Back

GEORGE

Financial Consultant • 8m

Correlation is not static. In bull markets, assets dance independently. In bear markets, they crash in sync. This is correlation under stress, and it's where diversification often fails. Your assets are uncorrelated.. until they aren’t. Stress binds everything. In a crisis, gold falls. Bonds fall. Equities fall. Liquidity becomes the only factor. Everyone sells what they can, not what they want to. 🔥 2008. 🦠 2020. 📉 2022. These weren’t just market corrections. They were also correlation explosions. All models failed because they assumed stability in relationships. Stress killed the math. Correlations rise toward 1 in crises. Why? Margin calls, fear contagion, risk-off flows. You thought you were diversified. Turns out, you were just in a crowded theater with multiple exits locked. During normal times: – Equity ↔ Bonds: negative – Equity ↔ Gold: negative During market stress: – Equity ↔ Bonds: positive – Equity ↔ Gold: positive

More like this

Recommendations from Medial

Priyant Dhrangdhariya

Head of Finance @ Th... • 1y

India’s Gold Loan Market: A Glittering Opportunity The Sparkling Growth: Bajaj Finserv Ltd., a diversified NBFC, predicts India’s gold loan market—valued at $55.52 billion in 2022—will soar to $124.45 billion by 2029. A 12.22% annual growth fuels t

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 10m

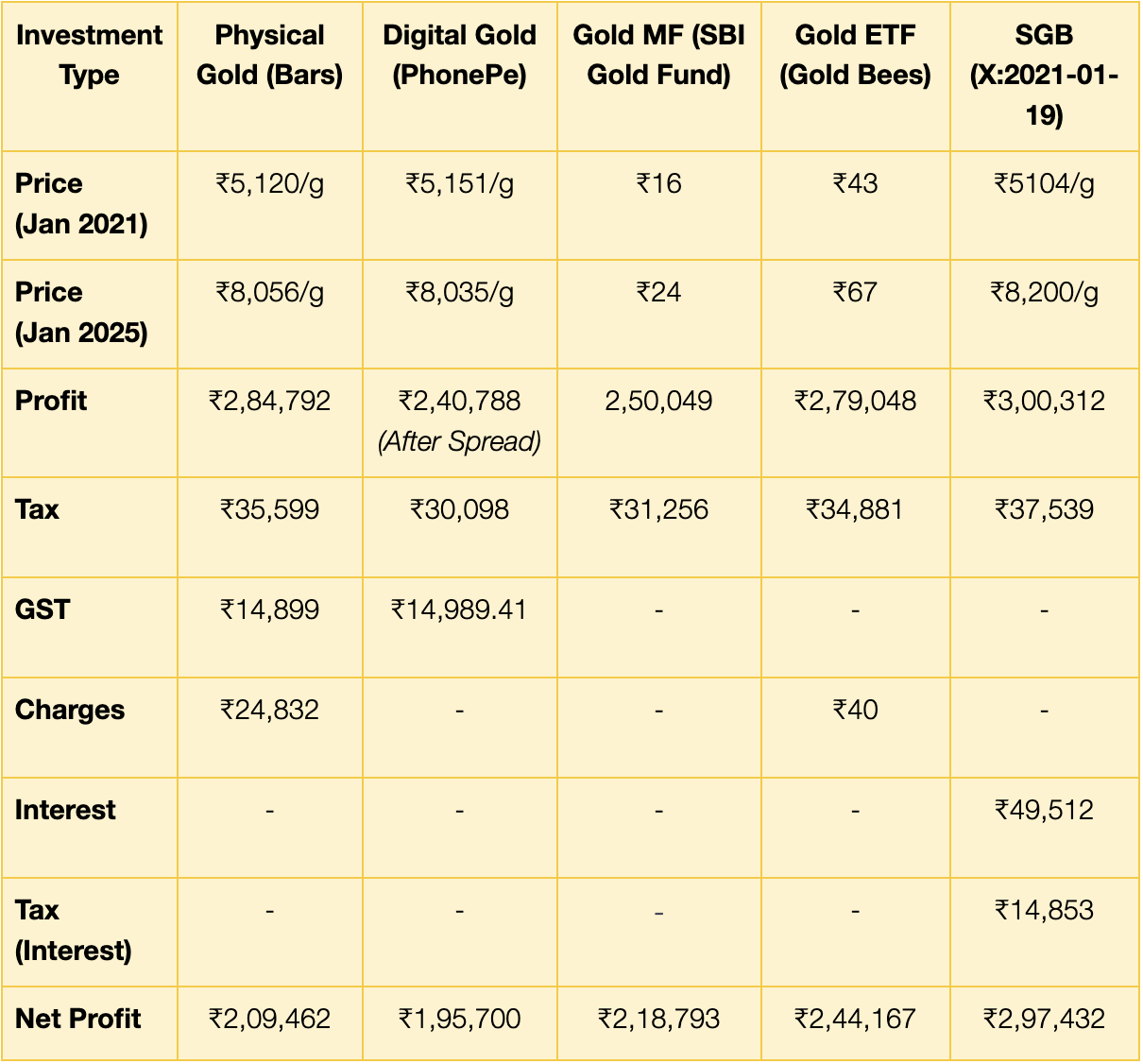

Different Ways to Invest in Gold 🪙 If you invest ₹5 Lakhs for a period of 5 years, what could your ROI look like across different gold investment options? There are commonly 5ways to invest in gold. 🪙 Physical Gold (Jewelry, Coins, Bars) 🪙 Digi

See More

Jithin Tomy

student ! b.com ! pu... • 1y

I have gone through different communication apps which are more negative than much positive but medial is different.... it gives zero negative content Are you aware of any other application which is more informative and can be a milestone in my prof

See MoreOmkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreRohan Saha

Founder - Burn Inves... • 8m

Even after the rate cut, bond values haven't dropped much in the secondary market. Government bonds have adjusted a bit, but not significantly. The upcoming primary issues will be worth watching a few NCD IPOs are expected in the coming days. Let’s s

See MoreGangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Equity Equity, in simple terms, is the money that is returned to all the shareholders of a company, if all the company's assets are liquidated and liablities are paid off. It is also a measure of the financial health of a c

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)