Back

Poosarla Sai Karthik

Tech guy with a busi... • 10m

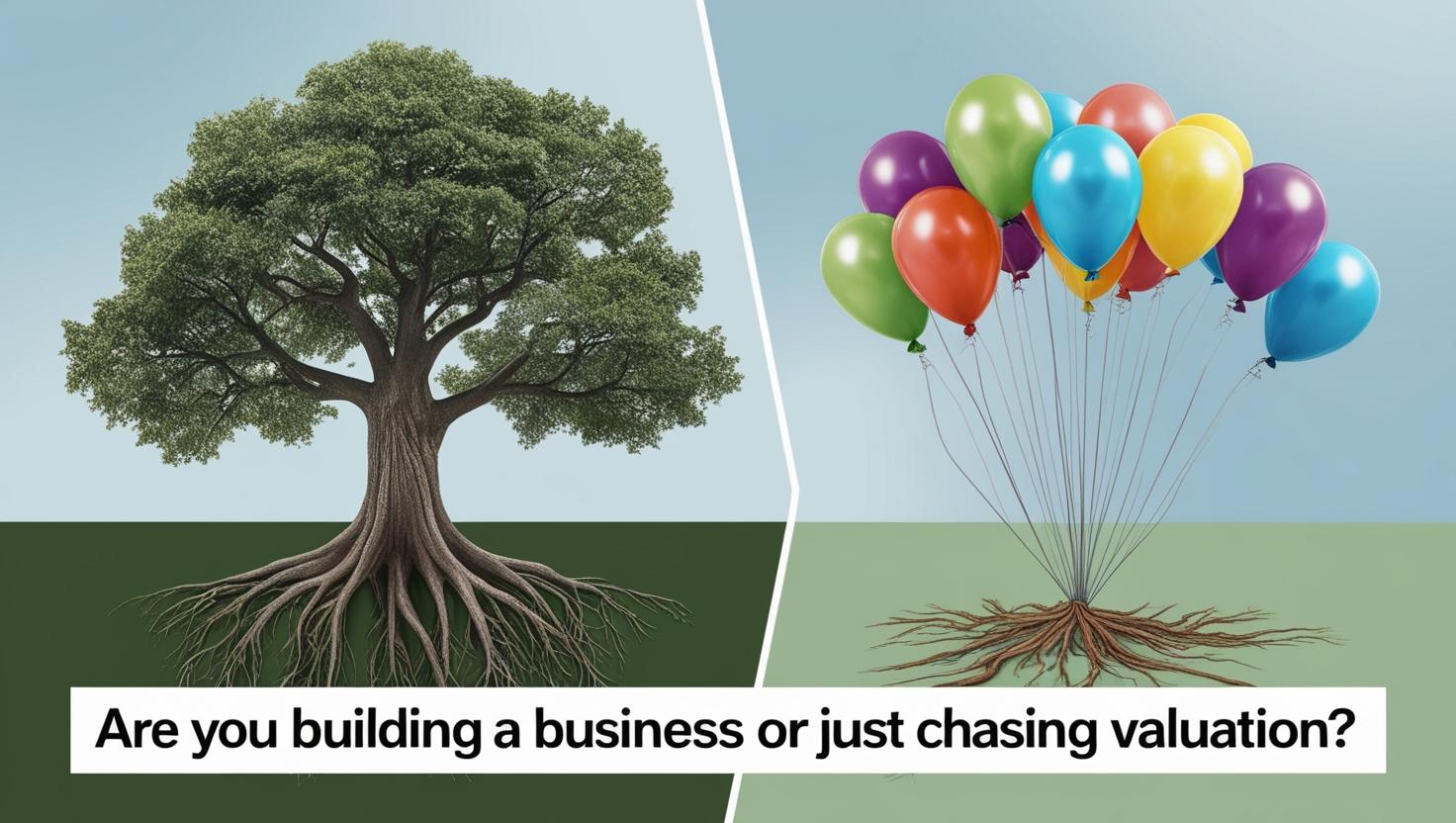

A startup’s valuation is the price investors believe it’s worth. But that belief is often based more on future potential than current reality. Factors like market size, growth projections, and hype around the sector often play a bigger role than actual revenue or profitability. This leads to startups getting massive valuations early on. Once one investor jumps in, others follow—driven by FOMO, not fundamentals. But with a high valuation comes high pressure. Founders are expected to deliver rapid growth, often at the cost of building a solid business. What follows? Aggressive hiring, overspending on marketing, chasing vanity metrics—just to meet expectations that were never grounded in reality. And when real performance doesn’t match the hype, the crash is painful. A healthy business > a hyped one.

Replies (4)

More like this

Recommendations from Medial

chirag sharma

•

Ybi Foundation • 1y

OYO latest funding round at $2.5B, down from a $10B valuation, highlights the sobering reality of the valuation bubble in the Indian startup ecosystem. A wake-up call for many sustainable growth over hype. #OYO #ValuationBubble #Startups #India #Tech

See MoreBusiness Insider

Let's grow together!... • 1y

📍 The Indian startup culture has indeed been hyped up to some extent, fueled by success stories and investment frenzy. However, the reality often differs from the glossy image portrayed. Challenges like fierce competition, regulatory hurdles, and fu

See MoreKarnivesh

Simplifying finance.... • 2m

Valuation ratios are often treated like answers, but I see them more as conversations the market is having with us. In Indian markets, the P/E ratio alone rarely tells the full story. A high P/E can reflect confidence in growth and stability, while

See MoreVatan Pandey

Founder & CEO @Zyber... • 11m

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)