Back

VCGuy

Believe me, it’s not... • 1y

Wealth management startups in India seem to be gaining significant traction. In the past few weeks - - Dezerv raised $32 M from Premji Invest, now valued at $210 M - StableMoney closed a $14.7 M Series A - Infynite Club secured $2.6 M from Elevation Cap. - Neo raised $48 M in a Series B Soon to happen ->Centricity is reportedly eyeing $15 M from Lightspeed. 🎯All are start-ups with a common focus: Capitalizing on India's growing affluent demographic 📈There's plenty of room for growth too - - Ratio of mutual fund AUM-to-GDP is at 15% versus a global average of 75% - Population of Indians with $10,000+ income to reach 100 million by 2027 (as per GS report) - Young and tech savvy Investor segment ⏩Dezerv’s co-founder Sandeep Jethwani projects India’s wealth creators will add nearly $1.2 trillion over the next five years.

More like this

Recommendations from Medial

ShipWithRathor

garoono.in minimal a... • 2m

My current subscriptions: > X (Twitter): free tier > Cursor: student account > Internet bill : $7/m > Medium: < free tier > EMI: $0 > Light bill : $15 per month > Firebase: Free tier > YT/Movies/Series: brave+$2.5 Total: $25 per month 9 apps publi

See MoreVCGuy

Believe me, it’s not... • 1y

Accel closed its 8th India fund with a $ 650 M corpus. Since entering India in 2008, Accel has been a key investor in some of the most influential startups. 📄A few early investments of Accel that have become behemoths today - - Myntra: Seed inv. i

See More

The next billionaire

Unfiltered and real ... • 12m

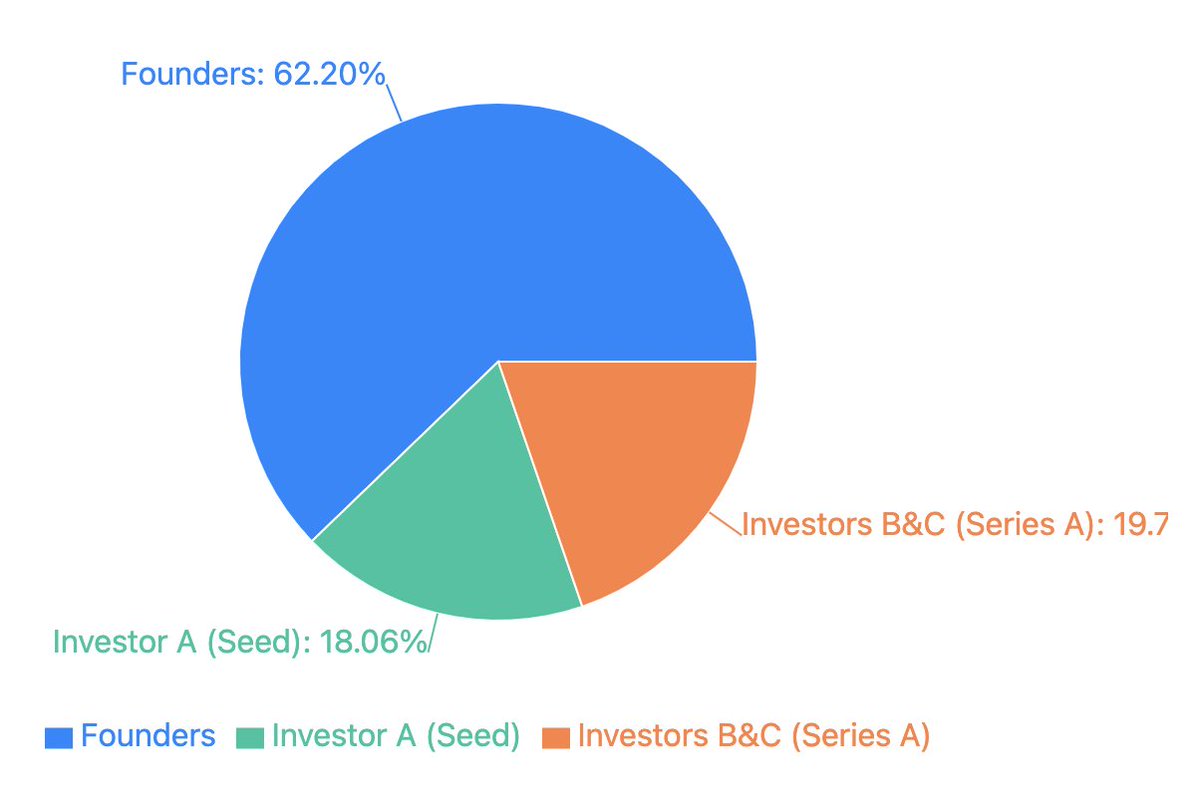

quick math on minimalist outcome: - raised $2M seed from peak (assuming 20 - 25% dilution) - raised $15M series a from peak + unilever ventures at a $76M val. - in talks to be acquired by HUL for $350M - founders to make $217M - seed investors get $6

See More

Vamshi Yadav

•

SucSEED Ventures • 9m

News of the day (March 19, 2025) 1) SaaS Unicorn Icertis Eyes $50M Fresh Funding: Pune-based SaaS Unicorn Icertis plans to raise $50M, filing a Form D with the SEC. The firm reported a net profit of ₹97 crore for FY24, up from ₹71 crore in FY23. Sou

See MoreDownload the medial app to read full posts, comements and news.