Back

VCGuy

Believe me, it’s not... • 9m

Q1 25 - Startups have secured just over $3.1 B in funding, across 232 deals. Several VC firms have recently closed or launched new funds in the last quarter⤵️ - Bessemer VP → Closed a $350 M India Fund II - Accel → Raised $650 M for India Fund VIII - Prime VP → Unveiled a $100 M India Fund V - Peak XV → In market to raise $1.2–$1.4 B for its first fund post-Sequoia split - Fireside Ventures → Targeting $230 M for Fund IV 📈Top 3 deals of 2025 - - Innovacer, $275 M round, B Capital Group, Generation Investment Management (Healthtech) - Zolve, $251 M, HSBC, SBI (Fintech) - Darwinbox, $140 M, Partners Group, KKR (Enterprise Tech) ⏭️As per Inc42 investor survey, AI agents are investors favourite. 76% optimistic about India’s AI, 47% wary of US hardware restrictions. 55% had no exits in Q1 2025, with multiples at 2x-5x.

Replies (1)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

Building SaaS from India for the world - Rocketlane raises a $24 M Series B. ➡️Total Funding: $45 M (Seed at $3 M, Series A at $18 M) ⏫Lead investors: 8VC, Matrix Partners and Nexus VP. In recent years, many Indian startups are building SaaS compan

See MoreVCGuy

Believe me, it’s not... • 10m

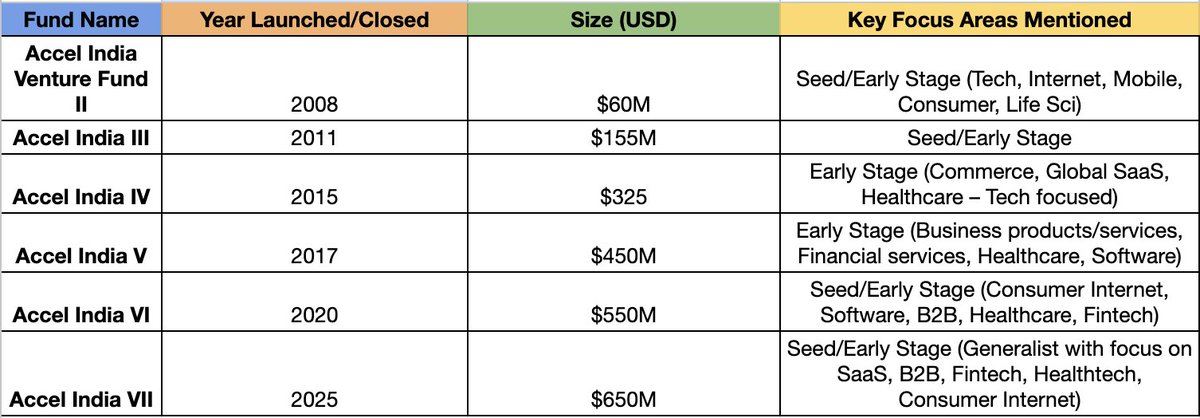

Accel in India has come a long way. Entered 2008→ acq. Erasmic Venture Fund —transforming EVF’s $10 M seed fund into 'Accel Venture Fund I'. Fund II closed in 08' with $60 M. Fast forward to today, the latest fund has 10x’ed, closed at a $650 M co

See More

VCGuy

Believe me, it’s not... • 1y

Accel closed its 8th India fund with a $ 650 M corpus. Since entering India in 2008, Accel has been a key investor in some of the most influential startups. 📄A few early investments of Accel that have become behemoths today - - Myntra: Seed inv. i

See More

VCGuy

Believe me, it’s not... • 8m

L Catterton (LVMH-backed PE) is making its biggest India bet yet with a dedicated $600 M fund. Previously - LC invested in India startups via their Asia fund⤵️ - Jio Platforms (Telecommunication, Reliance subsidiary) - SUGAR Cosmetics (cosmetics) -

See MoreAccount Deleted

Hey I am on Medial • 8m

PE/VC Flows in India - Q1 2025 Recap Despite a tough funding environment in #Asia, India’s startup ecosystem showed resilience in early 2025. Indian startups raised around $2.5-3.1B in Q1, up ~8-9% YoY. Deal flow remained healthy, with ~270 deals,

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)