Back

VCGuy

Believe me, it’s not... • 7m

Yesterday – reports suggested ChrysCapital finalised a ₹2,410 Cr deal to acquire Theobroma. One of India's most loved bakery chains is now set to be one of its largest cash exits in the F&B space. ICICI Ventures (which owned 42%) is expected to walk away with ~₹1,012 Cr on a ₹130 Cr investment made in 2017 → 7.8x return in 7 years Theobroma numbers (FY24, 225 outlets across 30+ cities): – Revenue: ₹452 Cr – Net Profit: ₹27 Cr – Projected FY25 EBITDA: ₹80–100 Cr Starting in a 1BHK in Colaba in '04, Sisters Kainaz & Tina Messman built a brand on premium bakes + strong word of mouth → took 10 years to raise their first round of capital: ₹22 Lakh from Zend advisors. 🧐There’s growing PE appetite in F&B, especially for brands with strong recall and national scale - a). Haldiram has seen consistent inbound interest (Temasek + Alphawave invested earlier this year) b). ChrysCapital is likely moving on Belgian Waffle Co next (₹1,000 Cr deal in the works) ⏭️Theobroma Founders will likely see one of the largest cash exits by women entrepreneurs in Indian consumer history.

Replies (5)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

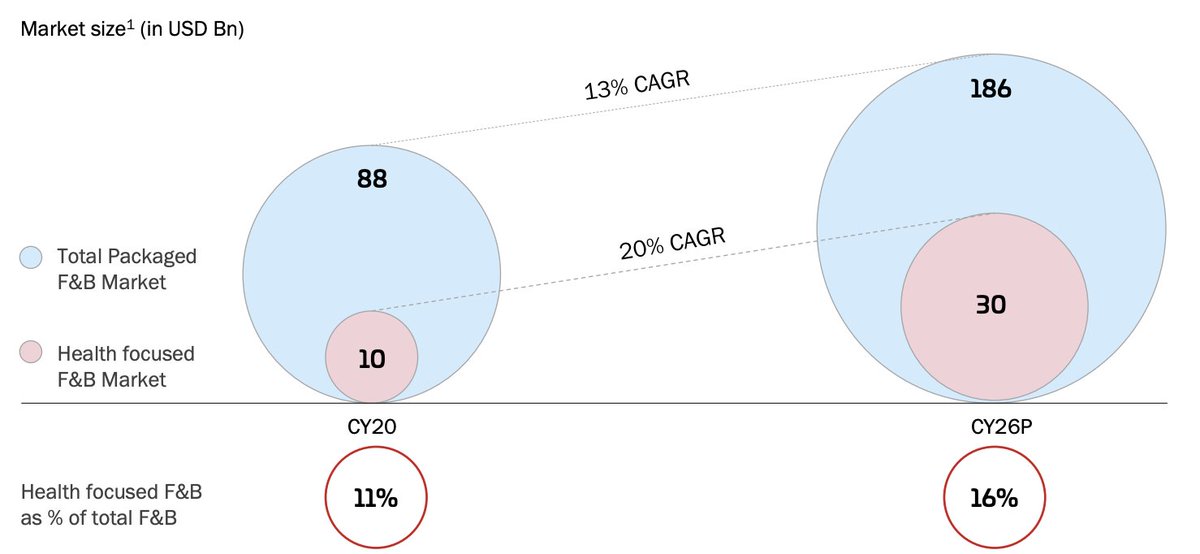

The health-focused food space has seen a noticeable uptick in activity. In the past few months - - WickedGud raised ₹20 Cr from Orios VP (healthy alt's for pasta/noodles/chips) - Troo Good raised $9 M from Puro Wellness, Oaks, V Ocean Inv. (offers m

See More

Linkrcap Studio

A digital news platf... • 2d

EV startup Bounce has raised ₹36 Cr ($3.9 Mn) in a funding round led by existing investors Accel and B Capital. The startup allotted 37.6 Lakh Series F CCPS to Accel India and B Capital each for a cumulative ₹36 Cr. CEO Vivekananda Hallekere told I

See More

Aditya Arora

•

Faad Network • 1y

Meet the woman who had an accident at 24 and built a 3500 CR business. 1. When Kainaz Messman was 16 and on a trip to France, she decided to dedicate her life to making pastries. After studying at the prestigious Oberoi Centre of Learning & Developm

See More

VCGuy

Believe me, it’s not... • 1y

Investors appear optimistic about co-working spaces and startups are capitalizing on this trend. 🏢A growing number are looking to raise funds via VCs , Family Offices or through the IPO route - - Innov8 raised ₹110 Cr via a primary funding - Workie

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)