Back

Chirag

•

&OTHERS • 10m

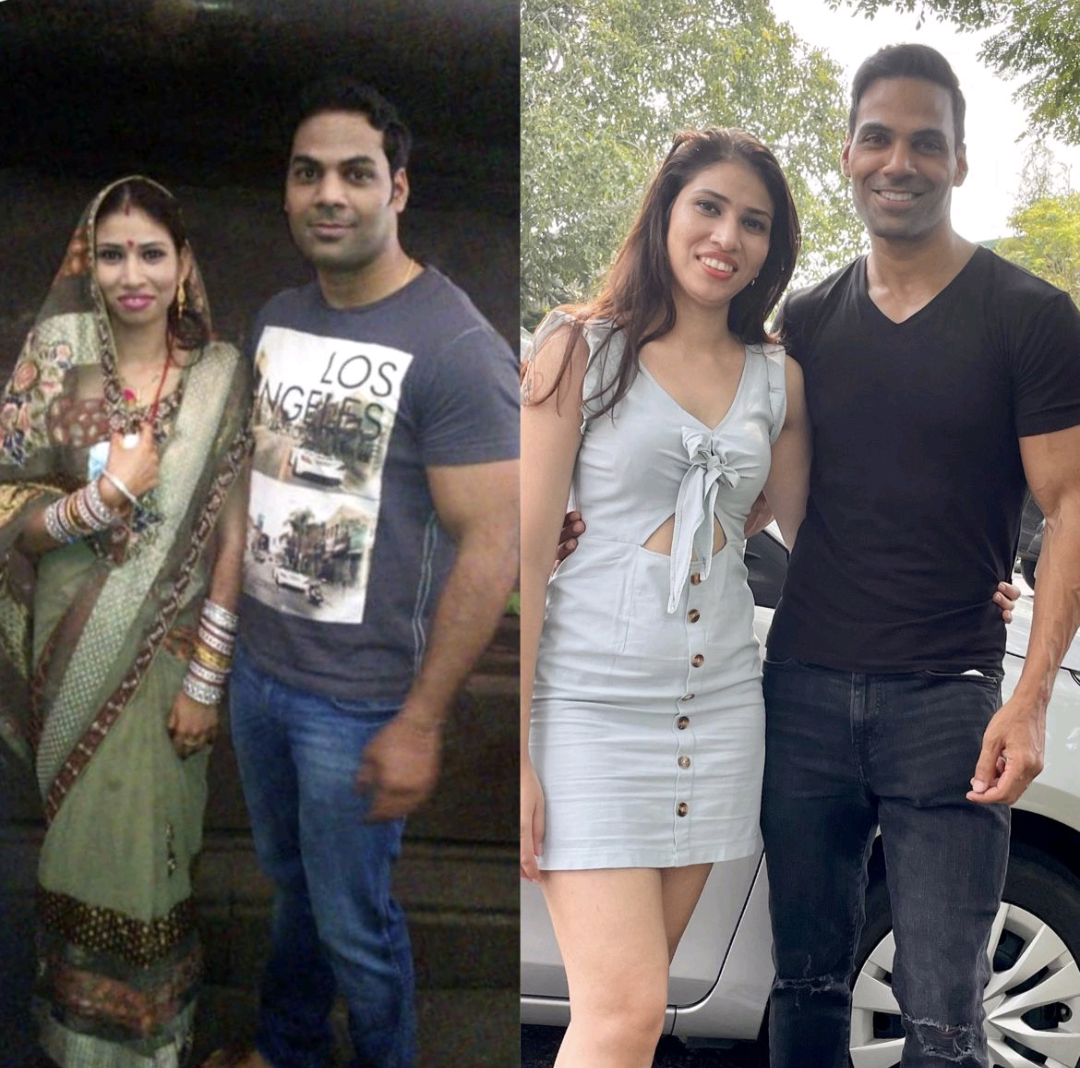

Growth hides flaws. Crisis shows if you really have a business. That’s exactly what happened with Fittr. During COVID, Fittr became the poster child of India’s online fitness boom. Revenue soared from ₹58 Cr to ₹90 Cr. Investors rushed in. But behind the scenes? - Cash burned. Losses ballooned. Growth masked broken economics. When gyms reopened, reality hit: The market was “niche and fickle.” Funding dried up. Founder Jitendra Chouksey (JC) had two options: Keep burning cash… or rebuild from scratch. A conversation with Nithin Kamath (Zerodha) became the turning point. Fittr slashed costs, shut performance marketing, halted discounts — and rebuilt with brutal discipline. The result: • ₹41 Cr loss in FY23 turned into ₹11.5 Cr profit by FY25 (cash basis). • Pivoted to healthcare with Fittr HART and diagnostics. Lesson: Revenue ≠ Success. Valuation ≠ Value. Growth ≠ Endurance. If it only works in good times, it’s a bubble. What’s your take — do we still over-glorify growth?

Replies (2)

More like this

Recommendations from Medial

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

boAt: Riding the Audio Wave (with a Recent Setback) Company: boAt (founded 2016) Industry: Consumer Electronics (Audio) Challenge: Stand out in a crowded audio market. Solution: Stylish, budget-friendly audio for young consumers. Results: Growt

See More

PRATHAM

Experimenting On lea... • 3m

Zerodha VS Groww ( Financial report ) Zerodha: Revenue Down 11% to 8,850 Cr, Profit down 23% to 4,237 Cr (still India's most profitable broker with 8M users) Groww: Revenue UP 30% to 4,000 Cr, Profit triples to 1,820 Cr (largest by active client

See MorePoosarla Sai Karthik

Tech guy with a busi... • 7m

Paytm Q1FY26 results shows a massive growth in its earnings: • Revenue: ₹1,918 Cr -> up 28% YoY (₹1,501 Cr last year) • Net Profit: From ₹(840) Cr loss to ₹123 Cr profit [+963 Cr - a massive swing] • Total Expenses: ₹2,016 Cr ->18.6% down (₹2,476 Cr

See MoreBusiness karo India

Business karo India ... • 7m

Do you agree **Two types of startups dominate India today:** 1. **Profit-focused startups** – They grow steadily, solve real problems, and build sustainable models. 2. **Valuation-focused startups** – They chase funding, burn cash on discounts, an

See MoreKarnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)