Back

Anonymous 3

Hey I am on Medial • 10m

For the average D2C brand running on tight margins, I doubt this model makes financial sense. Dark stores require significant upfront inventory investment, and you're still competing with the selection available on Zepto/Blinkit. Show me the unit economics for a typical brand before getting excited.

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 7m

What’s Growing: • Blinkit NOV: ₹9,200 cr (+127% YoY); users +123%; 1,544 dark stores (target: 2,000 by Dec’25). • Food delivery: GOV +16%, NOV +13%, orders +10% QoQ. • District: ₹8,000 cr annualised NOV, 2M users, ₹1,700/order. • Hyperpure: +89% YoY.

See MoreCapital Wire

Breaking Down Billio... • 4d

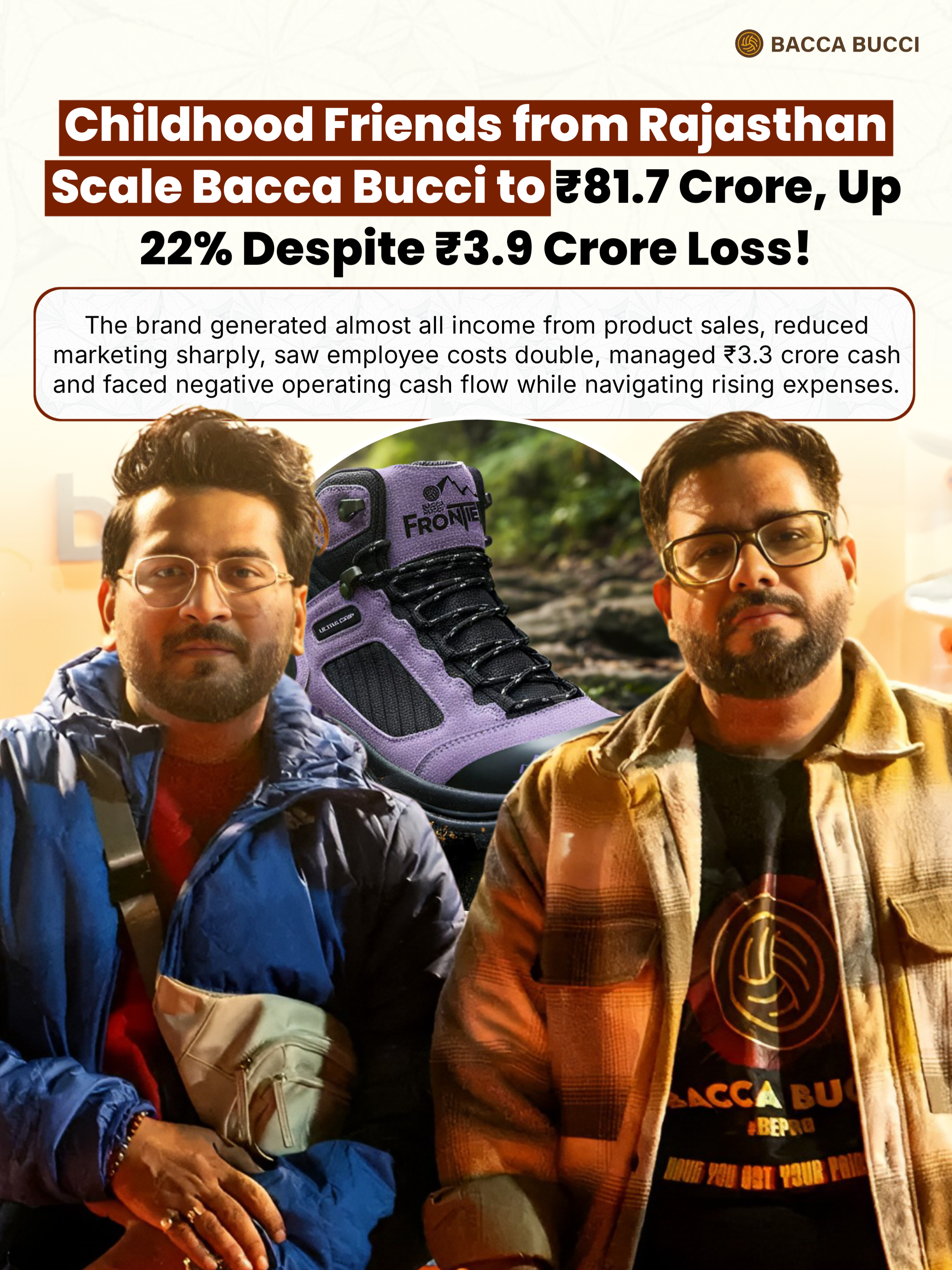

Bacca Bucci continued its growth in FY25 with strong demand for its footwear. Nearly all revenue came from product sales, but rising costs pressured margins. Expenses increased as inventory and employee costs rose, despite lower marketing spend. The

See More

VCGuy

Believe me, it’s not... • 7m

Blinkit is going inventory-led from Sept 1. It’ll now own stock → buying directly from sellers instead of just storing it (Amazon also operates on a storage + commission model — doesn’t own inventory) Why now? ➡️ Because its parent, Eternal, became

See MoreKarnivesh

Simplifying finance.... • 1m

I’ve noticed that many startups celebrate users, orders, and revenue before asking the hardest question: does each unit actually make money? That’s what unit economics reveals. Strip away the hype, and it comes down to whether a business earns more

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)