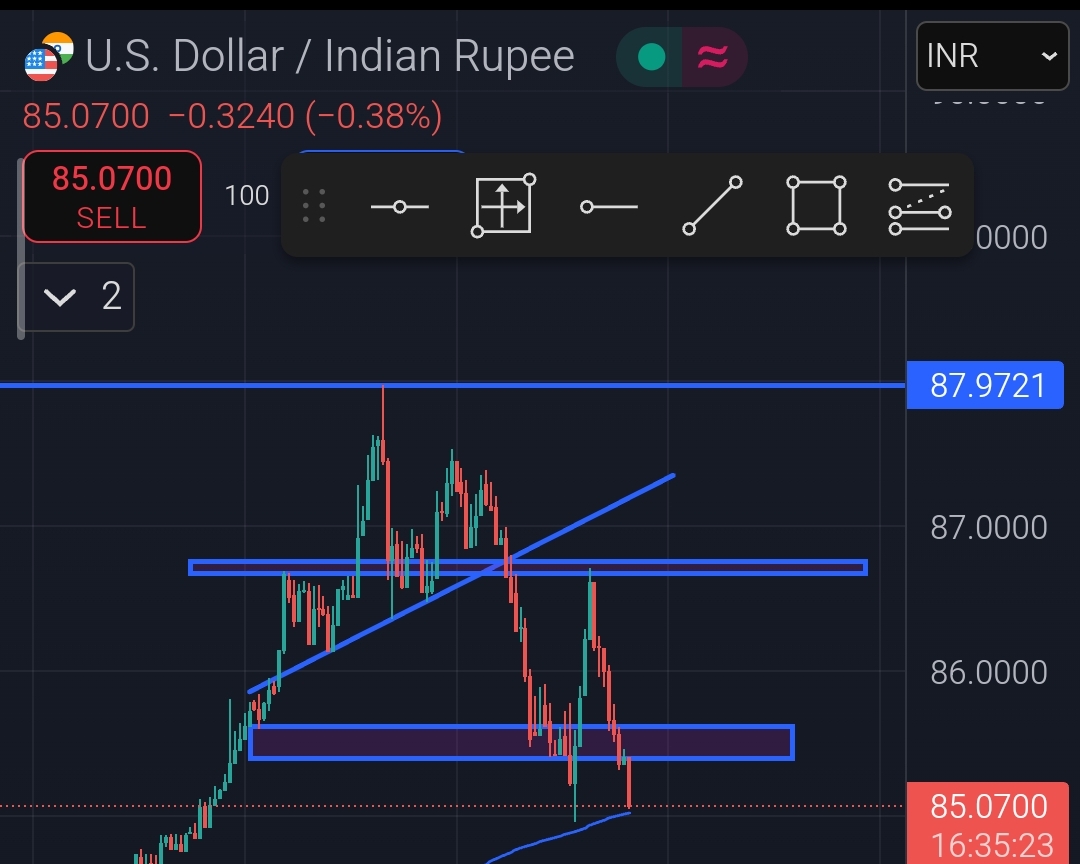

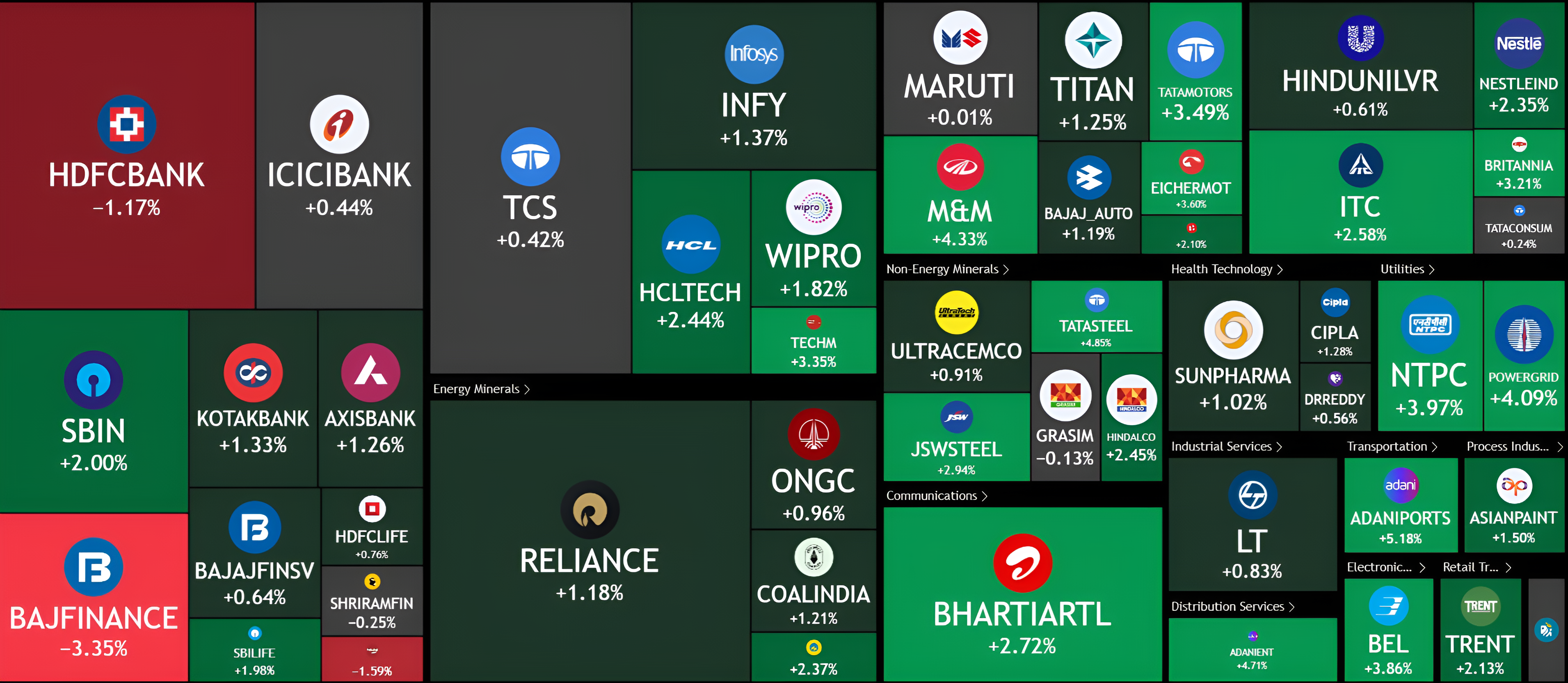

There is no need to be too happy with today's market gains as the budget is yet to come, and we need to wait for it. The market valuation has improved, and the RBI is also increasing money liquidity. A rate cut might happen in the near future, which is very positive for the Indian market. Today's US housing sales data is also expected to come, and FIIs will be watching that closely. The index is still in the non-trading zone and has not yet broken the resistance.

Replies (5)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See MoreRohan Saha

Founder - Burn Inves... • 11m

The Indian market has gone sideways again, and there is no positive news to drive the market forward. SIP flows are also gradually decreasing, and now retail investors are starting to get scared. FIIs are investing their money in China and other unde

See MoreAtharva Deshmukh

Daily Learnings... • 1y

The Stock Market Index When we want to know about the trends in the market, we need to analyze few of the important companies in each industry. The important companies are pre-packaged and continuously monitored to give you this information. This pr

See MoreRohan Saha

Founder - Burn Inves... • 10m

If we look closely at the USA's tariff policies, it is clear that the USA is also safeguarding its own interests here. Undoubtedly, IT companies are the most impacted by this, and this is evident in today's market. Among auto companies, only Tata Mot

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)