Back

Vivek Joshi

Director & CEO @ Exc... • 9m

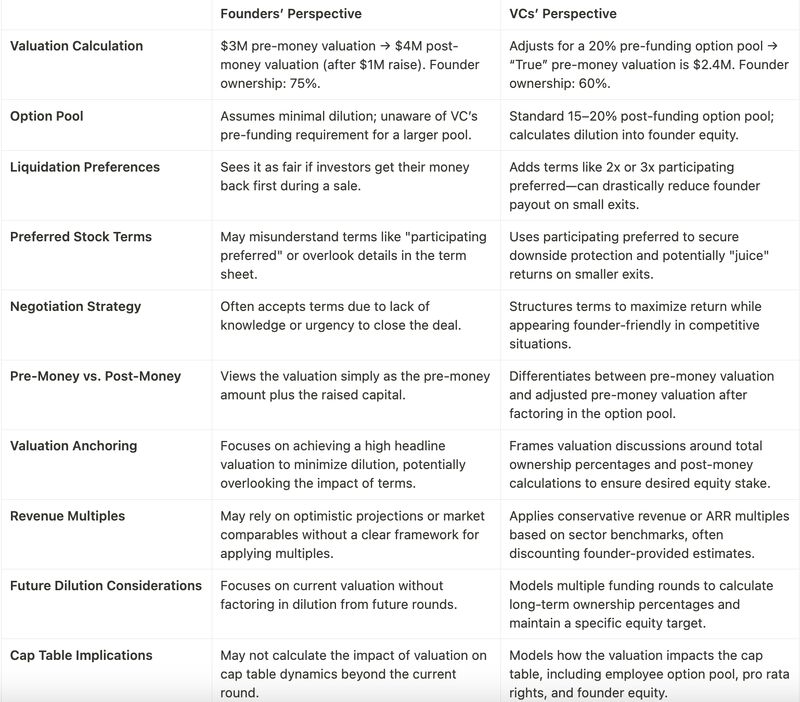

What Startup Founders Should and Shouldn’t Expect from Consultants, Handholders & Venture Scouts in VC Funding There’s a growing ecosystem of firms offering startup consulting, venture scouting, and “founder handholding” services. Many add real value—but founders must keep expectations real. Startup Consultants help refine your deck, strategy, and financials. Expect: Strategic clarity and readiness. Not expect: Guaranteed intros or funding. Handholding Services offer end-to-end support—pitch prep, Q&As, valuations. Expect: Confidence boost and sharper outreach. Not expect: That this replaces founder hustle. Venture Scouts connect startups to investors, often for a success fee. Expect: Warm intros (if there’s fit). Not expect: That VCs will fund you just because you’re “scouted.” Bottom line: VC funding is relationship-driven and founder-led. No consultant can replace vision, traction, or persistence. Choose your support system wisely. Expect partnership, not magic.

Replies (2)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

Navigating the world of VC funding can be challenging for startup founders. In this video, we explore what you should and shouldn’t expect from startup consultants, handholding services, and venture scouting companies. Learn how to leverage their exp

See MoreMayank Kumar

Strategy & Product @... • 1y

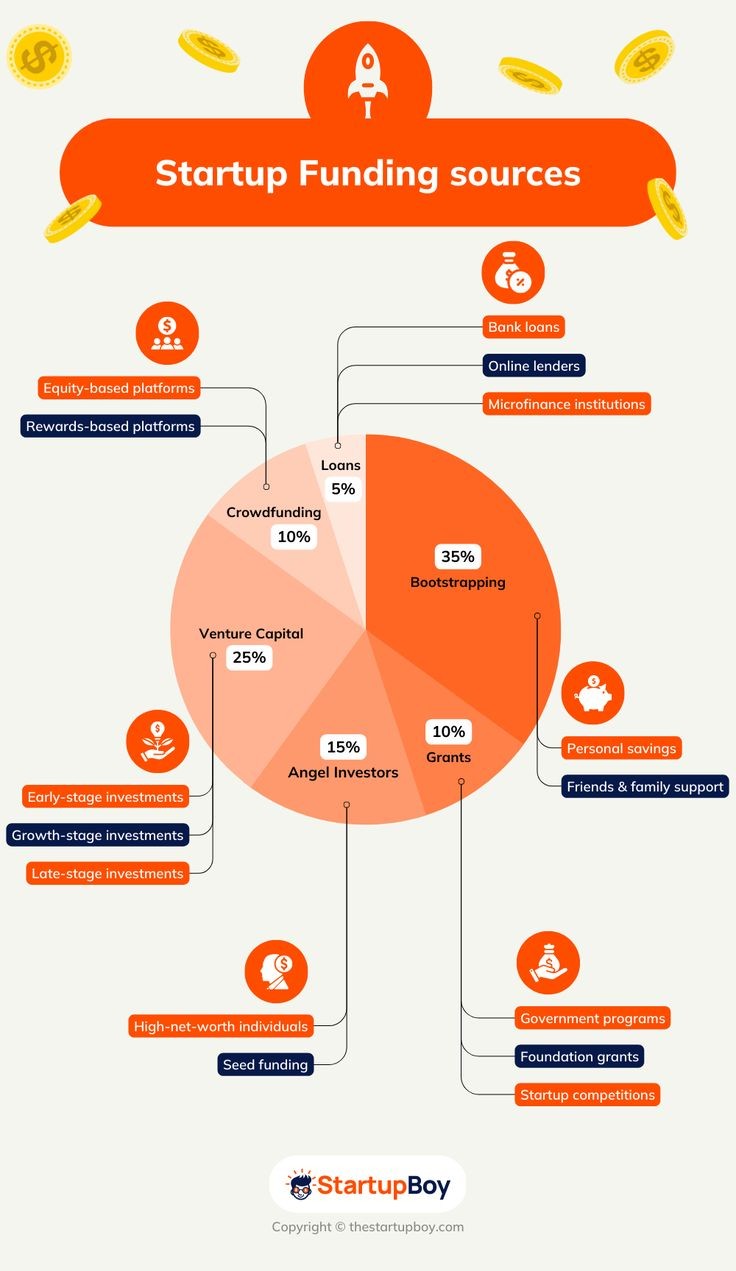

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreMayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreNikhil Raj Singh

Entrepreneur | Build... • 1y

🚀 Ready to launch your startup? Here’s a quick guide to funding sources to fuel your journey! 💡💰 Whether you're bootstrapping, seeking venture capital, or exploring grants, there’s a path for every dream. 🌟 DM me 'Fund' and I’ll share a curated

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)