Back

Anonymous 2

Hey I am on Medial • 10m

I don’t get the panic. Ather’s fundamentals are stronger than most EV players out there. They’ve got a solid product, brand recall, and customer loyalty. If anything, this dip could be a buying opportunity once it lists.

More like this

Recommendations from Medial

Nawal

Entrepreneur | Build... • 10m

DOWNFALL OF BLUESMART Once one of the most innovative players in electric vehicle (EV) ride-hailing, BluSmart is now knee-deep in trouble. What went wrong? It started with a bold idea: an all-EV fleet to take on giants like Ola and Uber. Unlike its

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

What next for Ather? A Hero subsidiary status? 😅😅 With the latest development, that has never been more likely. Let's dive in! .. Whenever Ather Energy’s in need of more money, Hero pounces in. -> This was evident in the Sep rights issue where

See MoreThe next billionaire

Unfiltered and real ... • 1y

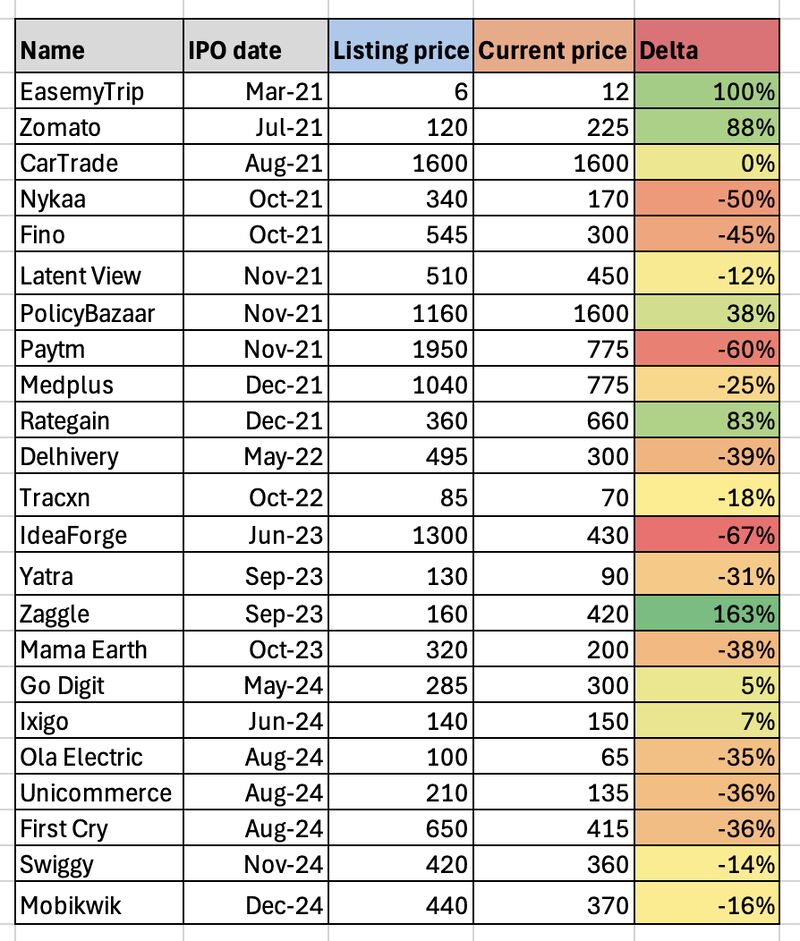

Are Startup IPOs Truly Creating Wealth—or Just Exit Liquidity for Founders and VCs? India has seen a wave of startup IPOs over the last three years - 23 companies went public, promising innovation, disruption, and wealth creation. But have they tru

See More

Pulakit Bararia

Founder Snippetz Lab... • 5m

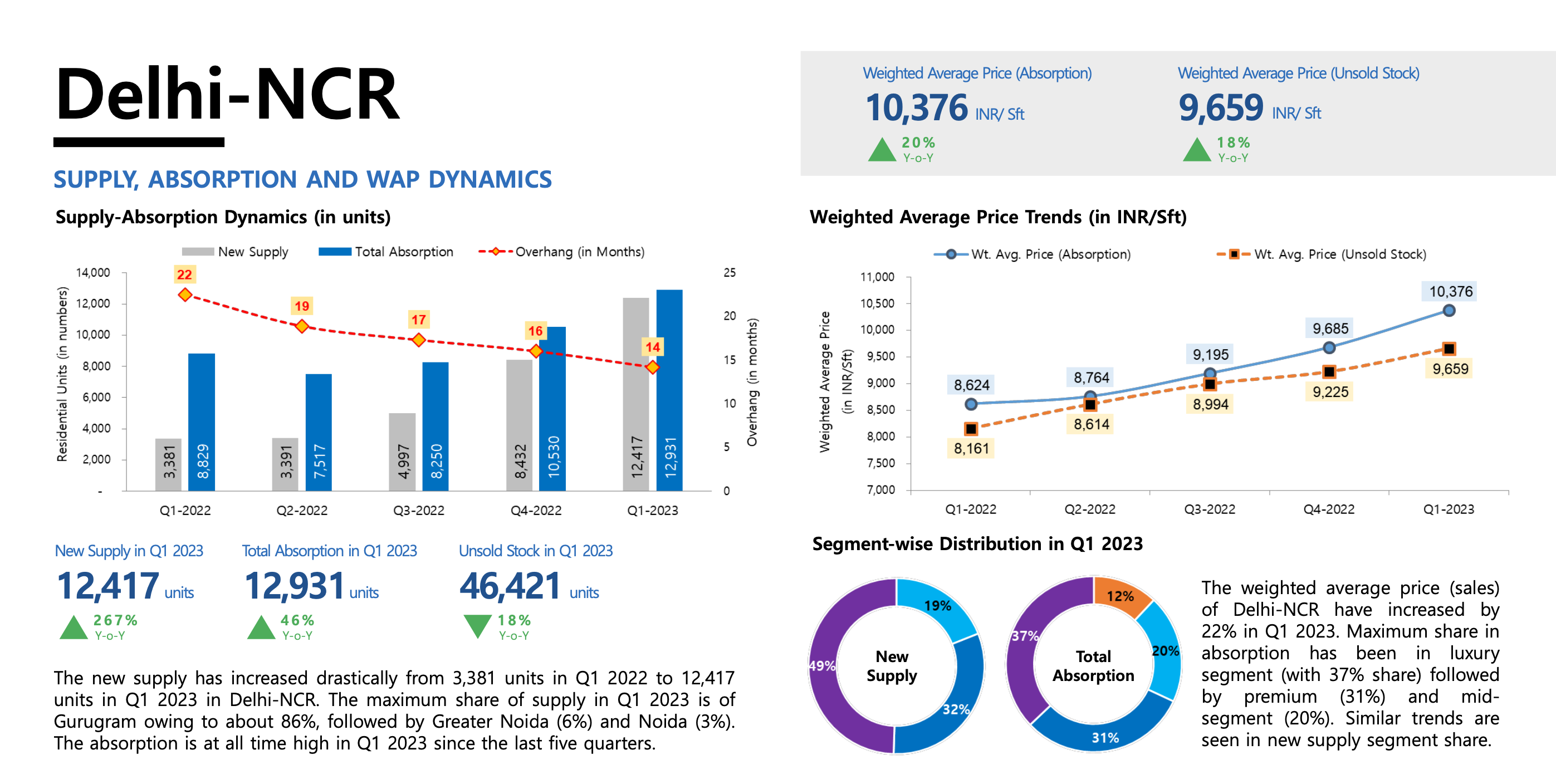

96% “sold-out” projects. ₹4.72 Cr average price. 60% investor-driven demand. Looks like India’s hottest housing market, right? Think again. Gurugram real estate market seems to be booming on paper - but in reality, it's basically an ecosystem whic

See More

Ravi s bhardwaj

We builds future • 7m

Is India in an Innovation Drought? India’s startup ecosystem has become a global force, fueled by entrepreneurial energy, increasing valuations, and international attention. But beyond the optimism, challenges remain. To sustain its momentum, India

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)