Back

VCGuy

Believe me, it’s not... • 9m

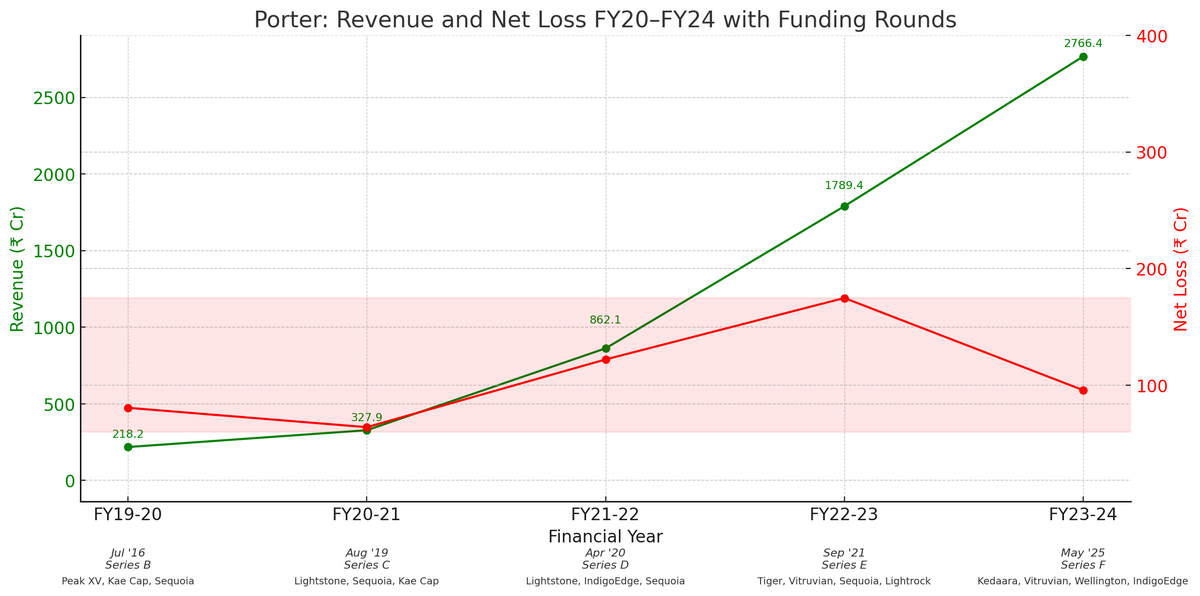

Peak XV's decade long Porter wager turns into a 11x exit. Last week → Porter raised $200 M in Series F. - Peak XV fully exited. Initially invested in a Series A in 2005, with follow-ons in Series B and C. i). As per reports, Porter held an ~13.77% stake prior to Series F, which translates to ~₹1200 Cr (Total inv. -> ₹116 Cr, accumulated over multiple rounds) - Lightrock & Kae Capital made partial exits Porter’s top-line has scaled ~13x over five years, with net losses held within a ₹60–175 Cr range ⤵️ 🚚Porter operates across three logistics segments – (a). 2W last-mile delivery for intra-city packages (≤20 kg) (b). Mini-truck bookings & relocations (≤3.5T) (c). Intercity courier shipments (≤17 kg) ⏭️Now crowned 2025’s third unicorn, Porter has its eyes set on the public markets.

Replies (3)

More like this

Recommendations from Medial

The next billionaire

Unfiltered and real ... • 1y

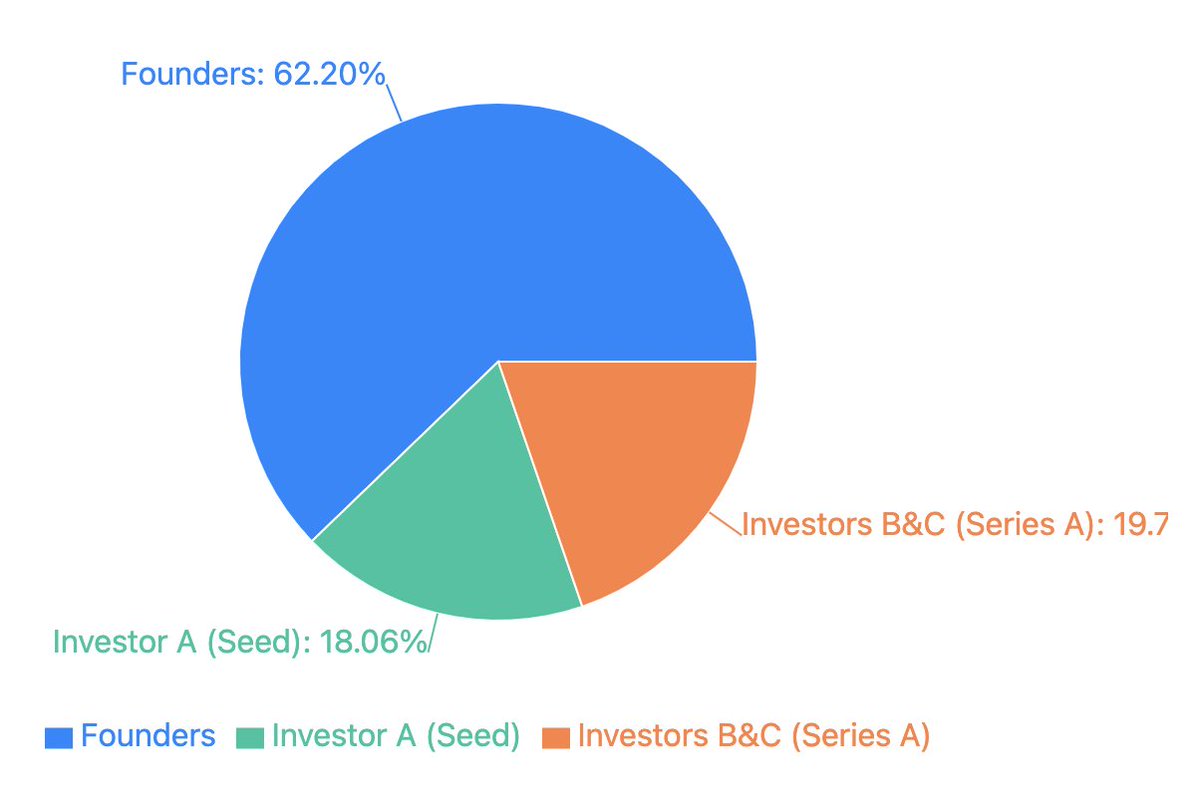

quick math on minimalist outcome: - raised $2M seed from peak (assuming 20 - 25% dilution) - raised $15M series a from peak + unilever ventures at a $76M val. - in talks to be acquired by HUL for $350M - founders to make $217M - seed investors get $6

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

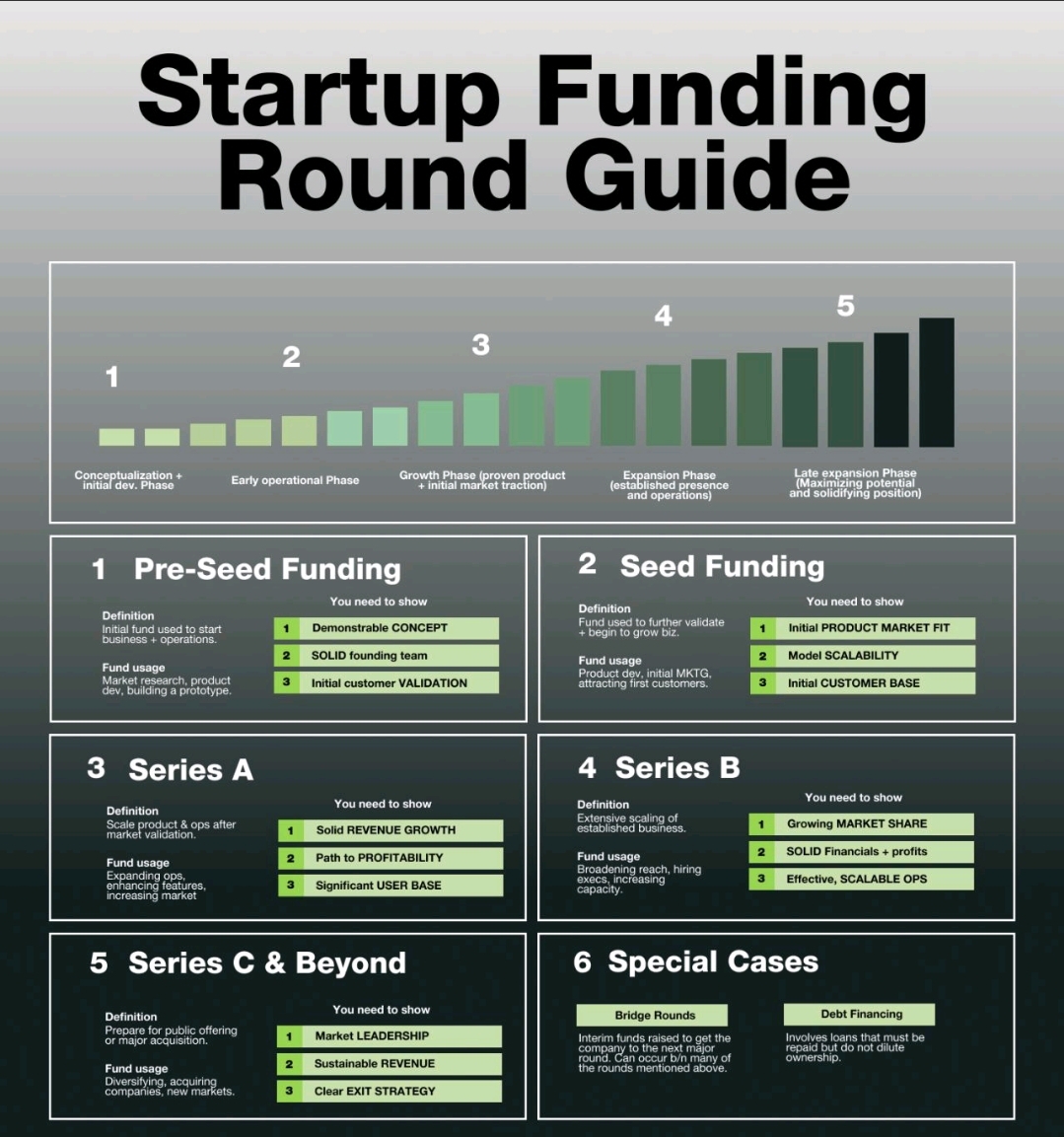

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)