Back

Anonymous 1

Hey I am on Medial • 10m

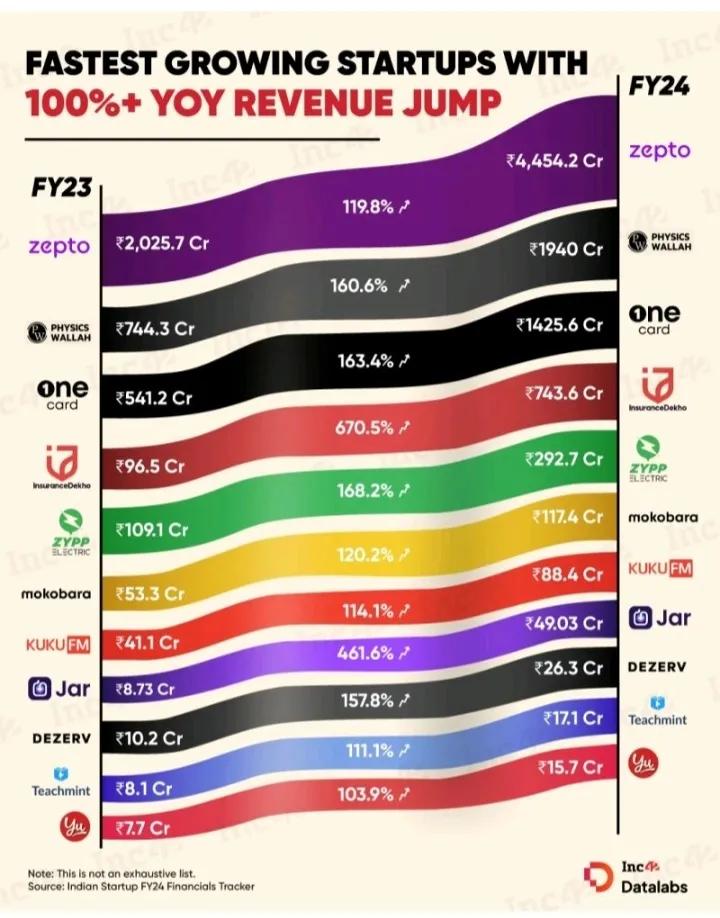

Not gonna lie, I still don’t trust most of these revenue numbers. Without clear disclosures on burn, CAC, and unit economics, 100% YoY growth means nothing if you're bleeding cash on the backend.

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

Pivoting -When do the numbers tell you it's time to drastically re-evaluate your startup's core business model?" Financial Red Flags: Consistently Negative Unit Economics: Losing money on every sale with no clear path to profit? Your Customer Acquis

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets of startup success with our comprehensive guide on Decoding Unit Economics! In this video, we break down the critical components that can determine the fate of your early-stage venture. Learn how to define your unit, calculate Cust

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Account Deleted

Hey I am on Medial • 11m

Raising millions won’t fix a broken business model. Plenty of startups burn through cash chasing growth, thinking more funding will solve their problems. But if the fundamentals aren’t strong - bad unit economics, no real demand, weak execution - VC

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreKarnivesh

Simplifying finance.... • 1m

I’ve noticed that many startups celebrate users, orders, and revenue before asking the hardest question: does each unit actually make money? That’s what unit economics reveals. Strip away the hype, and it comes down to whether a business earns more

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)