Back

Nikhil Raj Singh

Entrepreneur | Build... • 11m

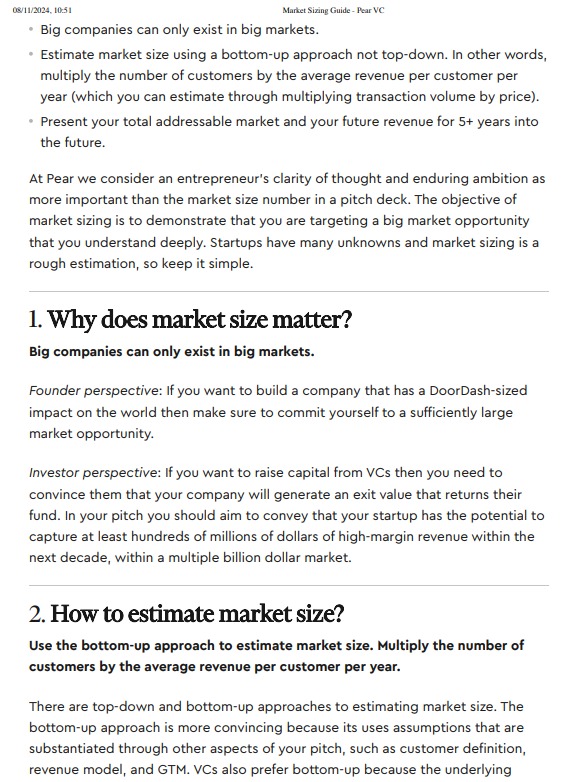

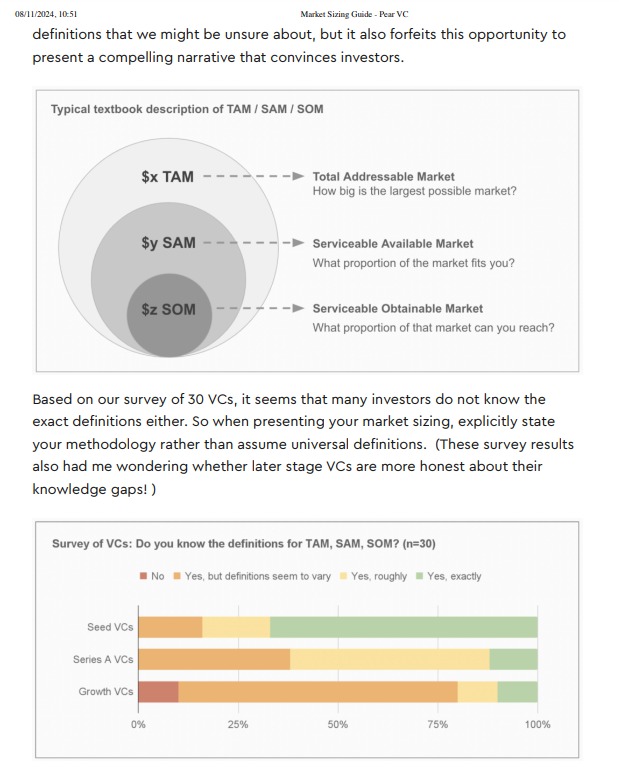

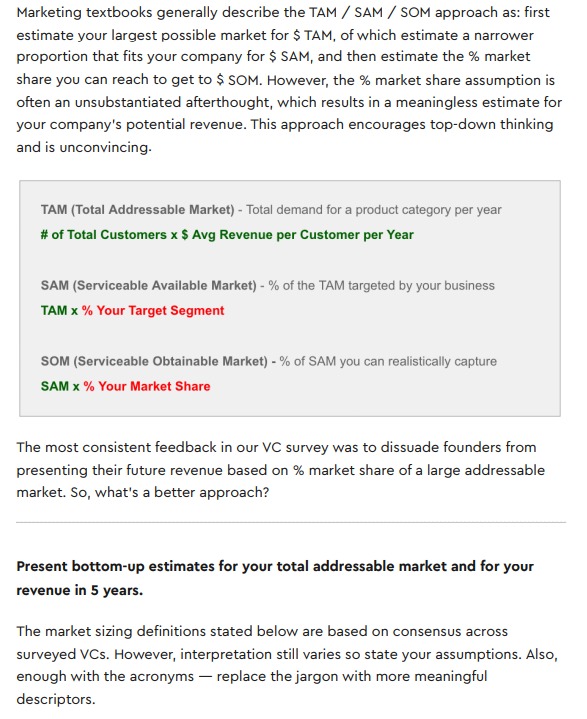

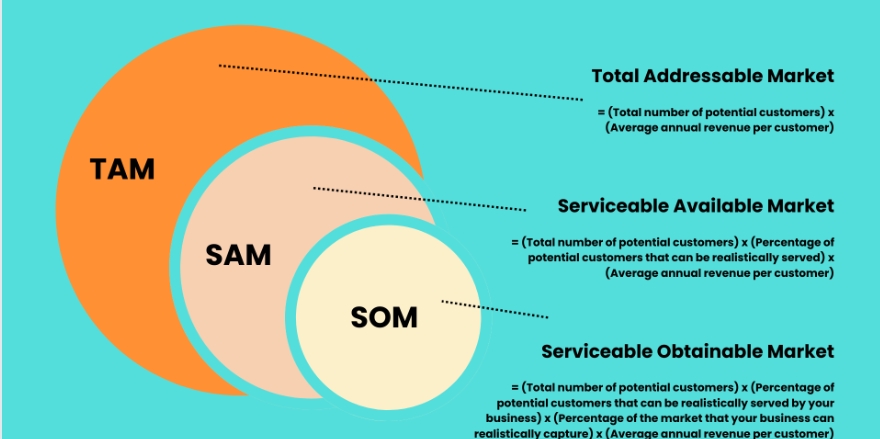

📢 14 Page of Market Sizing Guide – Must-Know for Startups! 🚀 And Dm for the Pdf📝 Here is the Summary 🚀 If you're building a startup, understanding market size is non-negotiable. Investors want to see the potential, and you need to show them the right way! Key Takeaways from Pear VC’s Market Sizing Guide ✅ Why market size matters – Big companies only exist in big markets. Investors look for high-growth potential. ✅ How to estimate market size – Use a Bottom-Up approach (customers × revenue per customer), NOT just % market share. ✅ TAM / SAM / SOM framework – Understand your Total Addressable Market (TAM), your target slice (SAM), and what you can realistically capture (SOM). ✅ 5-Year Revenue Projection – Investors prefer realistic, data-backed numbers over vague estimates. ✅ Many VCs don’t even fully grasp market sizing – So, make your assumptions crystal clear! 💡 Bottom Line: A well-calculated market size makes your startup more investable. Use data, not guesswork! 📌 Credit: Pear VC

Replies (2)

More like this

Recommendations from Medial

Maniraj N G

Marketing & Systems ... • 1y

Struggling to understand your market size? It’s time to stop guessing and start making data-driven decisions! Here's a simple guide to calculating TAM, SAM, and SOM that every founder, marketer, or strategist needs to know. "Determining your market

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 7m

🎯 Before You Build Anything, Know This: How Big Is Your Market? Most startup ideas don’t fail because of bad design or weak execution. They fail because the market was too small to matter. 🧊 Before you code, pitch, or even brainstorm too hard, as

See More

Sagar Motwani

Hey I am on Medial • 1y

To enter a market, understanding three key metrics is most important in any business field: 1) TAM (Total Addressable Market): The total demand for a product or service without limitations. Example: If 10 million people worldwide might buy $100 he

See MoreReetesh Aanand

Music Tech Entrepren... • 11m

how to exactly calculate TAM, SAM & SOM ?? I mean, TAM is supposed to be the total market value of an industry but does it differ on the kind of service that I am providing in that industry? what exactly should be considered while calculating thes

See MoreSameer Patel

Work and keep learni... • 1y

Business Terms TAM stands for Total Addressable Market, a key metric in business. It estimates the total revenue possible by selling your product to everyone in the market who could potentially benefit from it.Businesses use TAM to gauge market size,

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

How to calculate your Total Addressable Market (TAM)❓️ Market Size: 9 out of 10 Startups are doing it wrong 😐 It is not: ❌️ The total size of the problem ❌️ The TAM of your competitors ❌️ The size of the entire industry Example: Wrong Marke

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)