Back

Hari kiran

Insight guru • 7m

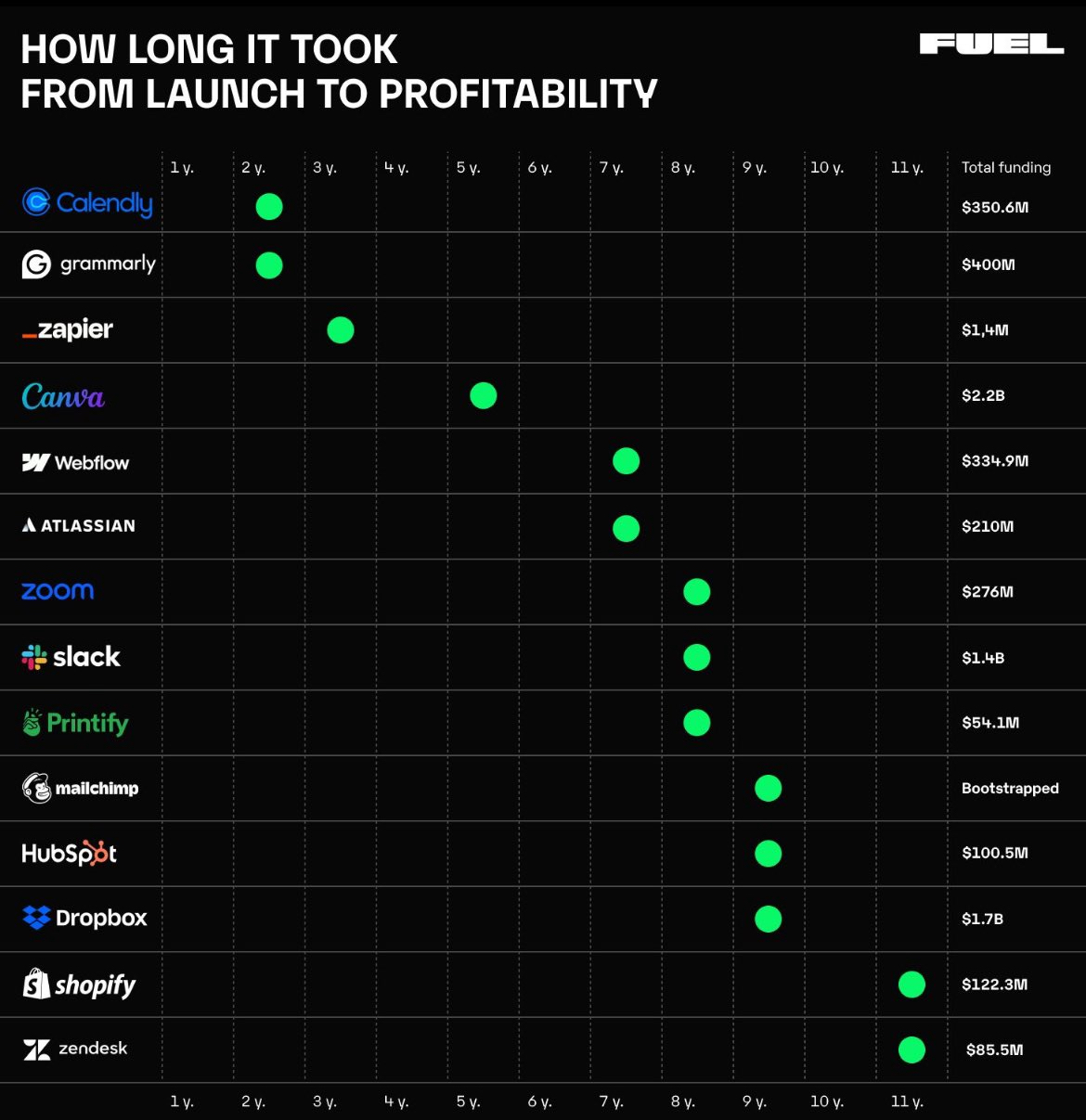

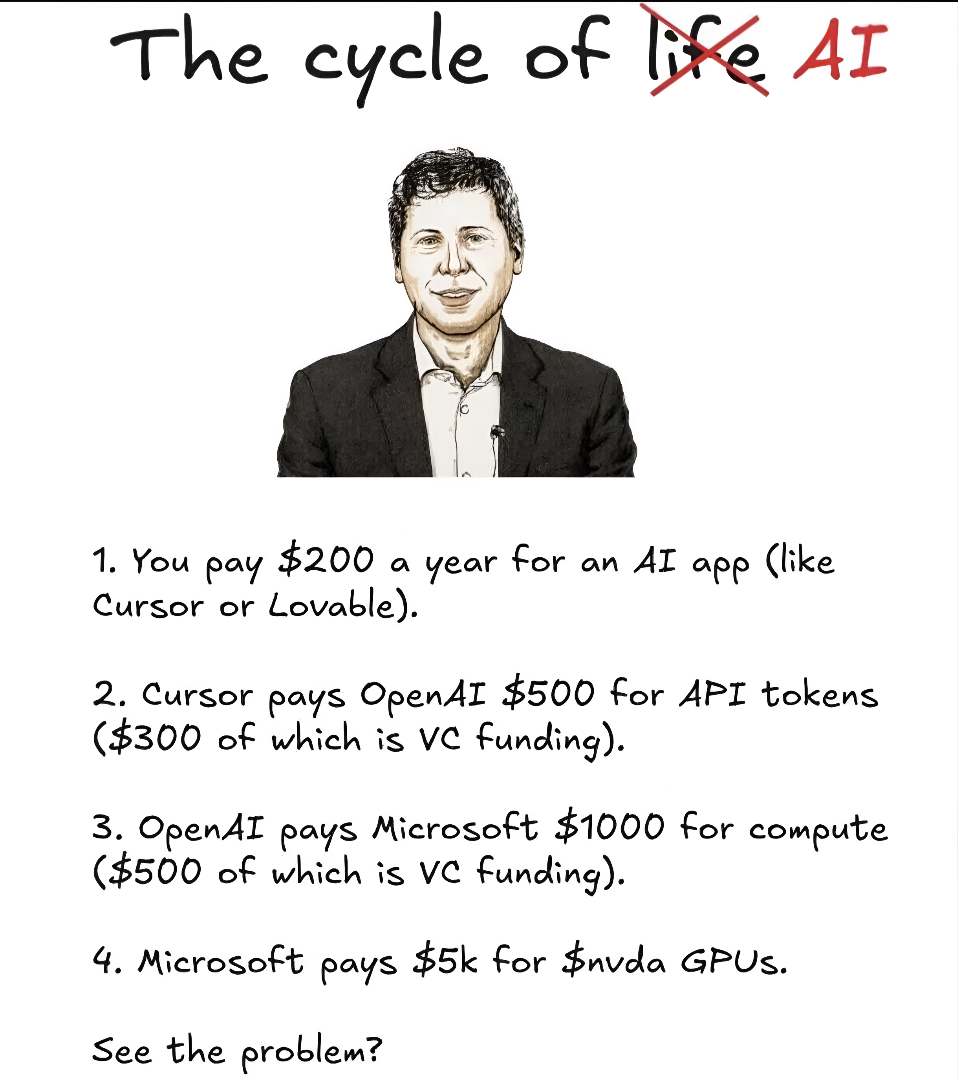

It looks like, the game of burning VC money to make an enterprise big by including more users ignoring the profitability is over. The sad thing is many enthusiastic founders still think, they can bring this era back.. BUSINESS MEANS PROFITS , BUSINESS MEANS CASHFLOW

Replies (5)

More like this

Recommendations from Medial

DAMALLA PIYUSH NARAYAN

"Building products, ... • 1m

Why Indian Startups Fail: Quick Hits ?? 🚀💥 1.No Product-Market Fit: No real demand? Validate early with feedback. 2.Burning Out of Cash: Poor money mgmt drains funds—budget strictly. 3.Weak Founding Team: Bad execution from mismatches—build bal

See More

Nithin Augustine k

DAY ONE • 1y

Burning through funds to capture Market share is TRENDING. For that startup sacrifice the control they have on the business. To what extent should we raise funds and what all things should we consider about the VC from which we are raising funds. OR

See MoreNikhil Raj Singh

Entrepreneur | Build... • 1y

Debate Topic: OYO’s Profit Surge – Smart Strategy or Market Bubble? With OYO’s Q3 profits skyrocketing sixfold, is this a sign of strong business fundamentals or a temporary boom? Has the company cracked the profitability code, or is it just benefit

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Karnivesh

Simplifying finance.... • 2m

For a long time, I assumed that profitability meant safety. If a business was making money, I believed it was stable. Over time, I realised profit alone can be misleading. Many businesses fail not because they aren’t profitable, but because deeper i

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)