Back

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 6m

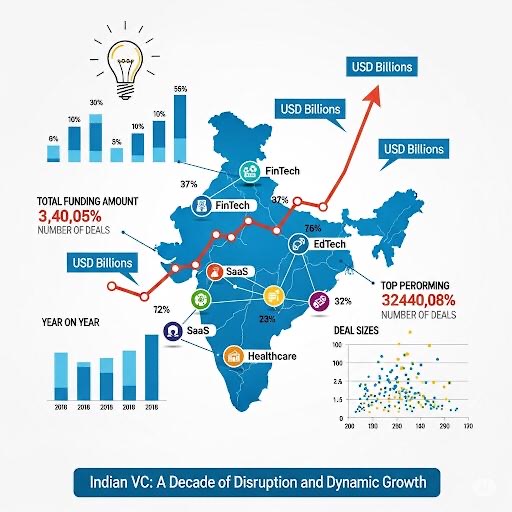

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

Atharva Deshmukh

Daily Learnings... • 1y

Investing helps us gain financial independence, create extra wealth, and better life opportunities. Everyone invests at some point or another in their life. There are various asset classes where one can invest, they are:- 1)Fixed Income Instruments:

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Today's Motivation🚀 I asked one of ISKCON's disciples why we often don't give our full effort to a particular task or why we tend to procrastinate. I received an amazing response. He said, "If you have only one option, you will commit to it, even i

See MoreShivam Chaturvedi

I am ambitious and I... • 4m

🤑 95% 🤤 of early-stage deals hide risk in unstructured data and incomplete documents. Our SaaS engine ingests any doc, confirms every number, and delivers fully validated investment memos at record speed. 👏 For investors: zero blind spots, near-

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)