Back

More like this

Recommendations from Medial

Swapnil gupta

Founder startupsunio... • 8m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Why Metrics Matter More Than Ideas in VC Funding. 🚀✨️ Be good at your numbers. You’ve got a bold vision and a slick pitch deck. But the moment you step into a VC meeting, the conversation shifts from your idea to your numbers. Why? Because VCs d

See More

Swapnil gupta

Founder startupsunio... • 8m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreCentriagal performance marketing agency

24 karat pure meta a... • 2m

The Real Metrics That Grow a Business Most businesses fail because they run ads without tracking three critical metrics: 1️⃣ ROAS (Return on Ad Spend) ROAS tells you how much revenue you generated from every ₹1 spent on ads. For example, if you sp

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets of startup success with our comprehensive guide on Decoding Unit Economics! In this video, we break down the critical components that can determine the fate of your early-stage venture. Learn how to define your unit, calculate Cust

See MoreManu

Building altragnan • 9m

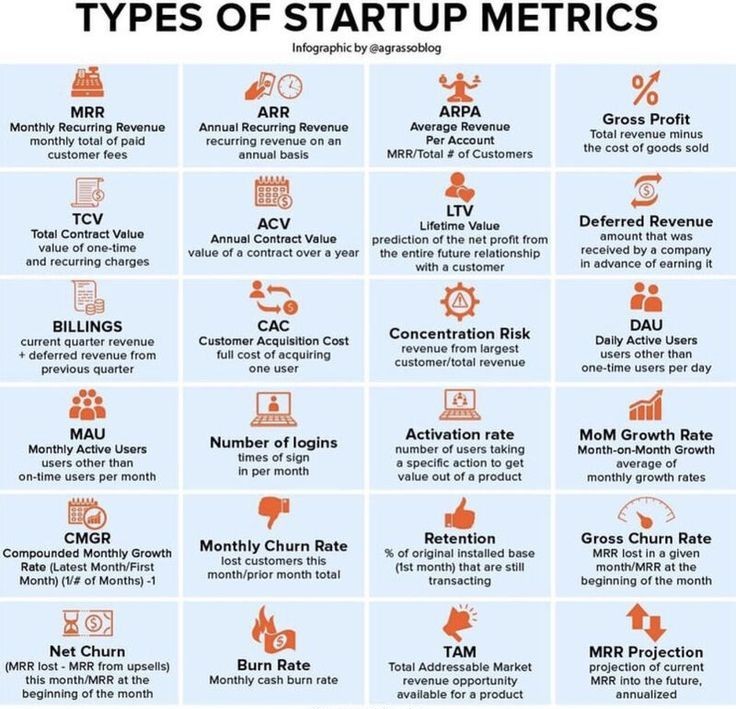

This infographic shows key startup metrics. MRR is monthly recurring revenue, while ARR is annual recurring revenue. ARPA shows average revenue per customer. Gross Profit is revenue minus costs. TCV and ACV measure contract values. LTV predicts total

See More

Akash Koli

Experienced Financia... • 1y

Understanding Return Ratios: Measuring Your Business Performance 📊💡 Hello VittArena Network! Return ratios are key to assessing how well your business is performing. Here’s a quick guide: # ROI (Return on Investment): Measures the gain or loss f

See MoreDownload the medial app to read full posts, comements and news.