Back

More like this

Recommendations from Medial

Nimesh Pinnamaneni

Making synthetic DNA... • 11m

🚨 The magic number: ₹800 Cr ⸻ VCs invest in businesses that can be big enough to return their entire fund. To get VCs interested, your startup must at least have the potential to reach ₹800 Cr+ in annual revenue or ₹8,000 Cr+ in market cap (assumi

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

D2C Founders: Ready for VC Funding? Submit Your Pitch! Are you a revenue-generating D2C startup on the hunt for VC funding? Excess Edge Experts Consulting is partnering with a prominent VC fund to connect visionary founders like you with the capital

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

D2C Founders: Ready for VC Funding? Submit Your Pitch! Are you a revenue-generating D2C startup on the hunt for VC funding? Excess Edge Experts Consulting is partnering with a prominent VC fund to connect visionary founders like you with the capital

See More

Amandeep Singh

Co-Founder @ The Waf... • 11m

The Highest-Paid CEOs: Are We Seeing Visionary Leadership or a Broken System? The data on S&P 500 CEO compensation with over $100 million in total pay. According to this infographic, the Top 10 alone collectively rake in more than $800 million. Th

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

What Startup Founders Should and Shouldn’t Expect from Consultants, Handholders & Venture Scouts in VC Funding There’s a growing ecosystem of firms offering startup consulting, venture scouting, and “founder handholding” services. Many add real valu

See More

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

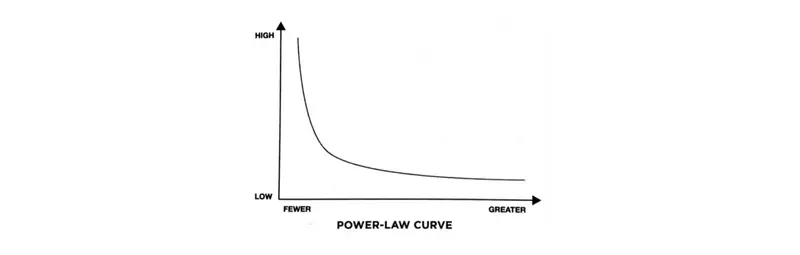

💥 A VC turned $6.4m into $1.3b in 5 yrs — there’s a lesson here for founders💥 Cyberstarts just turned a $6.4M seed investment in Wiz into $1.3 BILLION after Google’s $32B acquisition—a mind-blowing 222x return in just 5 years! 🚀🔥 This is why VC

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-2 😳Only 21 Indian VC Firms are there in 2013 So, Today’s VC topics are: 🎯Who Invests in Venture Capital? 🎯Definition & Difference between Private Equity & Venture Capital? 🎯Investors-VC also raises, We also raise but the di

See MoreFarhan Raza

Founder And CEO Give... • 10m

STARTUP INDIA, or SHUTDOWN INDIA? Layoffs are rising. Kiosks are shutting. Founders are burning out. But wait — wasn’t the valuation ₹300 Cr? It’s time we face the truth: Fundraising ≠ Success. Revenue = Success. Press ≠ Validation. Retention = Va

See More

Vivek Joshi

Director & CEO @ Exc... • 5m

Want VC funding? Master these 6 founder skills! In this 45s, trait-by-trait reveal, we break down the personal traits and business skills VCs actually look for — beyond the pitch deck. Learn why resilience, coachability, and visionary leadership matt

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)