Back

Account Deleted

Hey I am on Medial • 8m

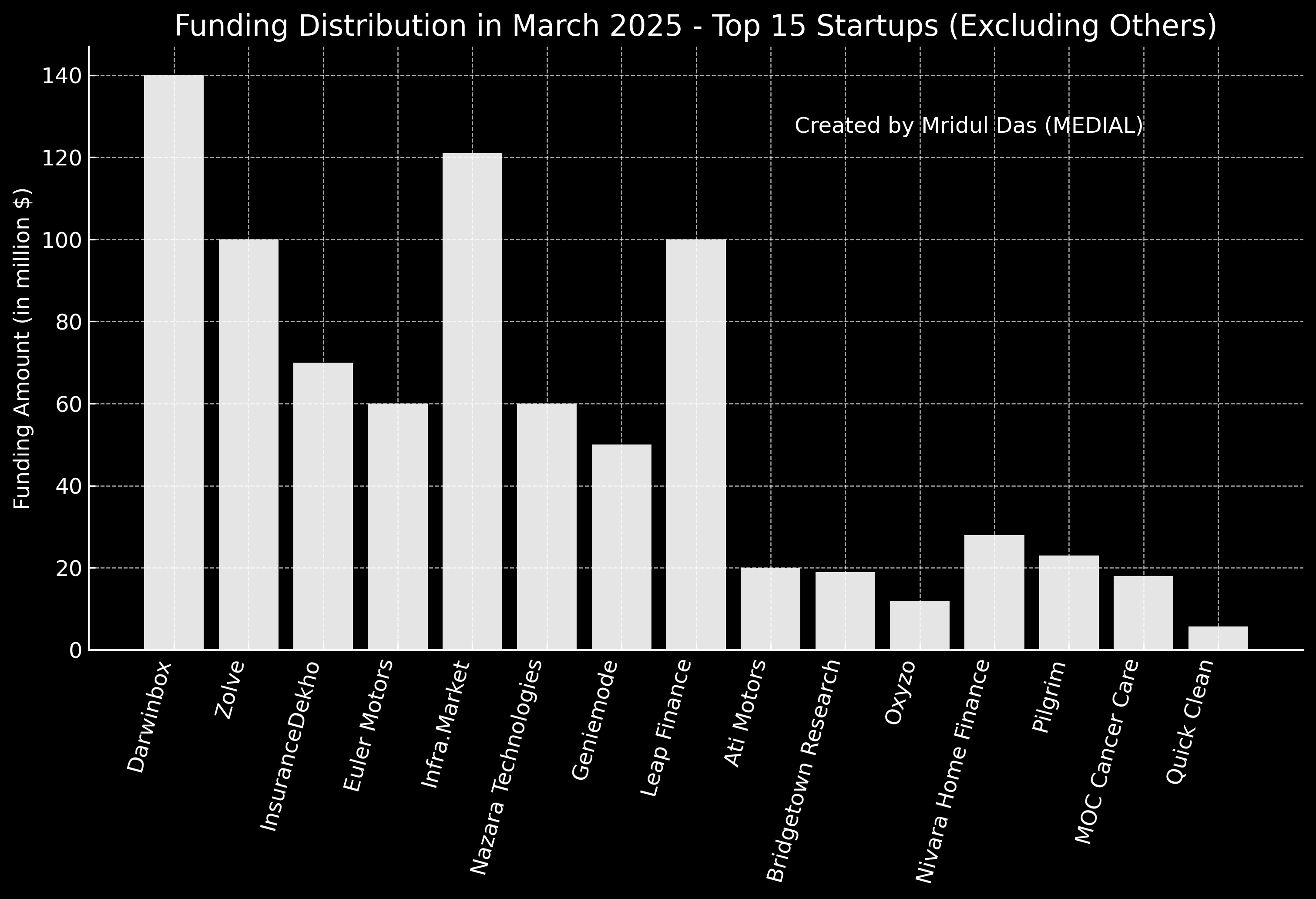

PE/VC Flows in India - Q1 2025 Recap Despite a tough funding environment in #Asia, India’s startup ecosystem showed resilience in early 2025. Indian startups raised around $2.5-3.1B in Q1, up ~8-9% YoY. Deal flow remained healthy, with ~270 deals, and 18 mega-deals ($100M+) contributed nearly $5.1B - a sharp rise from Q1 last year. India ranked 3rd globally in terms of total VC funding in Q1'25 - a strong position amidst a cautious global climate. Funding was heavily region-focused: - Delhi/NCR led with ~40% of funding - Bangalore followed at ~21.6% But there’s a concern: - Seed-stage funding dropped ~56% YoY - Late-stage deals (~$1.8B) dominated (up 38% QoQ) - Key sectors: Fintech, e-commerce, consumer tech Bain also notes a rise in tech IPOs, helping valuations hold steady.

Replies (2)

More like this

Recommendations from Medial

ProgrammerKR

Founder & CEO of Pro... • 10m

Cybersecurity Startups Raise $2.7B in Q1 — Despite Fewer Deals Cybersecurity may have seen fewer deals this quarter, but funding is up — way up. In Q1 alone, investors poured $2.7 billion into cyber defense startups, a 29% surge compared to the pre

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)