Back

Arcane

Hey, I'm on Medial • 1y

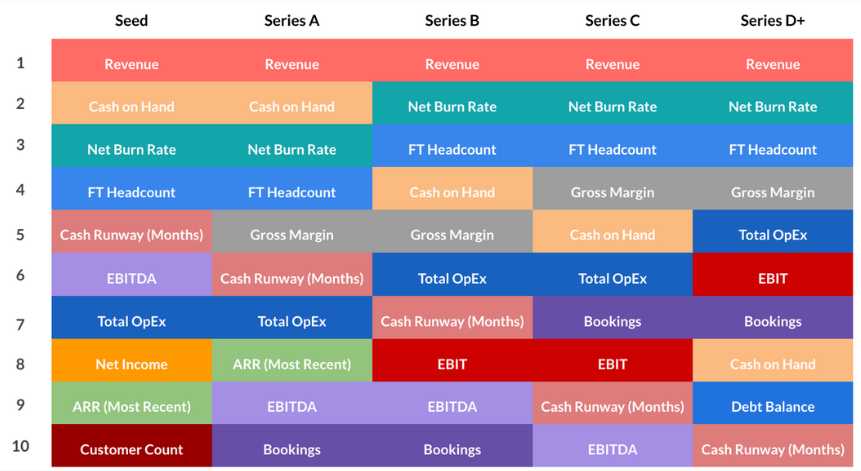

🚨 Critical Startup Metrics VCs look for ➨ When securing venture capital, 4 key metrics are essential at EVERY stage of a startup's growth: • Revenue • Net Burn Rate • Full-time Employee Headcount • Gross Margin ➨ Cash is king in early stages but starts to become less critical in later stages ➨ Also, as startups grow, VCs start looking more at OPERATIONAL EFFICIENCIES instead of just survival metrics like cash runway Refer the image below. This will give you a good understanding of which metrics matter at each stage and align with what investors really want.

Replies (3)

More like this

Recommendations from Medial

Swapnil gupta

Founder startupsunio... • 9m

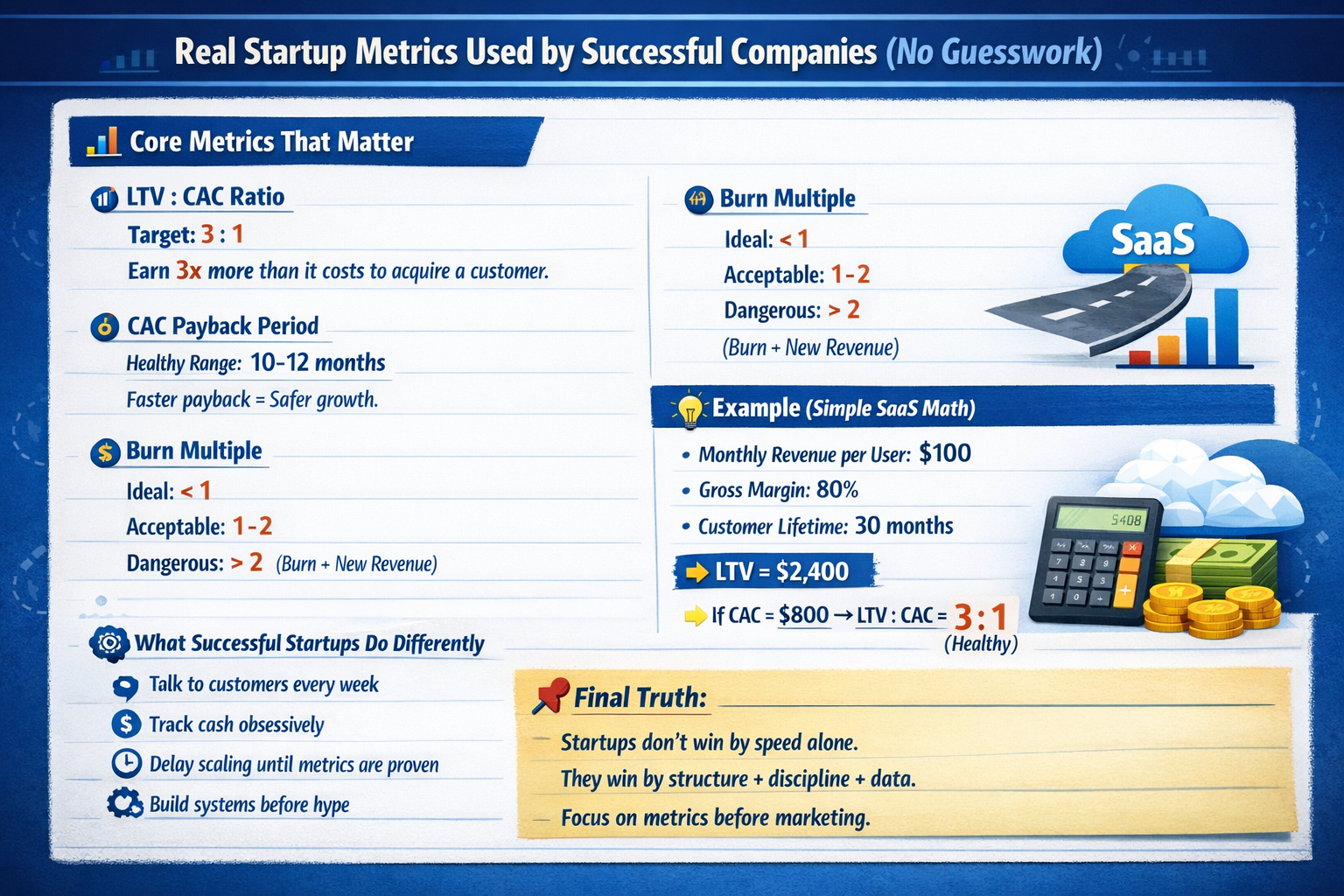

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreThe Vc Girl

Not a Vc Yet, just O... • 7m

16 VC Terms I’m Learning to Become Sniper . Not a VC (yet), but I’m obsessed with how they think. TAM – Size of the $$ opportunity CAC – Cost to get a user LTV – Money a user brings over time Runway – Months till cash runs out Burn Rate – Monthly

See MoreShaswat Raj

Think. Feel. Build. ... • 8m

I’ve been building a SaaS product and learning a lot about startups and marketing along the way. Now I’m at the stage where I’m thinking about a few key things: How do you get your first 10–50 users? When is the right time to start talking to VCs?

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 10m

Why Metrics Matter More Than Ideas in VC Funding. 🚀✨️ Be good at your numbers. You’ve got a bold vision and a slick pitch deck. But the moment you step into a VC meeting, the conversation shifts from your idea to your numbers. Why? Because VCs d

See More

Adithya Pappala

250Tn Global Impact Ventures • 4m

Insaneeeee! 99% of Indian-founders think VCs are cash-rich In reality, It's not. For those who aren't well aware about- Startups raise from VC VC raises from L.P'S & L.P's do the business 🔁Repeat VCs are not cash-rich. I had a line that struck

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)