Back

Account Deleted

Hey I am on Medial • 10m

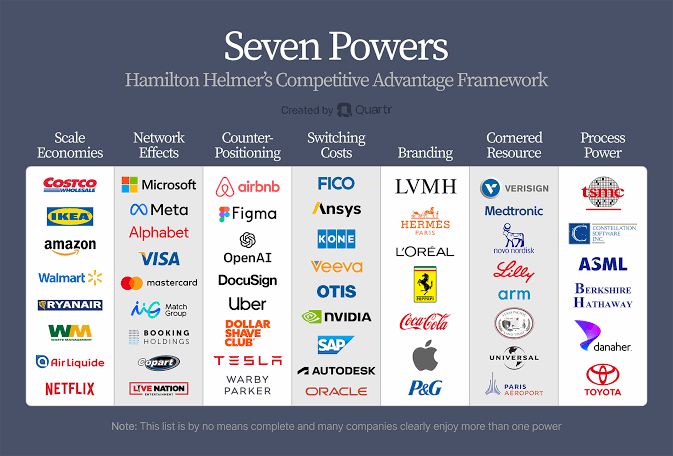

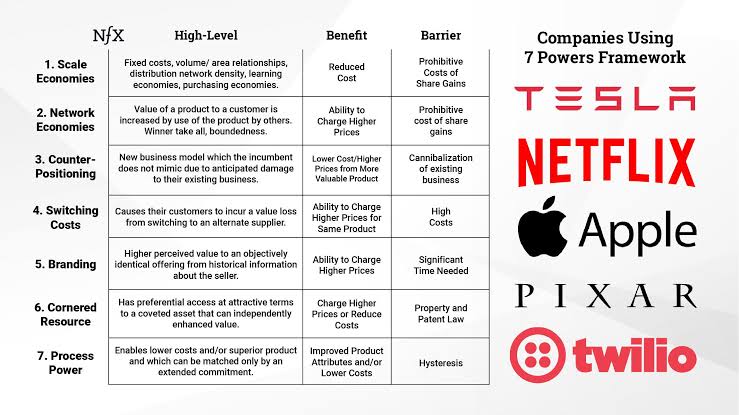

A quick short read one should must explore. Purpose: To build enduring, compounding business value ("Power" = sustainable differential advantage). Few build Power while other chase growth. #Hamilton Helmer breaks it down into 7 defensible advantages: • Scale Economies - costs drop as you grow (think Amazon logistics) • Network Effects - every new user adds value (Facebook, Airbnb) • Counter-Positioning - a model incumbents can’t copy without hurting themselves (Netflix vs Blockbuster) • Switching Costs - too painful to leave (Salesforce, AWS) • Branding - meaning > marketing (Apple, Nike) • Cornered Resource - exclusive asset no one else can access (early Pixar talent) • Process Power - internal systems competitors can’t replicate (Toyota’s lean ops) Note - Without Power, growth is fragile. With Power, growth becomes gravity

Replies (8)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

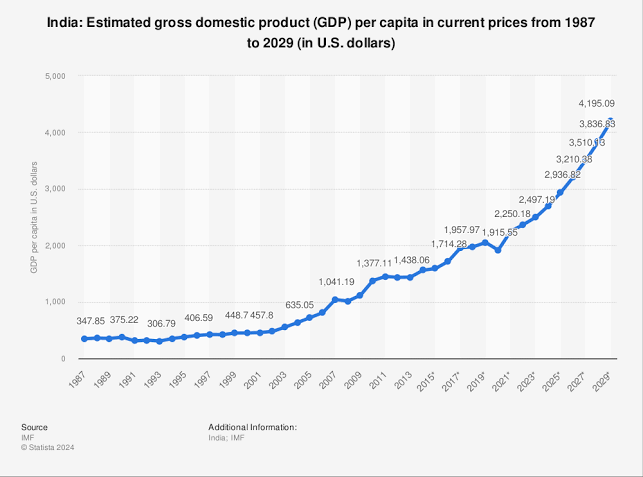

Does India Have the Capability? Does India Have a Market as Strong as the USA or Other Countries? Probably Not. This is where Price Power Parity (PPP) comes in. PPP compares the purchasing power of currencies by analyzing how much a basket of goods

See More

Karnivesh

Simplifying finance.... • 1m

Growth looks good on dashboards. But I’ve learned that not all growth actually creates value. Some companies grow organically, improving products, deepening customer trust, strengthening margins. It’s slower, but resilient. Others grow fast throug

See MoreSairaj Kadam

Student & Financial ... • 1y

Build relationships, not just transactions. Most people are chasing quick sales, but real growth comes from nurturing long-term relationships. Clients and customers stay loyal when they feel valued, not just sold to. Focus on providing value and bui

See MoreKarnivesh

Simplifying finance.... • 1m

ROCE is one of those metrics that quietly reveals business quality. I look at it as a simple test: For every ₹100 of capital a company uses, how much value does it actually generate? Revenue growth and profit numbers can look impressive, but ROCE

See More

Account Deleted

Hey I am on Medial • 1y

SolarSquare’s Losses Surge Despite Revenue Growth in FY24 Rooftop solar provider SolarSquare saw a 63.5% YoY revenue growth in FY24, reaching ₹175 crore. However, its losses jumped 2.3X to ₹69 crore due to rising costs. Revenue from operations grew

See More

Armaan Nath

Startups | Product • 12m

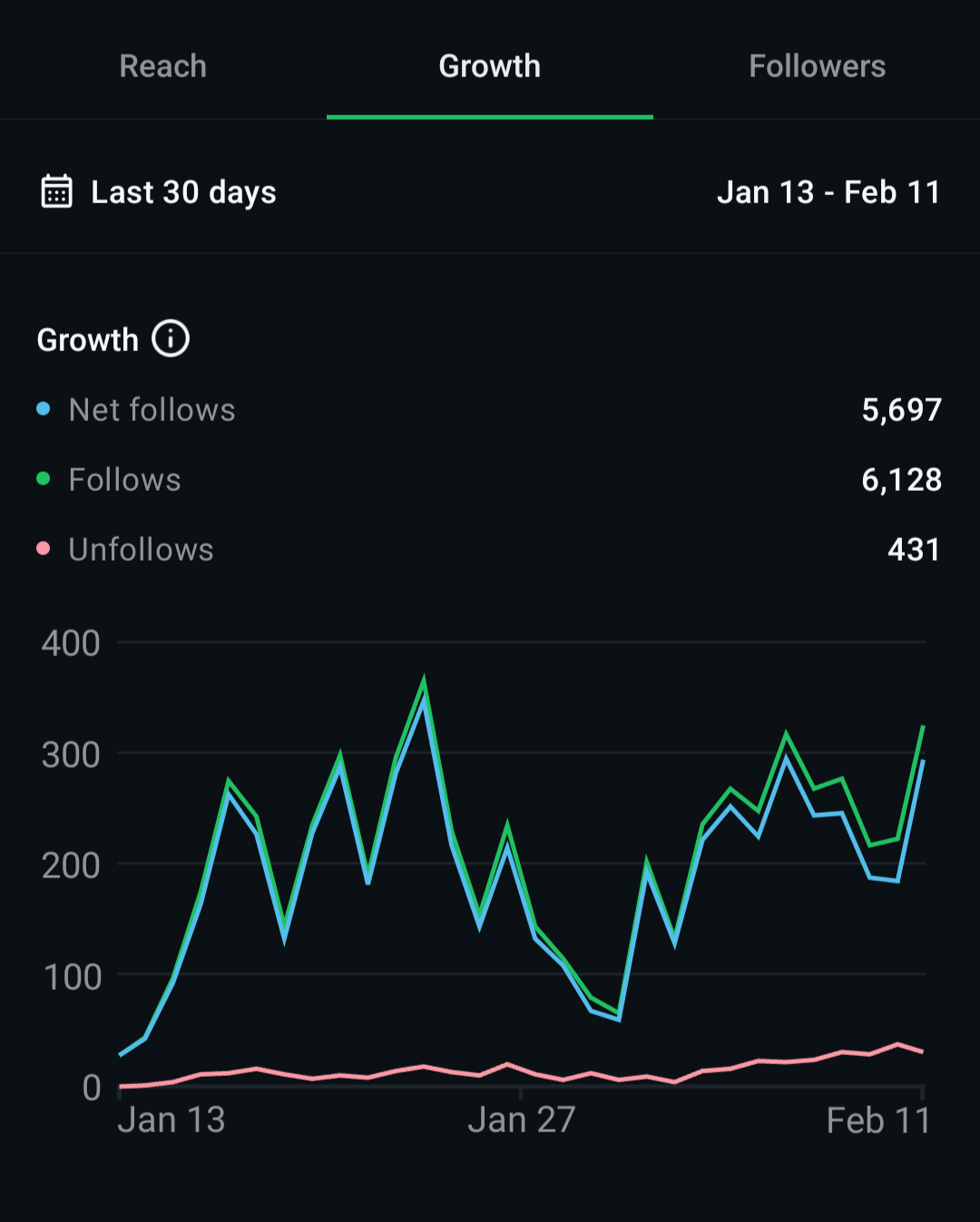

The Power of Organic Growth 🚀 Last month, our community grew 5,697 net followers, and now the community is about to hit 10,000 followers on WhatsApp and 4,000 on LinkedIn. No ads. No shortcuts. Just consistency, value, and word-of-mouth. This jou

See More

Sairaj Kadam

Student & Financial ... • 1y

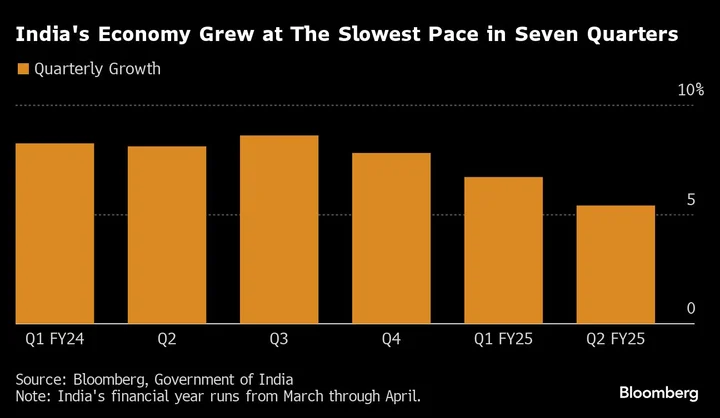

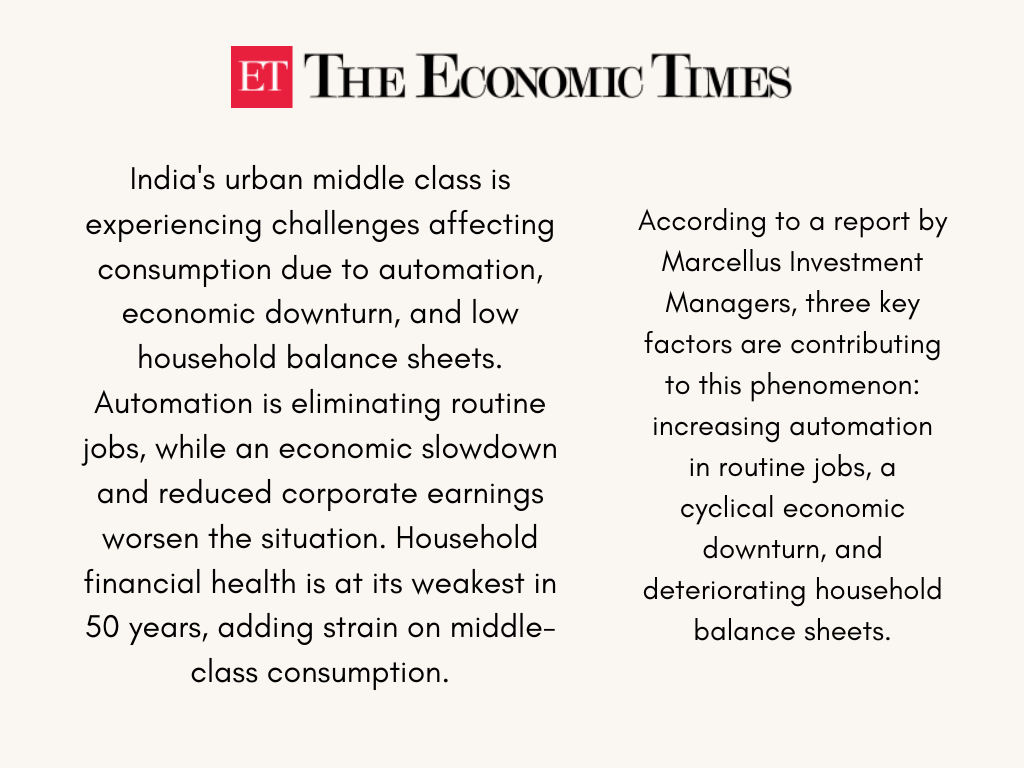

India's Two-Year Low: The Middle Class Squeeze Amid Economic Turmoil India's urban consumption has hit a two-year low in 2024, driven by persistent inflation and stagnant wages. Middle-class households, already struggling with rising costs, are cu

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

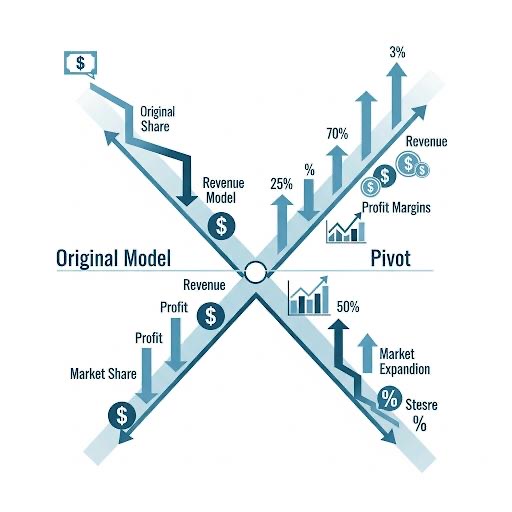

Pivoting -When do the numbers tell you it's time to drastically re-evaluate your startup's core business model?" Financial Red Flags: Consistently Negative Unit Economics: Losing money on every sale with no clear path to profit? Your Customer Acquis

See More

Prem Siddhapura

Unicorn is coming so... • 1y

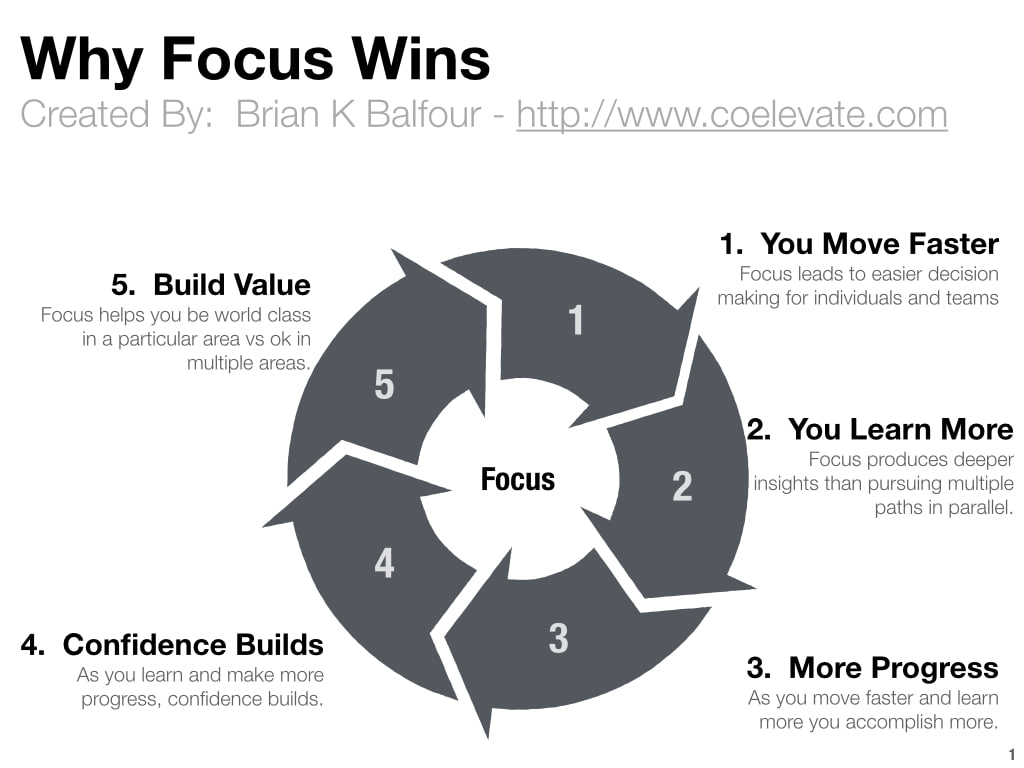

How We Apply Focus to Drive Growth Faster Warren Buffet famously advises, "If it isn’t the most important thing, avoid it at all costs." Similarly, Peter Thiel once refused to engage in conversations unless they were about an individual’s top priori

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)