Back

Swamy Gadila

Founder of Friday AI • 7m

The “growth at any cost” era is done. Founders who still chase vanity metrics are playing yesterday’s game. Business = Profits. Business = Cashflows. Distribution without monetization is just a burn. Time to build real value, not just valuations.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 7m

Most startup advice sounds smart. Few actually survived. What truly matters: • Speed is nothing without clarity • Revenue hides weak retention • Vanity metrics kill conviction • No PMF? Nothing else matters • Burn is silent until it burns everythin

See MoreSwapnil gupta

Founder startupsunio... • 9m

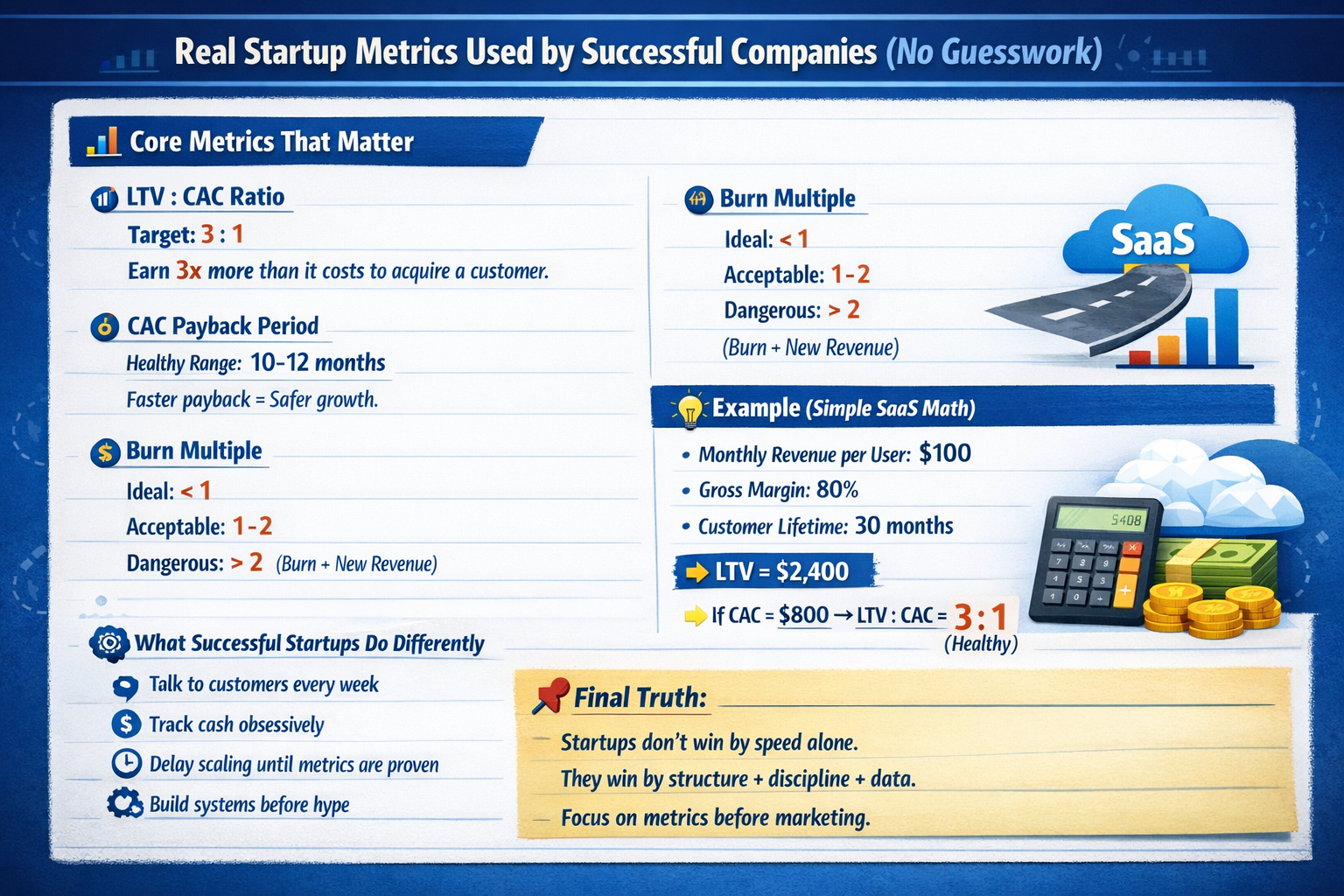

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MorePoosarla Sai Karthik

Tech guy with a busi... • 10m

A startup’s valuation is the price investors believe it’s worth. But that belief is often based more on future potential than current reality. Factors like market size, growth projections, and hype around the sector often play a bigger role than actu

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets to startup success with our latest video: "5 Early Indicators for Startup Success!" 🚀 Dive deep into essential metrics that go beyond typical revenue figures, focusing instead on predictive insights that can steer your business gr

See MoreVatan Pandey

Founder & CEO @Zyber... • 11m

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Lukoon Founder

Building Lukoon — a ... • 1m

What creators actually need from real-time social apps in 2026: 1. Authentic discovery — algorithms that connect you with people who genuinely care, not just vanity metrics 2. Monetization flexibility — multiple revenue streams (tips, subscriptions

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)