Back

The next billionaire

Unfiltered and real ... • 1y

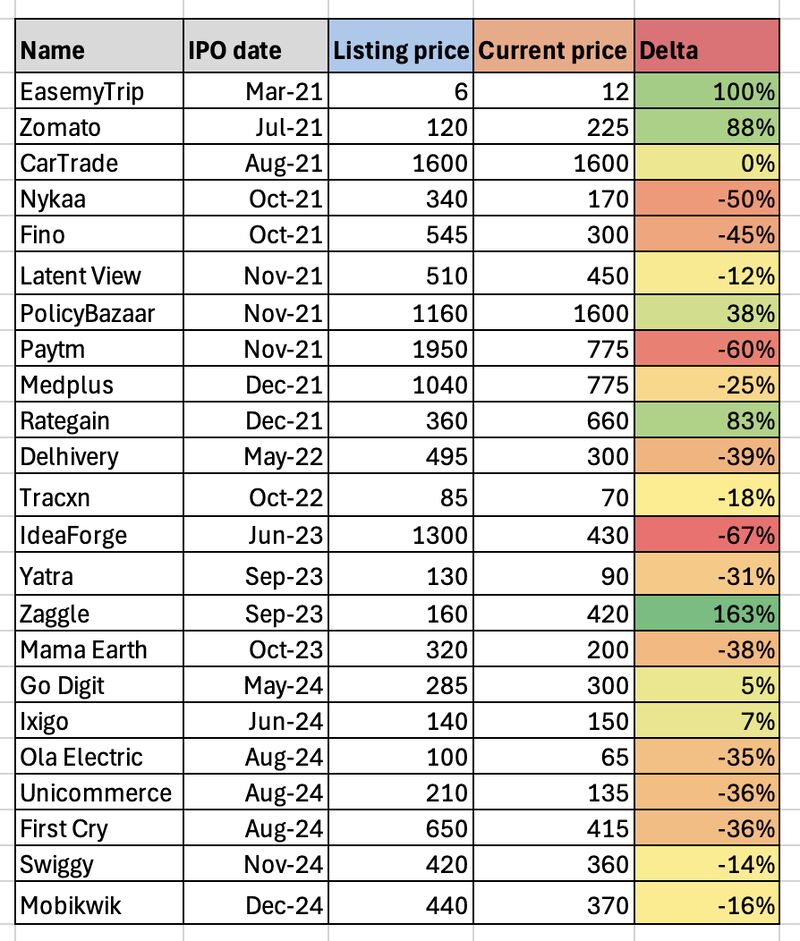

Are Startup IPOs Truly Creating Wealth—or Just Exit Liquidity for Founders and VCs? India has seen a wave of startup IPOs over the last three years - 23 companies went public, promising innovation, disruption, and wealth creation. But have they truly delivered for investors? Let’s get into the numbers. The Reality Check Winners: Only 7 out of 23 IPOs are trading above their listing price—with an average return of +69%. Compare that to the midcap index, which posted +78% over the same period. Losers: 16 startups have lost value, with an average return of -35%. Meanwhile RIL, the largest large cap, delivered +14% in the same period. The biggest winner? Zaggle (+163%) The biggest loser? IdeaForge (-67%) What’s the reason for heavy losses? Lets cut through the noise and look at a few key examples: 🚨 Paytm (-60%): Three months after its IPO, Paytm hit a massive roadblock when the RBI barred it from onboarding new customers over persistent KYC and compliance issues. While insiders like Vijay have their stock vesting tied to hitting certain valuation milestones, these regulatory setbacks have clearly dented investor confidence. 🚨 Nykaa (-50%): Influenced by heavyweights like KKR, Nykaa listed at a $7bn valuation - 6X of its GMV. Yet, despite all that hype, its annual profit has never surpassed FY21 number of ₹61 Cr. The disconnect between valuation and fundamentals is real. 🚨 Ola Electric (-35%): Ola Electric is wrestling with multiple challenges: mounting customer complaints, leadership exits (yes, both the CMO and CTO have resigned), and a shrinking market share. When rapid scaling meets operational chaos, big ambitions get hit hard. Why Is This Happening in India? 📉Valuation Discipline missing: Startups are going public on sky-high revenue or GMV multiples without a solid path to profitability to back them up. Eventually markets correct this valuation. 📊 Regulatory Uncertainty: India’s regulatory framework is still catching up in sectors like fintech, gig work, and emerging tech, adding extra volatility. 👥 Investor Sentiment: Indian retail investors have little patience for high-risk, unprofitable businesses, which need time and money to stabilise. A little speculation --> A lot of price movement. What Needs to Change? ✅ Founders’ Mindset: Instead of obsessing over “Can we IPO?”, ask yourself, “Should we IPO?” Build sustainable businesses with strong governance systems with a long term view. 🔎 Stronger Governance: Founders should invest in good legal counsel, a solid Chief of Staff, and an independent board that isn’t afraid to call out red flags. 📜 Tighter Regulatory Oversight: Investment banks and SEBI must enforce stricter IPO pricing and disclosure standards to protect retail investors. Final Thoughts At the end of the day, an IPO isn’t just an exit—it’s a transition into long-term public accountability. The harsh reality? Hype fades, but solid fundamentals and hard numbers endure. Source : Pranay Jindal/linkedin

Replies (3)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

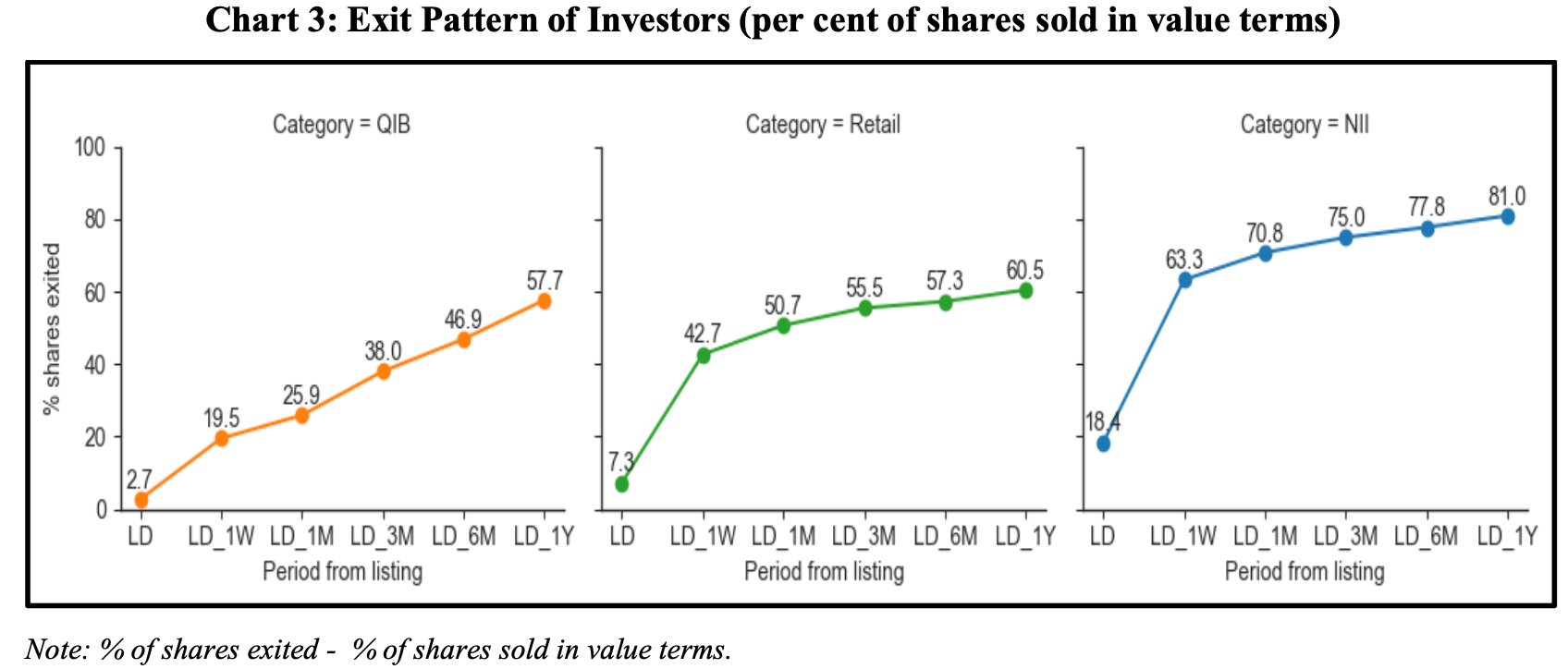

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares

See More

Account Deleted

Hey I am on Medial • 1y

Lenskart IPO Also Coming Soon! • Lenskart.com is also planning an IPO to raise between $750 million to $1 billion, with a valuation of $7-8 billion. • In FY24, Lenskart generated ₹5,427 crores in revenue, a 23% increase from the last financial year

See More

Account Deleted

Hey I am on Medial • 1y

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)