Back

Pulakit Bararia

Founder Snippetz Lab... • 5m

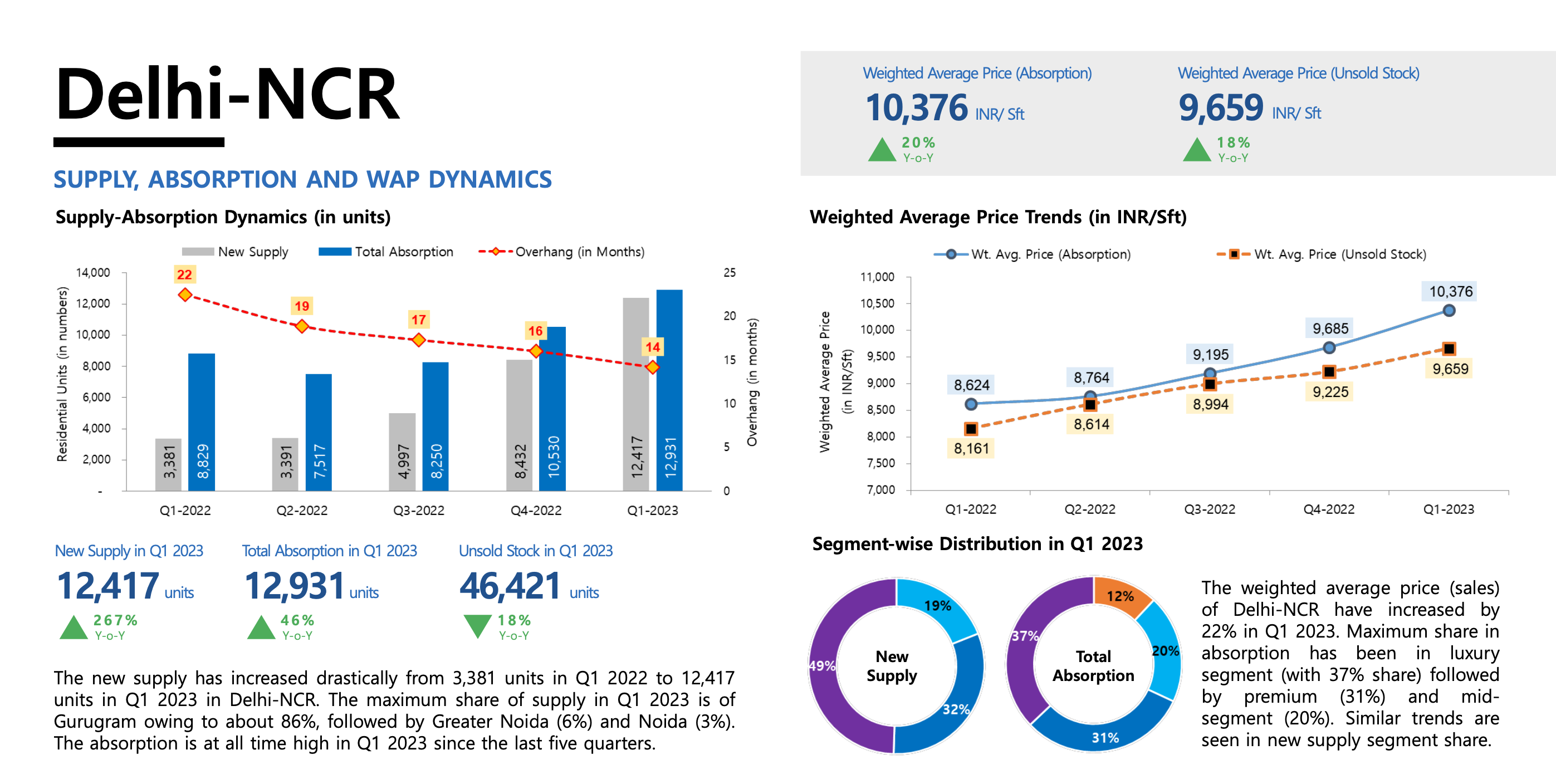

96% “sold-out” projects. ₹4.72 Cr average price. 60% investor-driven demand. Looks like India’s hottest housing market, right? Think again. Gurugram real estate market seems to be booming on paper - but in reality, it's basically an ecosystem which is driven by speculation and artificial scarcity. If we look at what a healthy real estate market should look like, prices are supported by end-user demand, which is families buying homes to live in. Gurugram demand is highly fabricated. over 60 per cent of the homes in Gurugram are purchased by investors and traders, people who are not intending to stay there. Developers exploit this by bulk-selling units to brokers and investors in advance, creating the illusion of “sold-out” projects on launch day. These projects are often flipped multiple times before construction even begins, pushing prices up without any real increase in organic demand. Rising prices are sustained only because buyers believe prices will keep rising. Developers depend on traders for early bookings to secure financing. Traders, in turn, rely on constant price appreciation to flip properties for profit. But genuine end-user demand remains weak due to high unaffordability. If prices plateau, traders lose incentive, begin exiting the market, and developers face funding shortfalls, which lead to construction delays. These delays trigger panic among remaining buyers, forcing more traders to offload properties at lower prices, accelerating the downward spiral. Once this loop starts, price corrections of 25% to 30% are highly probable. Making the real estate bubble burst Official reports suggest Gurugram has a manageable 13 months of unsold housing inventory, but this figure is highly misleading. When we account for the 60% of trader-held units, the reality is starkly different. Over 28,000 housing units are effectively unsold, translating to 30 to 46 months of real inventory, which is nearly three to four times higher than healthy levels. High unsold stock, along with artificially inflated prices, will result in traders beginning to exit, and the sheer volume of available inventory will drive prices downward sharply. If we compare Mumbai and Gurugram, while Mumbai’s average residential unit price is around ₹3 crore, Gurugram averages ₹4.72 crore, which is a staggering 57% higher despite Mumbai’s larger population, stronger job market, and far superior infrastructure. In real estate economics, when property prices significantly outpace income levels, employment growth, and infrastructure readiness, the market enters a danger zone where valuations are unjustifiable. Gurugram’s sky-high pricing simply isn’t supported by underlying fundamentals, making it especially vulnerable to correction.

Replies (2)

More like this

Recommendations from Medial

Rohit Mishra

Real Estate Experts,... • 11m

🌟 Why Real Estate Investment is Your Best Bet in Today's Market! 🏡 In a world of economic uncertainty, many investors are turning to real estate for stability and growth. As an estate consultant, I can confidently say that now is the time to consi

See More

Anonymous

Hey I am on Medial • 1y

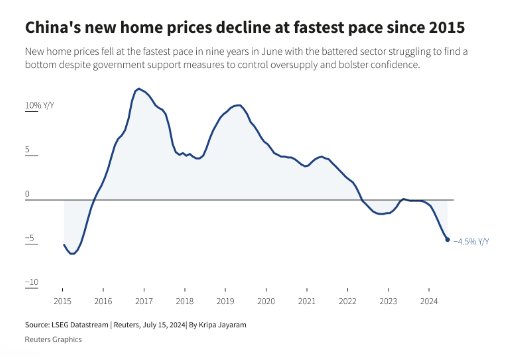

China's new home prices have experienced a significant decline, with June 2024 marking the steepest drop in nine years—a 4.5% year-on-year fall, the largest since June 2015. Despite multiple government interventions, the property market remains unde

See More

Pradeep Raja

Venture scout • 11m

What If Real Estate Prices Were Based on Pollution Levels and a future where nature dictates wealth, would that be justice or a new kind of inequality? Imagine a world where home prices weren’t just about location but also about the quality of air y

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)