Back

Mohammad Ali Shah

Co Founder & CEO at ... • 7m

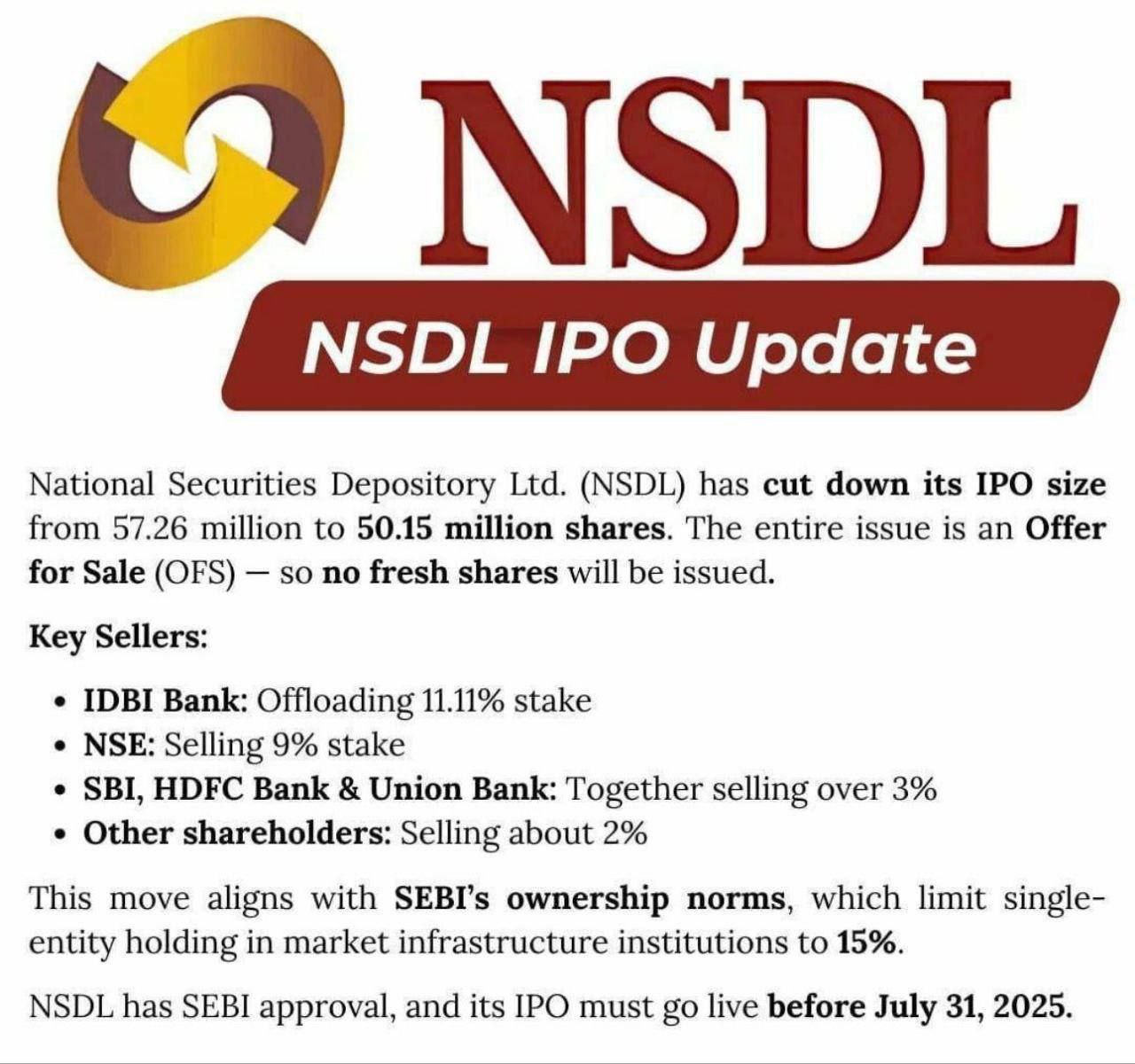

India’s IPO Boom Hits ₹20,000 Crore+ in Just July India’s IPO market is booming again. In July alone, Indian companies are expected to raise $2.4 billion (₹20,000+ crore) through IPOs. Big names like: Credila Financial NSDL Aditya Infotech JSW Cement LG Electronics India …are all lining up. This follows a massive $2 billion raised in June, showing clear investor confidence and liquidity is back. But here’s the big question for you: Is IPO the dream? Or is it just a milestone on the road to something bigger? Would you ever take your startup public? --- 💬 Let’s hear it: 📊 IPO = Exit goal? Or just a funding tool? 👇 Drop your answer in comments.

More like this

Recommendations from Medial

Shanu Chhetri

CS student | Tech En... • 8m

This is about the HDB Financial Services IPO, which is HDFC Bank’s NBFC arm. The ₹12,500 crore IPO opens June 25–27, 2025, with shares priced between ₹700–740 each, and it’s India’s biggest NBFC IPO ever. HDFC Bank will reduce its stake from 94% to 7

See More

Kishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9

See MoreAccount Deleted

Hey I am on Medial • 1y

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Account Deleted

Hey I am on Medial • 11m

Meesho Is Planning For $10 Billion IPO! • Meesho is planning to file its IPO papers in the second half of 2025, with a potential listing in 2026. • The company is planning to raise $1 billion at a $10 billion valuation and appointed Morgan Stanley,

See More

Ashish Singh

Finding my self 😶�... • 1y

In 2025, several companies are expected to launch significant IPOs, potentially breaking records in the Indian market. Key players include: -- Reliance Jio: Valued over $100 billion, anticipated to be India's largest IPO. -- Flipkart: Expected to

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)