Back

VCGuy

Believe me, it’s not... • 8m

L Catterton (LVMH-backed PE) is making its biggest India bet yet with a dedicated $600 M fund. Previously - LC invested in India startups via their Asia fund⤵️ - Jio Platforms (Telecommunication, Reliance subsidiary) - SUGAR Cosmetics (cosmetics) - Drools Pet Food (India's first homegrown Pet Food brand) - PVR INOX (India's largest multiplex chain) Impresario Entertainment (Social, Smoke House Deli) - Farmley (healthy snacking) - Fabindia (Ethnic wear, exited 2016) LC's India Fund I will be lead by Sanjiv Mehta (ex-HUL CEO/MD)🕴️- → 7–9 investments/year → $25 M–$150 M cheque sizes → Consumer-focused verticals: F&B, Consumer Services (incl. healthcare), Retail & Restaurants, D2C + Consumer Brands. ⏭️L Catterton, formed in 2016 by merging Catterton, LVMH & Groupe Arnault, now manages $37 B+ AUM across 300+ consumer brands → making it the world’s largest consumer-focused PE firm.

Replies (1)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

D2C snacking brand Farmley has secured $40 Mn (around INR 338.8 Cr) in a Series C funding round led by L Catterton, along with participation from existing investor DSG Consumer Partners. The startup plans to use the fresh capital to further scale up

See More

IncorpX

Your partner from St... • 9m

Farmley's $40M Series C Funding: A Game-Changer in India's Healthy Snacking Industry In a significant development for the Indian consumer goods sector, Farmley, a leading healthy snacking brand, has secured $40 million in its Series C funding round,

See More

Aditya Arora

•

Faad Network • 1y

Rejected 1 CR job offer to build her 3000 CR cosmetics empire. 1. After completing her MBA at the prestigious IIM Ahmedabad, Vineeta Singh received an astounding 1 CR job offer from Deutsche Bank. However, she was not happy as she wanted to start he

See More

Adithya Pappala

Busy in creating typ... • 1y

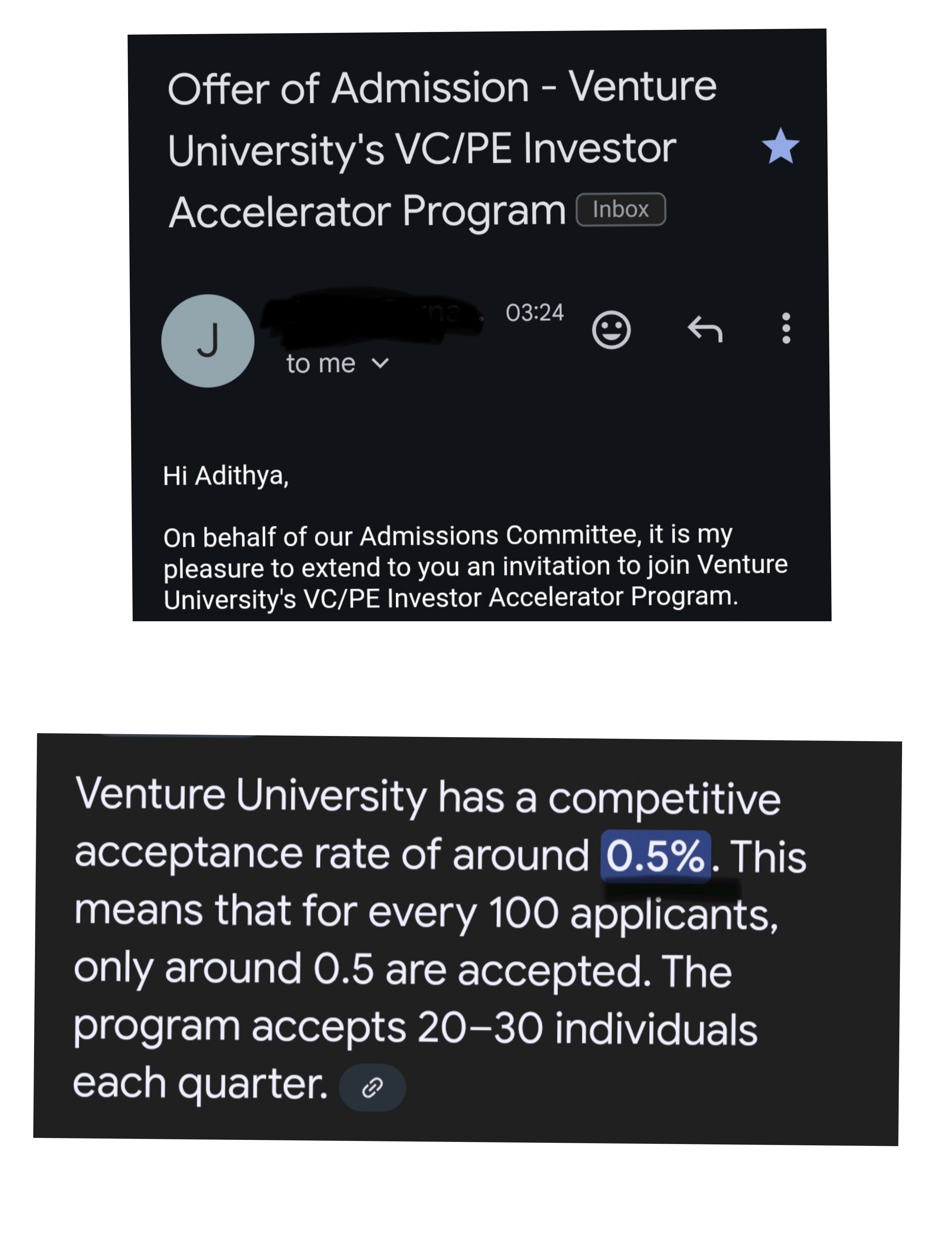

🚀🔥Finally, I have been Selected for another World's largest Venture Capital Accelerator called Venture University. U.S.A Goal is becoming true, 2 Months Back it was just a written goal for me & Now I successfully manifested it. 2 Months 5 Steps

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)