Back

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 7m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

VCGuy

Believe me, it’s not... • 1y

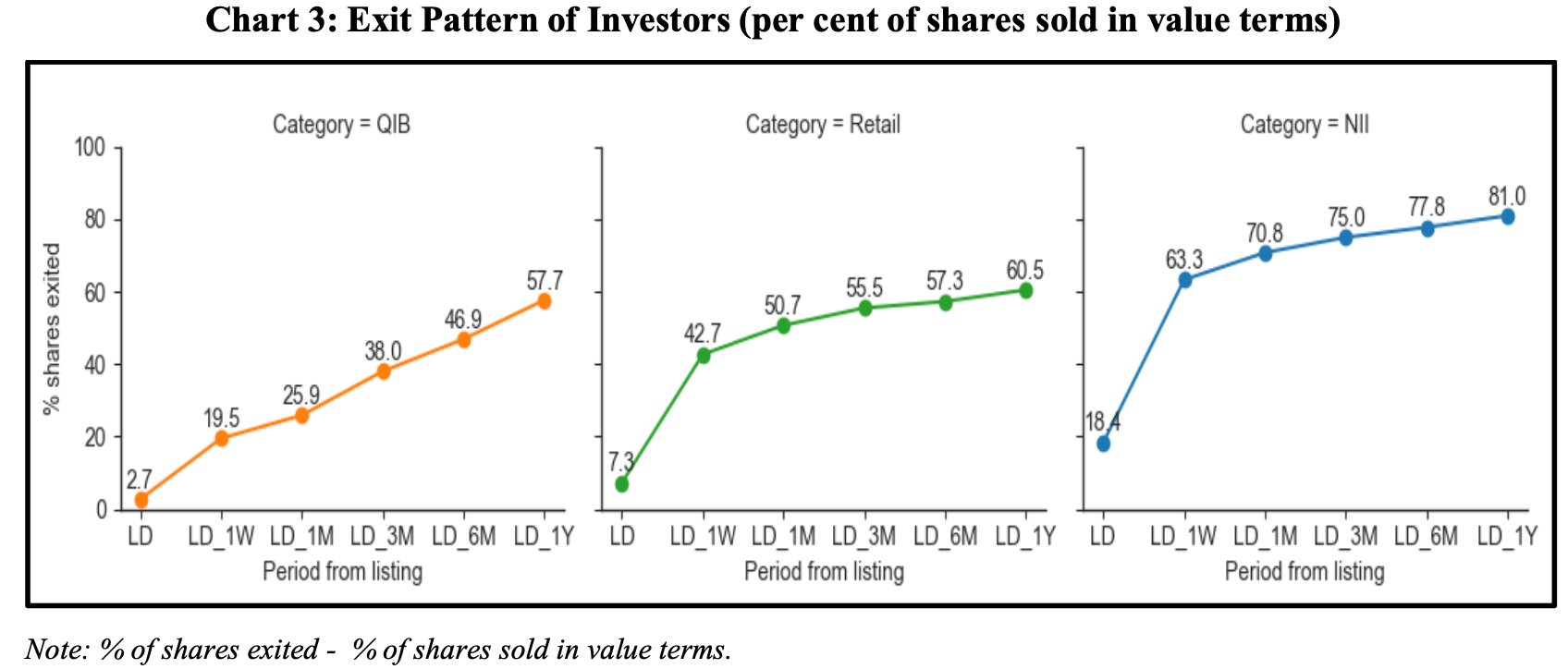

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares

See More

Siddharth K Nair

Thatmoonemojiguy 🌝 • 9m

When a Brand Name Becomes the Language You don’t search, you Google. You don’t buy adhesive, you grab Fevicol. You don’t ask for toothpaste, you ask for Colgate — even if it’s not Colgate. This is what marketers dream of: Becoming the noun. The act

See More

Mohammad Ali Shah

Co Founder & CEO at ... • 7m

India’s IPO Boom Hits ₹20,000 Crore+ in Just July India’s IPO market is booming again. In July alone, Indian companies are expected to raise $2.4 billion (₹20,000+ crore) through IPOs. Big names like: Credila Financial NSDL Aditya Infotech JSW Cem

See MoreSamCtrlPlusAltMan

•

OpenAI • 7m

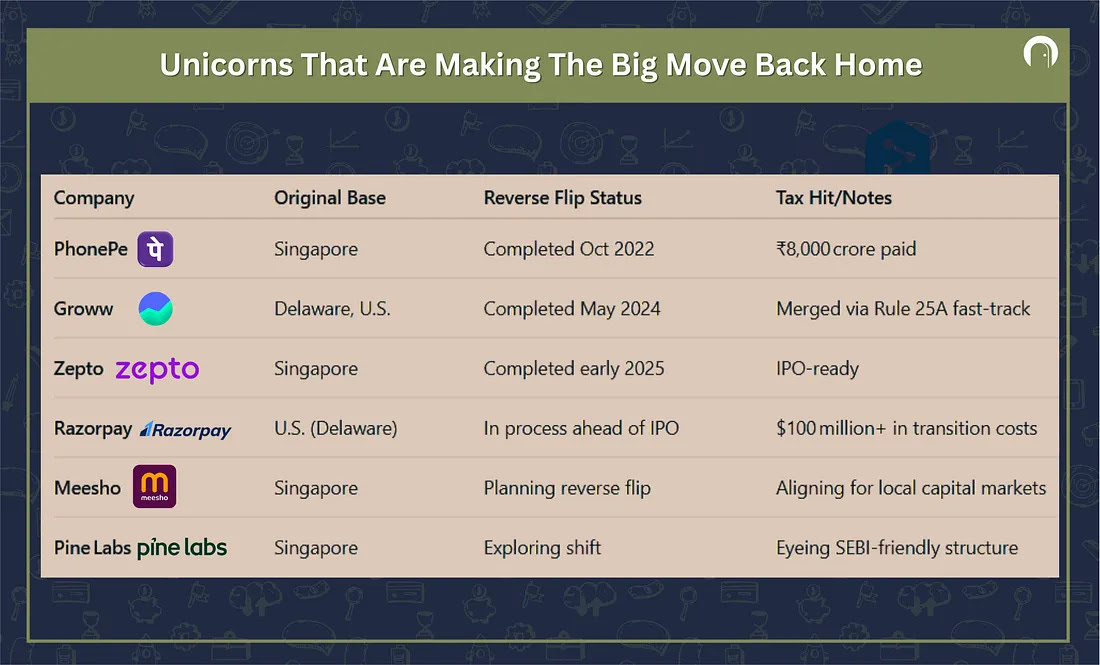

After years of chasing capital abroad, billion-dollar tech giants are shifting their HQs back to India. Once drawn overseas by easier fundraising and U.S. IPO dreams, over 70 fastest-growing Indian tech companies are making a U-turn, closing offshore

See More

Shivang Jatwani

Zindagi daud rahi, M... • 1y

I've seen that with newer startup's coming in the e-commerce space, there's a variety of options to buy from. I have used multiple apps, rewards platforms, brand loyalty cards, however, it always makes sense to switch because there will be a better

See MoreJewelpik App

House of jewellery b... • 7m

Why Every Jewelry Brand Needs Professional Photography in 2025 In 2025, great jewellery isn't enough—how you present it matters more than ever. With shoppers making split-second decisions online, professional photography is no longer a luxury. It’s a

See MoreDownload the medial app to read full posts, comements and news.