Back

Wild Kira

/Internet_ • 1y

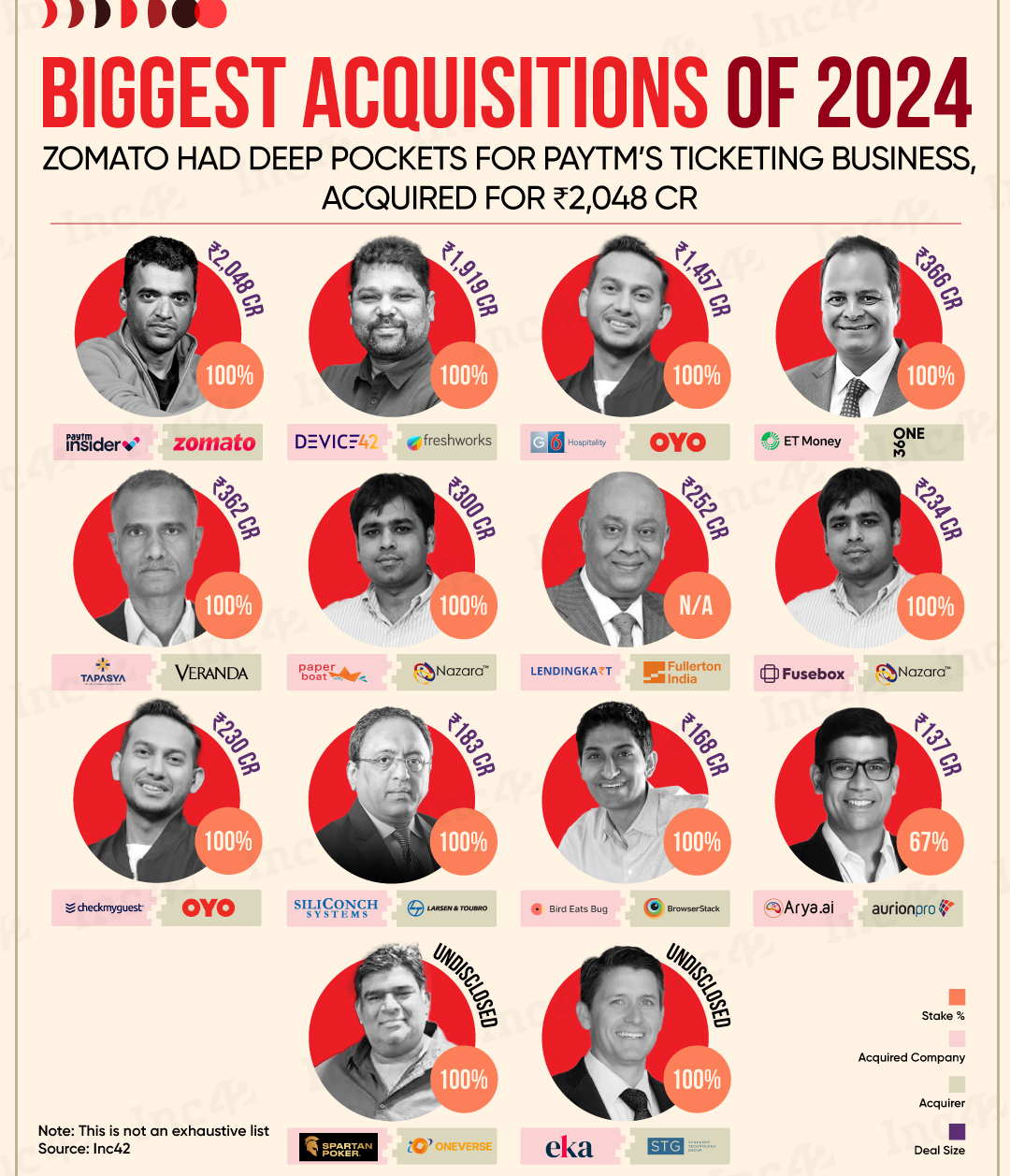

Following an 'extended' funding winter, the year 2024 has proven to be no less than a rollercoaster ride for Indian startup so far Notably, the first half (H1) of the year saw a decline in mergers and acquisitions (M&As) due to various macro and micro factors. However, favourable trends, ongoing regulatory reforms and a rise in entrepreneurial activity across sectors like technology and infrastructure fuelled the momentum of acquisitions in the second half (H2) of the year. As per an report, the first half of the year saw a 45% year-on-year (YoY) decline in M&A deals to 37 from 67 such deals in H1 2023. Sequentially, M&As slipped 34% from 56 M&A deals in H2 2023. While the first half of the year still faced the ripple effects of the funding winter, the second half hogged the limelight for some notable acquisitions, turning over a new leaf for the Indian startup ecosystem.

More like this

Recommendations from Medial

Medial Startup Trivia

Trivias Around start... • 1y

🚀 2024 In Review: India’s Startup Ecosystem Flourishing Despite Challenges 🇮🇳 🦄 Unicorn Club of 2024: Six New Additions This year, six startups crossed the coveted $1 billion valuation mark, bringing India's total unicorn count to 118. Together

See MoreAccount Deleted

Hey I am on Medial • 7m

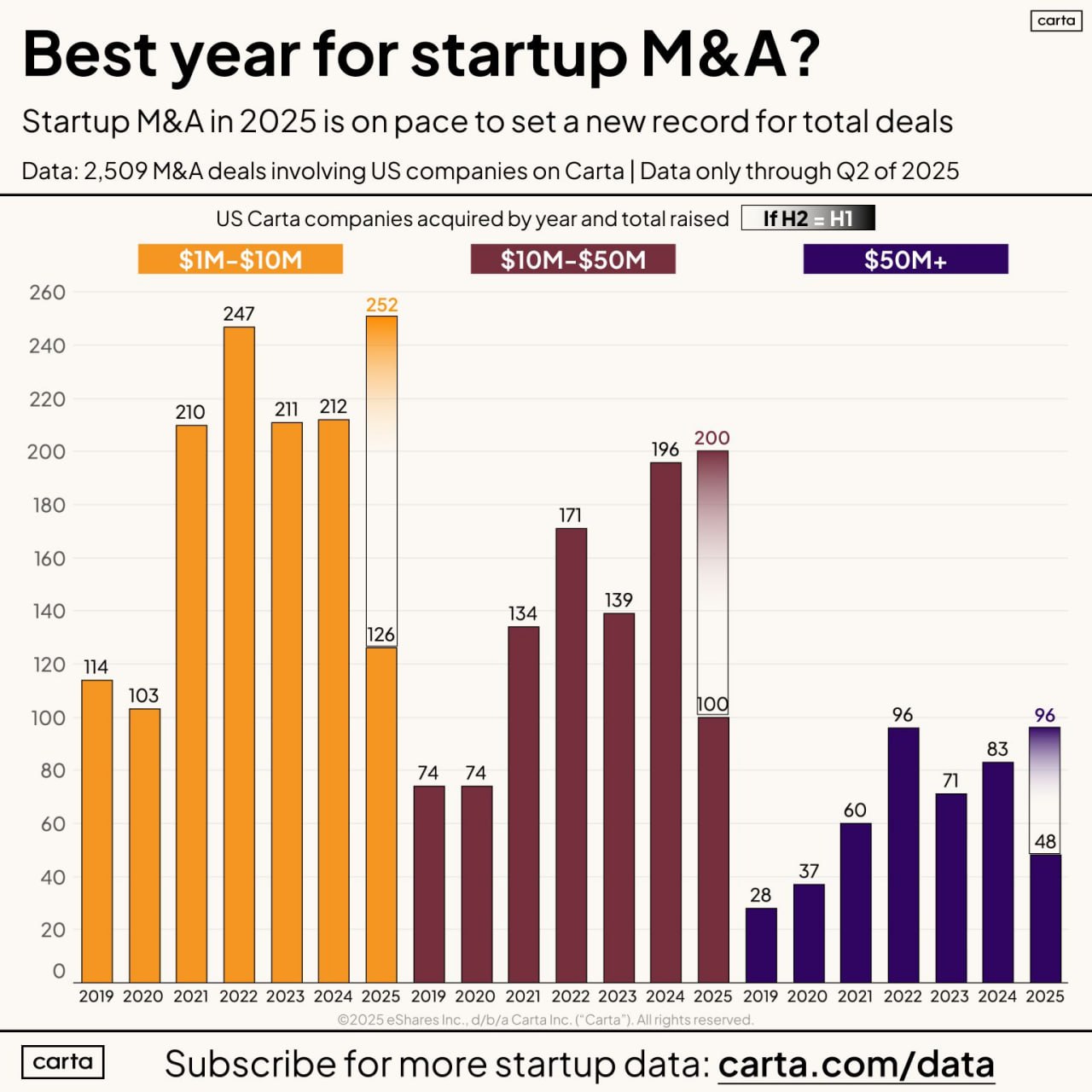

*2025 could become a record year for startup acquisitions. Carta analyzed data from companies on its platform for the first half of the year: 1) 126 exits from companies that raised $1M–$10M 2) 100 exits from startups with $10M-$50M in funding 3)

See More

TREND talks

History always repea... • 1y

🚀 Funding winter over? India’s tech startup ecosystem outshines China, Germany with $11.3 billion raised in 2024 🌎 💰 During H2 2024, the technology sector raised $5.32 billion across 540 rounds marking an 8 percent increase from H2 2023's $4.92

See More

brijesh Patel

Founder | Venture Pa... • 3m

I am reading *VC/PE report* by *EY India*. Performance of *India* in *2024* vs *2023* 1. In *2024*, the total deal count was at *1,352* deals, a notable *54%* increase from *880* deals in *2023*. 2. Start-up segment was the *volume leader* with

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)