Back

Anonymous

Hey I am on Medial • 1y

Investing helps us gain financial independence, create extra wealth, and better life opportunities. Everyone invests at some point or another in their life. There are various asset classes where one can invest, they are:- 1)Fixed Income Instruments:-Less Risk, includes options like investments in Bank Fixed Deposits(FD),Government Bonds,Company Bonds,etc.Return from these investments is about 5-10% depending on the assets chosen. 2)Equity:-Investments in equity are a bit risky but highly rewarding as Harshad Mehta said, "Risk hai toh Ishq hai."It involves buying shares of publicly listed companies which are traded on the Bombay Stock Exchange(BSE) or National Stock Exchange(NSE).Returns are 12-15%. 3)Real Estate:-Involves large cash flow and cannot be liquiditate easily as there are many legal process to transfer property.Returns are of two types,one is rental yield which is 2-3% and other is capital appreciation in land prices which is not uniform. 4) Commodity:- Precious Metals

More like this

Recommendations from Medial

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

Ways to Multiply Money 🤯 Investments: 1. Investing in the Stock Market: You can multiply your money by investing in the stock market, but it involves risks. 2. Mutual Funds: By investing in mutual funds, you can diversify your money into differen

See MoreTushar Aher Patil

Trying to do better • 1y

Day 4 About Basic Finance Concepts Here's Some New Concepts Financial Markets and Institutions Stock Markets: Where shares of publicly traded companies are bought and sold (e.g., New York Stock Exchange) Bond Markets: Markets where debt securitie

See More

Rohan Saha

Founder - Burn Inves... • 9m

These days, as more retail investors step into the bond market, high yield bonds are getting harder to find. I remember being able to buy AA rated bonds on the exchange with returns as high as 24% to 30%. Now, those same bonds hardly go beyond 12% or

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Got very busy with work,so couldn't post my today's learning but I read about history of BSE,writing here in short. BSE Limited, also known as the Bombay Stock Exchange is an Indian stock exchange which is located on the renowned Dalal Street, also

See MoreGangesh Rameshkumar

Figure it out • 8m

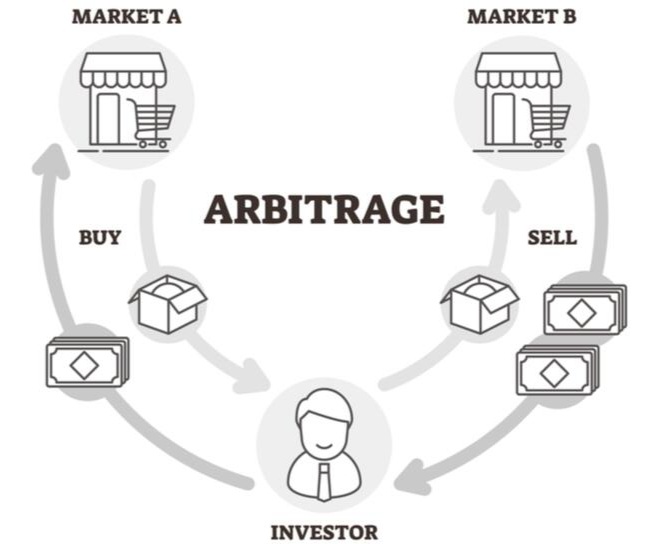

Term of the day: Arbitrage Arbitrage is the exploitation of market inefficiencies where the price of an asset is different in different markets For example, Company X's stock is listed at 20$ on the New York Stock Exchange(NYSE), but $20.05 on th

See More

Hemanth Varma

''Money can't buy ha... • 1y

what are stocks ? A stock, also known as equity, is a security that represents the ownership of a fraction of the issuing corporation. Units of stock are called shares, which entitle the owner to a proportion of the corporation’s assets and profits

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)